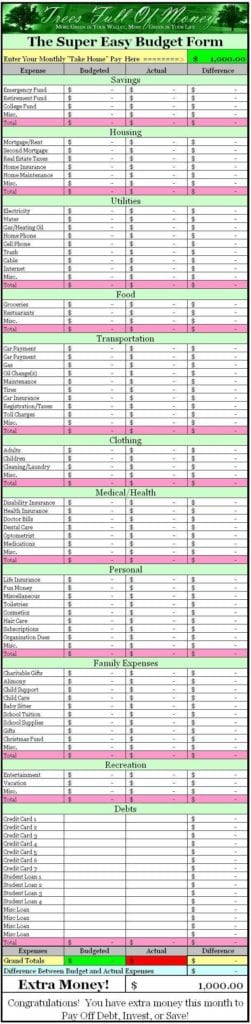

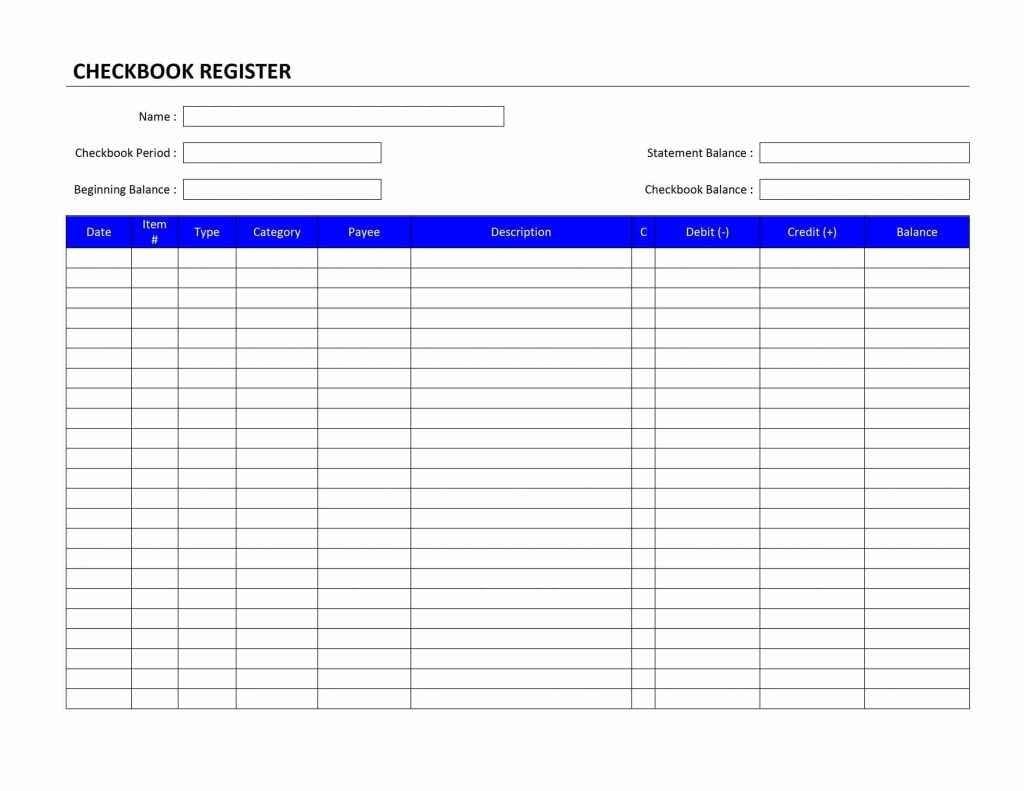

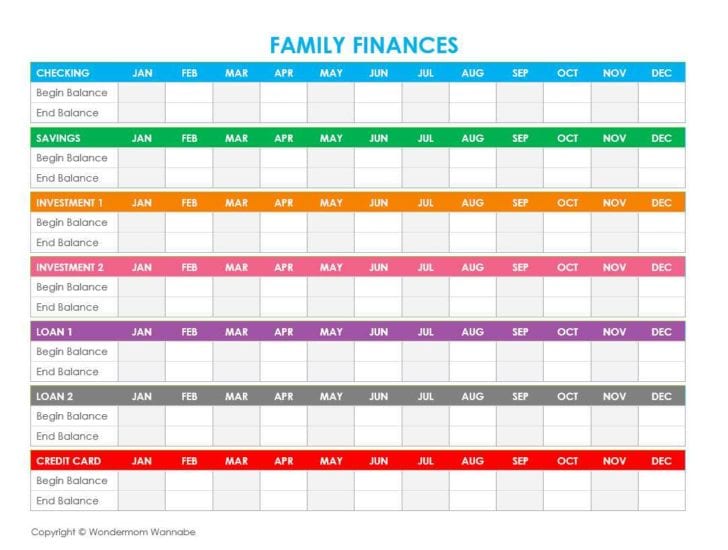

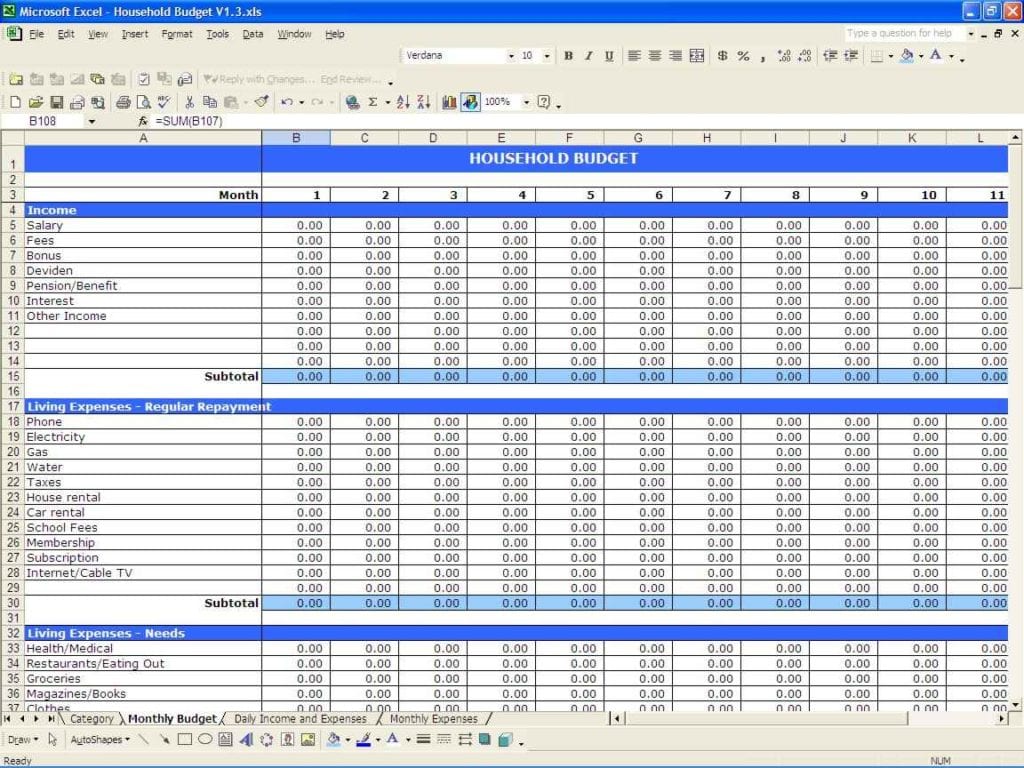

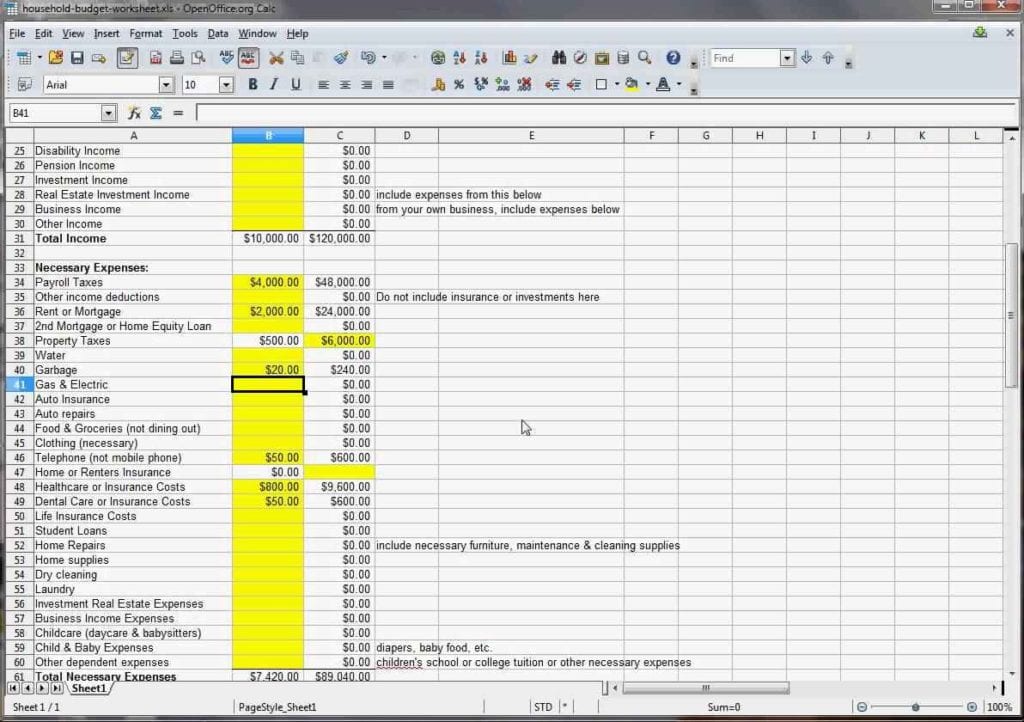

Choose where you’re likely to continue to keep your financial plan. You are additionally not committing to a single budget for the remainder of your life. Though a month-to-month budget is normally the most reasonable timeframe for which to set up an initial personal or household budget, there are a number of sources of revenue and expenses that don’t perfectly comply with a month-to-month schedule.

A budget is a critical tool in making certain you’re living within your means. It can help you here too. Maybe you’re interested in developing a budget for monthly small business expenses or company projects. You will each learn to adhere to a budget. Putting a budget together takes a resource that assists you to organize your finances. Possessing a working budget in place will allow you to identify precisely where you stand with your finances.

Your financial plan needs to be less than your example month, or you’ll want to return and take some things out. There are several reasons to create a startup budget. It is usually a key component of your business plan and is useful when applying for a loan or pitching to investors. Developing a startup budget is just one of the most essential tasks a new small business operator will undertake. It serves as a roadmap for the business. A good example startup budget is also included to help direct you through the approach.

When you comply with a budget, it enables you to achieve your aim of affording a remarkable vacation or saving for a home or retirement. Then with a bit clean up, you have your financial plan. Your very first budget should truly be simple to manage and keep up with to help you to get a handle on your finances.