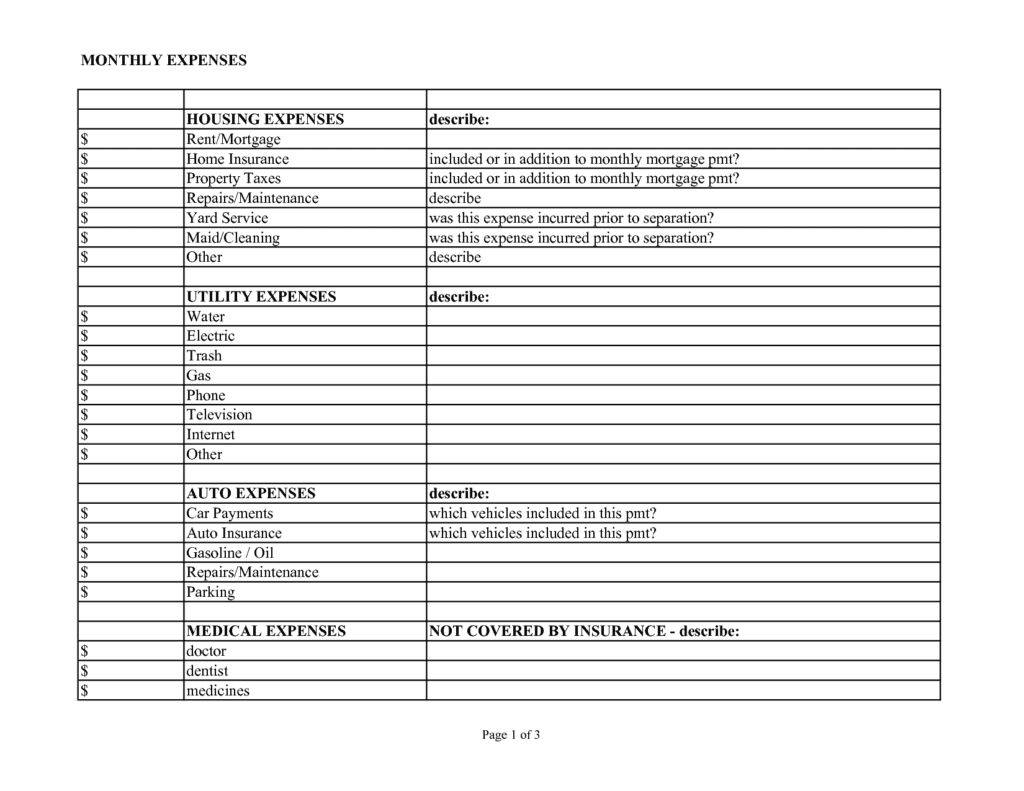

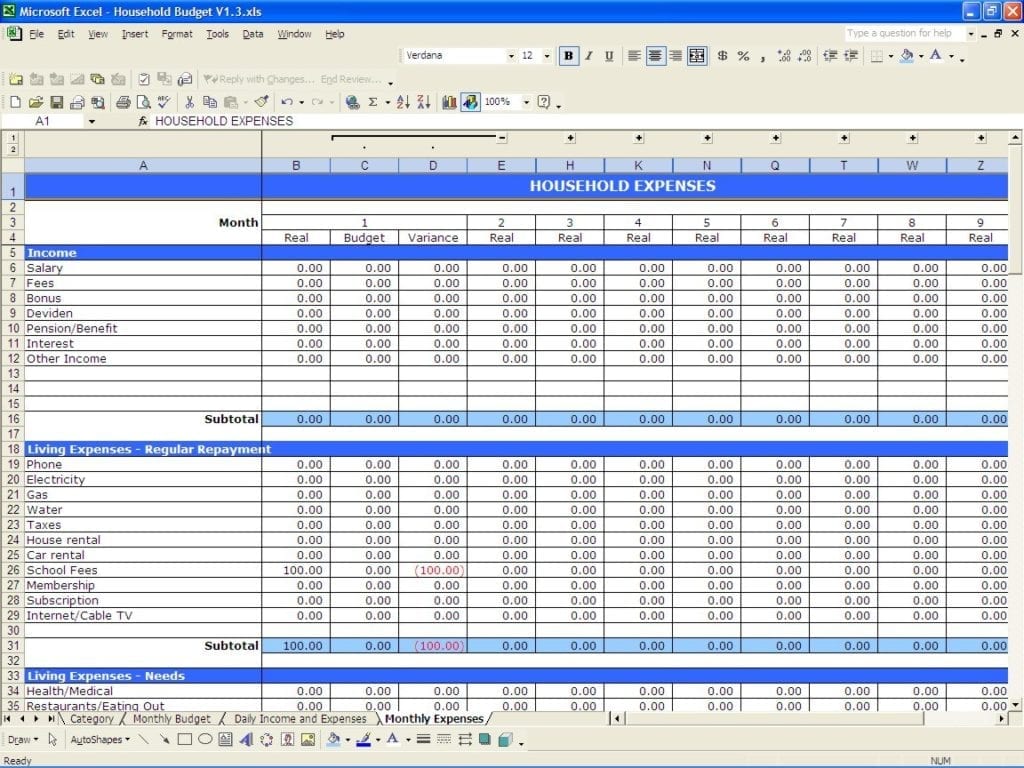

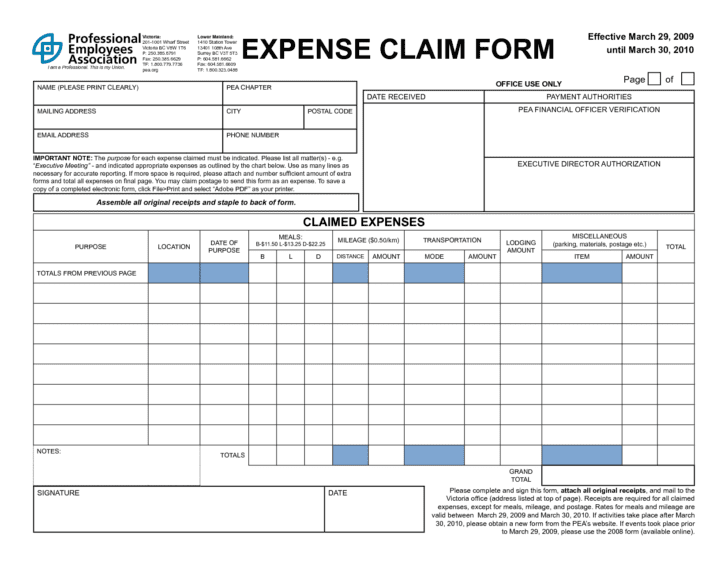

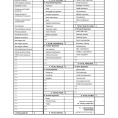

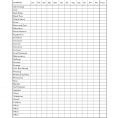

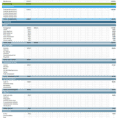

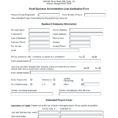

In the event the expense was only partly for business, you will need to allocate it between the company and personal part. It’s okay, provided that business is the main goal of the trip. As a result, the date as soon as the company can be believed to have commenced have to be known. Not only does this help you grow your company, but often the money that you spend can be subtracted from your enterprise income in influencing your taxable income.

If you don’t expect your business to last over a year at your present place, you could be in a position to deduct the entire cost in 1 year. Business start up costs To deduct a business expense, you must have carried on the company in the fiscal period where the expense was incurred. If you are only getting started in your company or haven’t been in a position to create a profit still, you should think about employing a joint sponsor. The very last thing that you want to do is to run your company at a loss because of wrong accounting. So, you wish to begin your very own small company, or you wish to be self-employed.

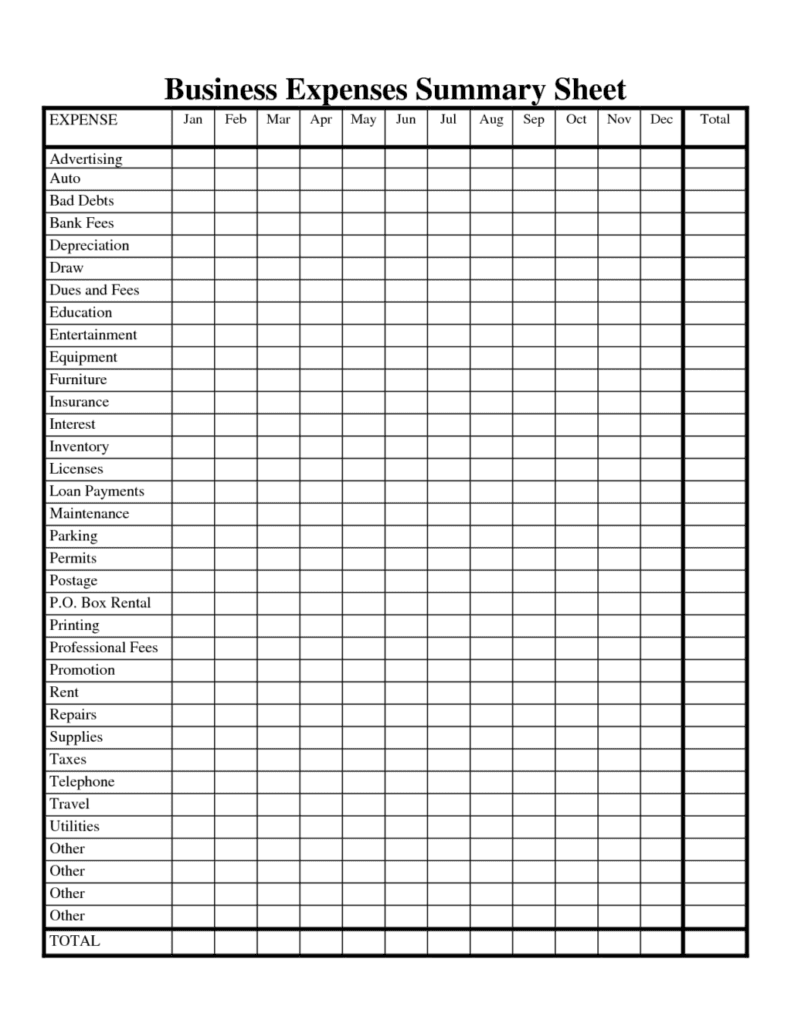

A expense doesn’t have to be indispensable to be considered necessary. Business expenses are the price of running a business enterprise. As a rule of thumb, if something is a real small business expense, it is most likely deductible.

A expense doesn’t have to be required to be considered necessary. Business expenses are the price of conducting a trade or company. As an employee or company owner, you will routinely come face to face with certain expenses that are essential to your status as an employee or a business proprietor.