As a sole proprietor, it’s simple to receive your own personal and company expenses muddled up. Although your company is probably legally separate from your own personal assets, a bank that considers giving you a business loan will probably request individual collateral if your company has little real price. In the end, if you don’t clearly distinct company and individual expenses (using separate banking accounts and credit cards for each), you’re discover that it’s difficult or impossible to receive a business loan should you ever need one.

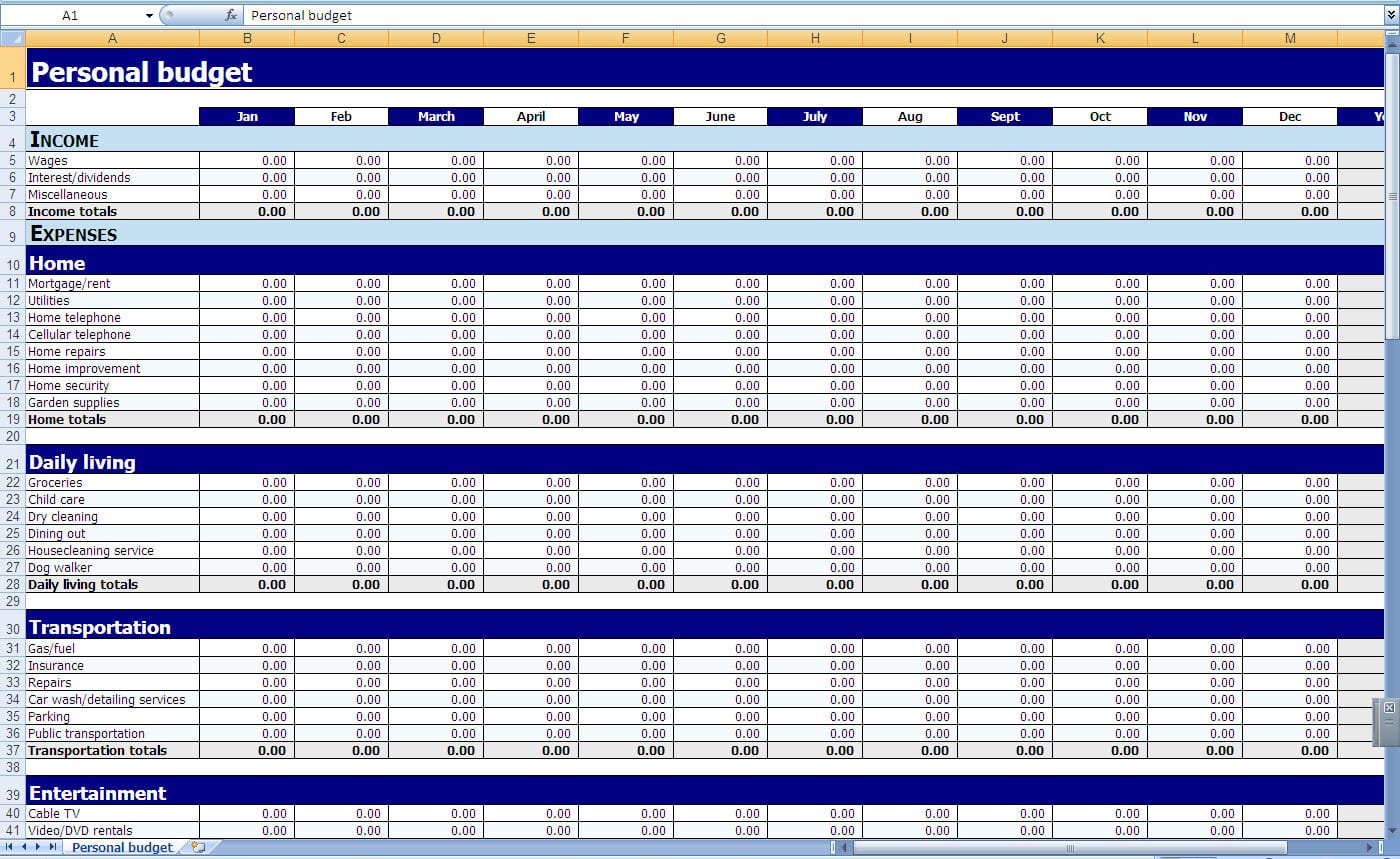

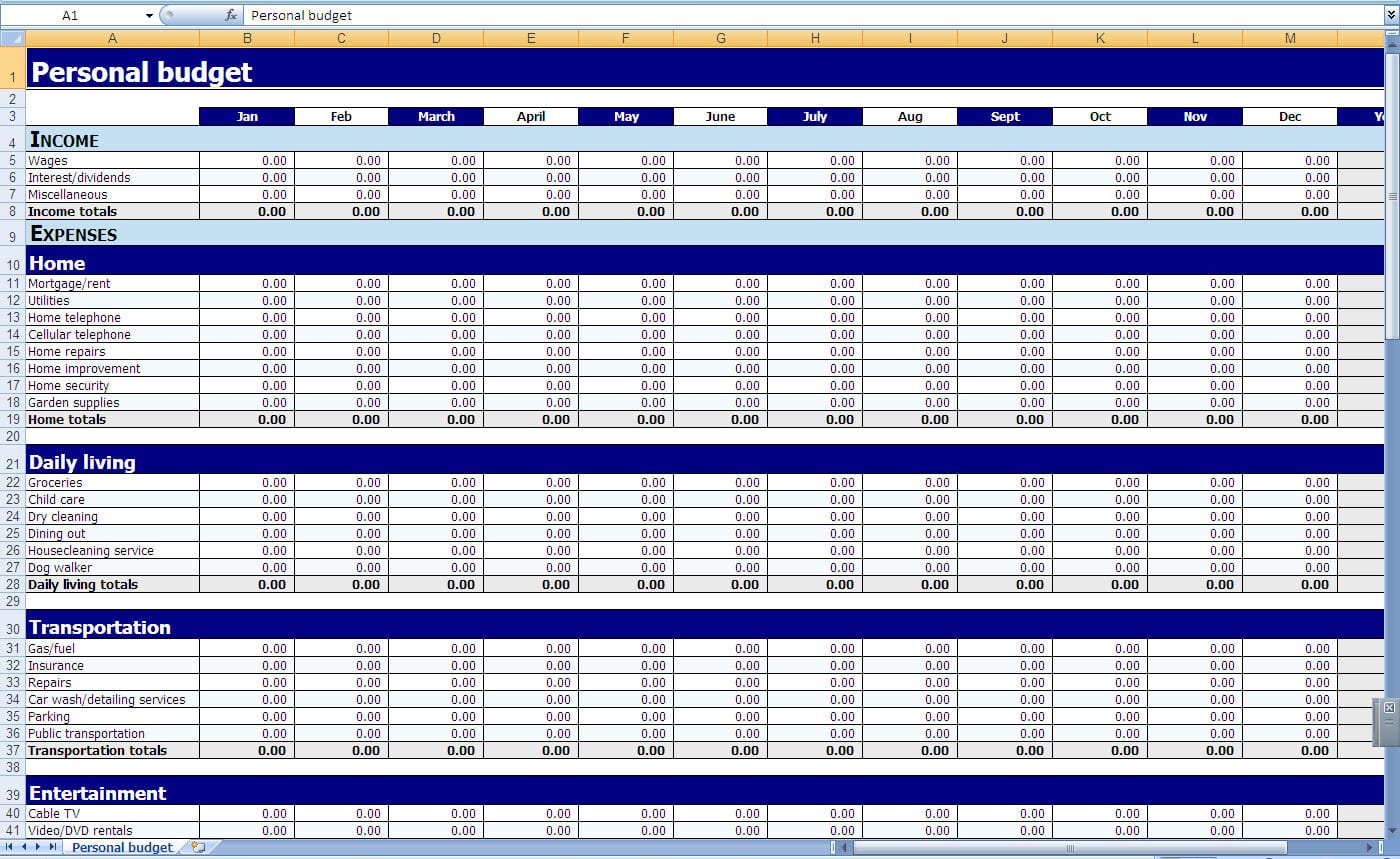

11 photos of the "Personal Finance Spreadsheet Template"

Related posts of "Personal Finance Spreadsheet Template"

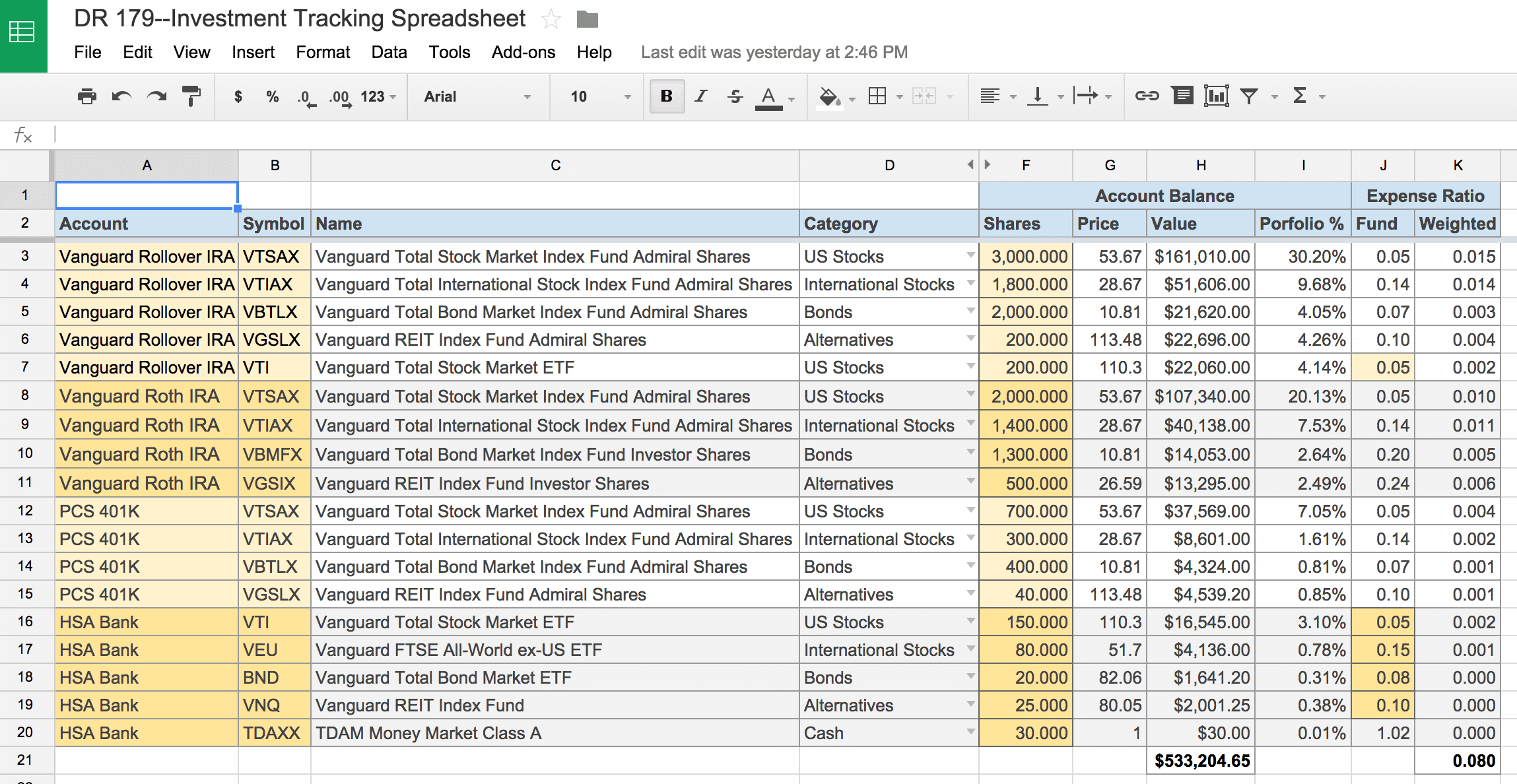

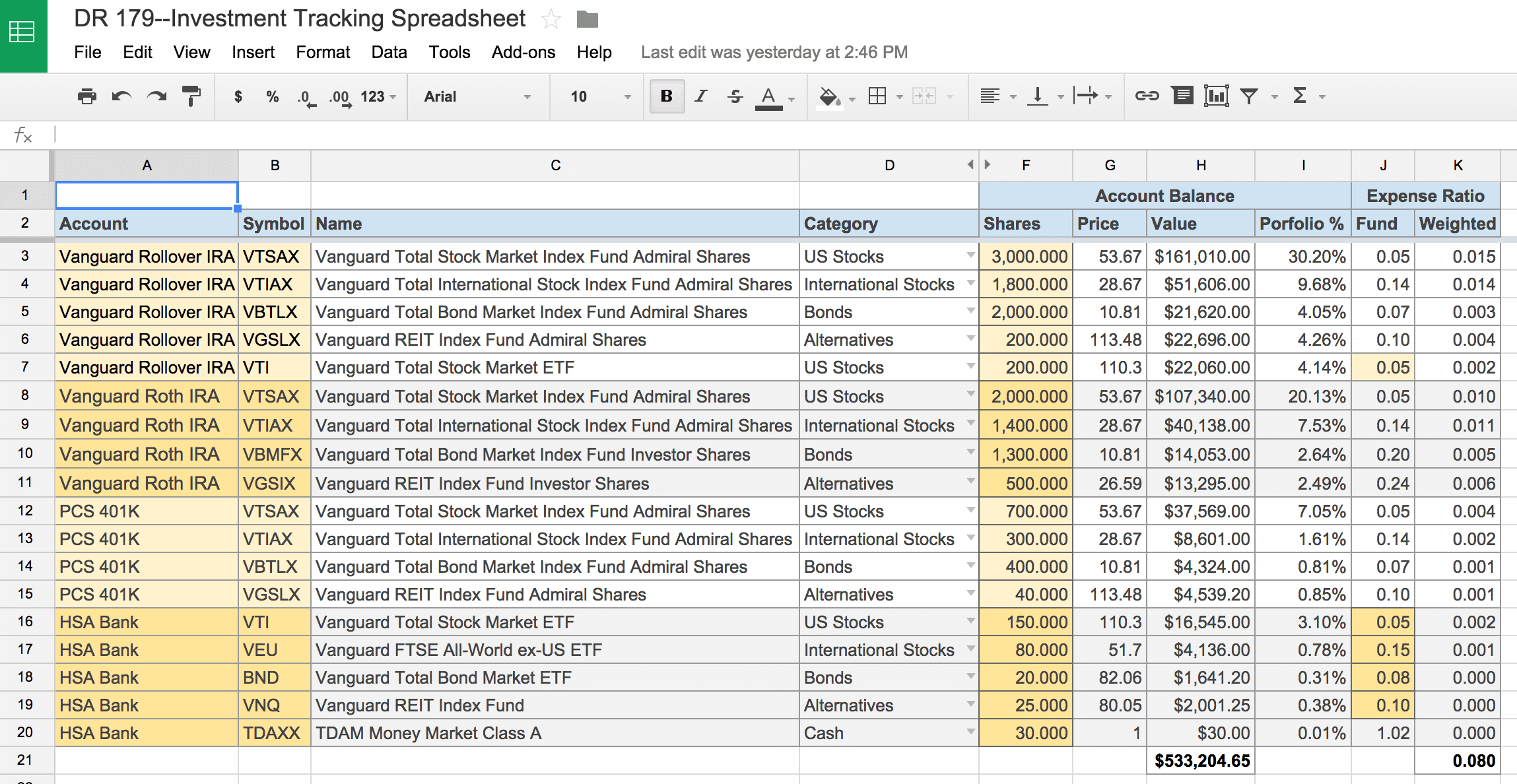

Every time a spreadsheet gets overly large or complicated one wants to ask is there an electronic remedy to create the exact same info. It contains room for various account names, as well as the type of tender used, and the initial and final balances. Items here need to be spent for your company, and...

Since Excel is a great report-generating tool if you understand how to utilize it, it is a good method to display visual reports relatively simply. It is a fantastic tool. It is useful for starting projects and developing a breakdown of tasks (sometimes called a Work Breakdown Structure). Based on your project's complexity, you are...

By the same way, the templates are currently utilizing worldwide and among the most trustworthy tool for the intelligent small business owners on account of their user friendly interface and availability. It may also be used to track your unpaid bills, unpaid invoices, and unpaid domestic and international taxes. There are several such templates out...

Our template may be used to assist you assess your goods in comparison to your top competition. Therefore, the template will offer you a weighted total amount for each vendor. Below you can receive a free product comparison template excel that may function as a handy tool to analyze products or feature category between at...