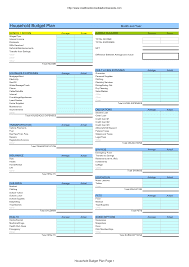

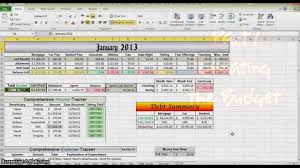

Much like allocation, there are a variety of methods out there for following a budget. It is a plan that helps you manage your money. If it is too complicated, you won’t use it, so let’s just go through the steps to create a simple, workable budget. Developing a month-to-month small business budget may look like a hassle, but I bet it’s something which you’ve been thinking about for quite a while.

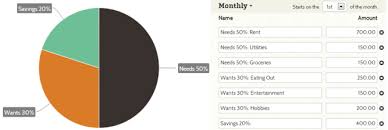

If you find it hard to stick with your finances, start looking for strategies to lower costs and to earn more money, then tweak your budget again. A budget can allow you to plan for expenses and know where your hard-earned money is going. From that point, you may set a fair budget for your disposable income, together with achievable savings targets.

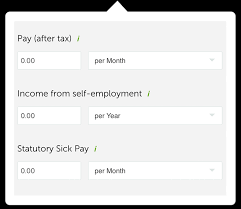

At this time you can return to your financial plan and adjust your numbers if you must. When the budget is set up and you may see where your hard-earned money is actually going, there’ll be a lot of opportunities to modify your spending. Keeping up a monthly budget and investing for the future will also offer you with a feeling of security. The very first step in making a budget is to recognize the quantity of money you have coming in. Utilizing a budget might not be a new or fancy tactic, but it is a smart one. A budget or spending program is merely a way to inform your money where you desire it to go instead.