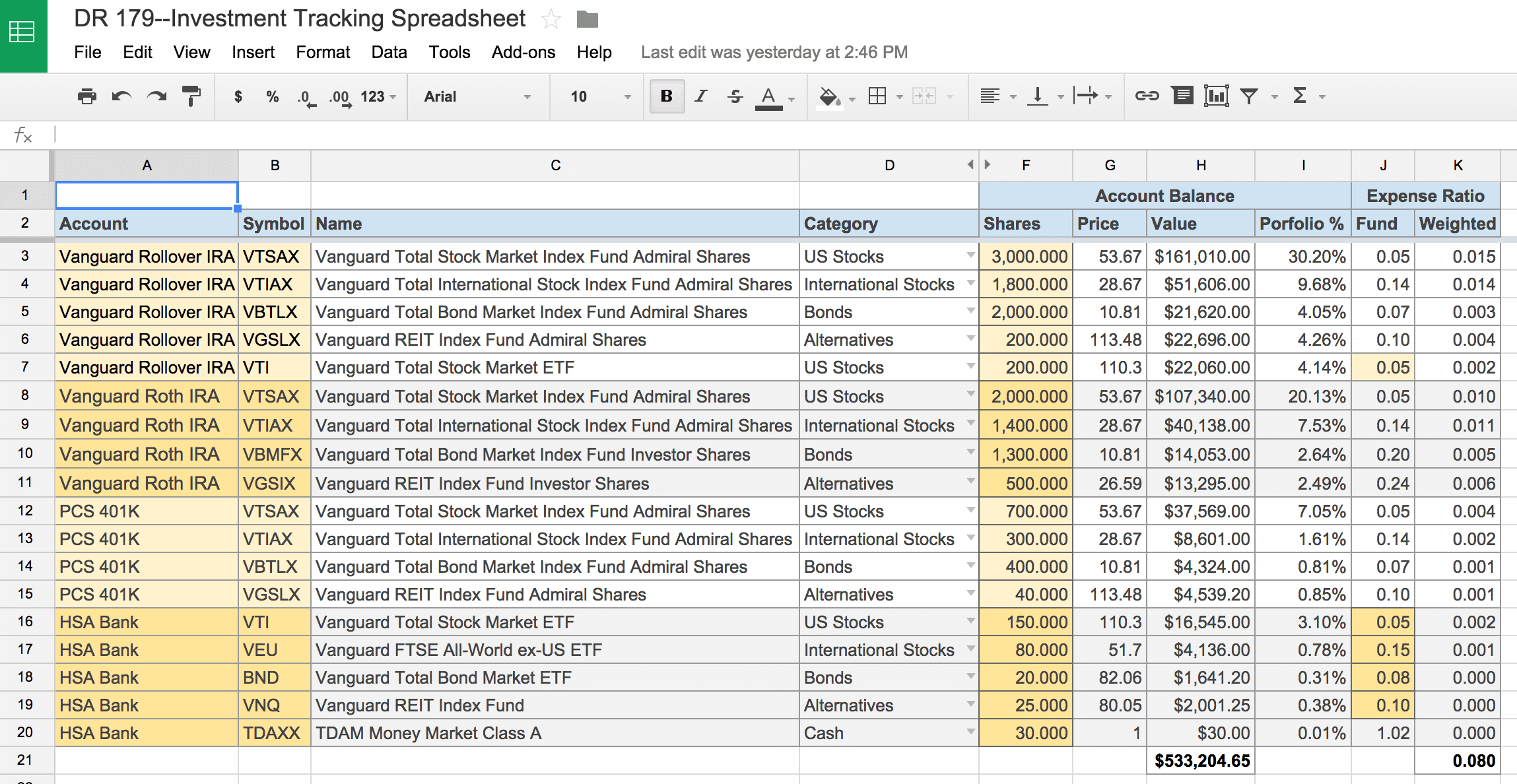

As a sole proprietor, it’s simple to receive your own personal and company expenses muddled up. Although your company is probably legally separate from your own personal assets, a bank that considers giving you a business loan will probably request individual collateral if your company has little real price. In the end, if you don’t clearly distinct company and individual expenses (using separate banking accounts and credit cards for each), you’re discover that it’s difficult or impossible to receive a business loan should you ever need one.

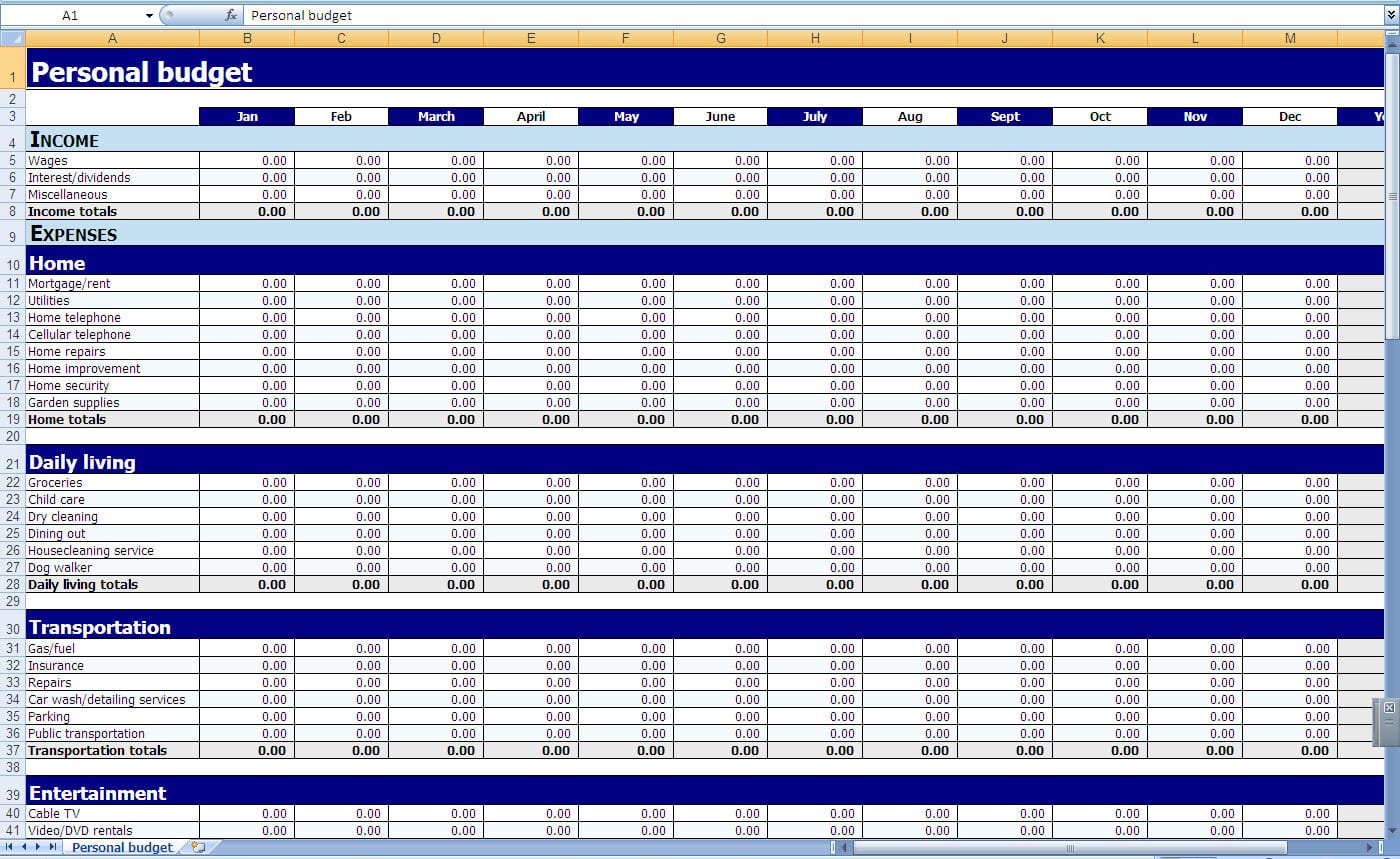

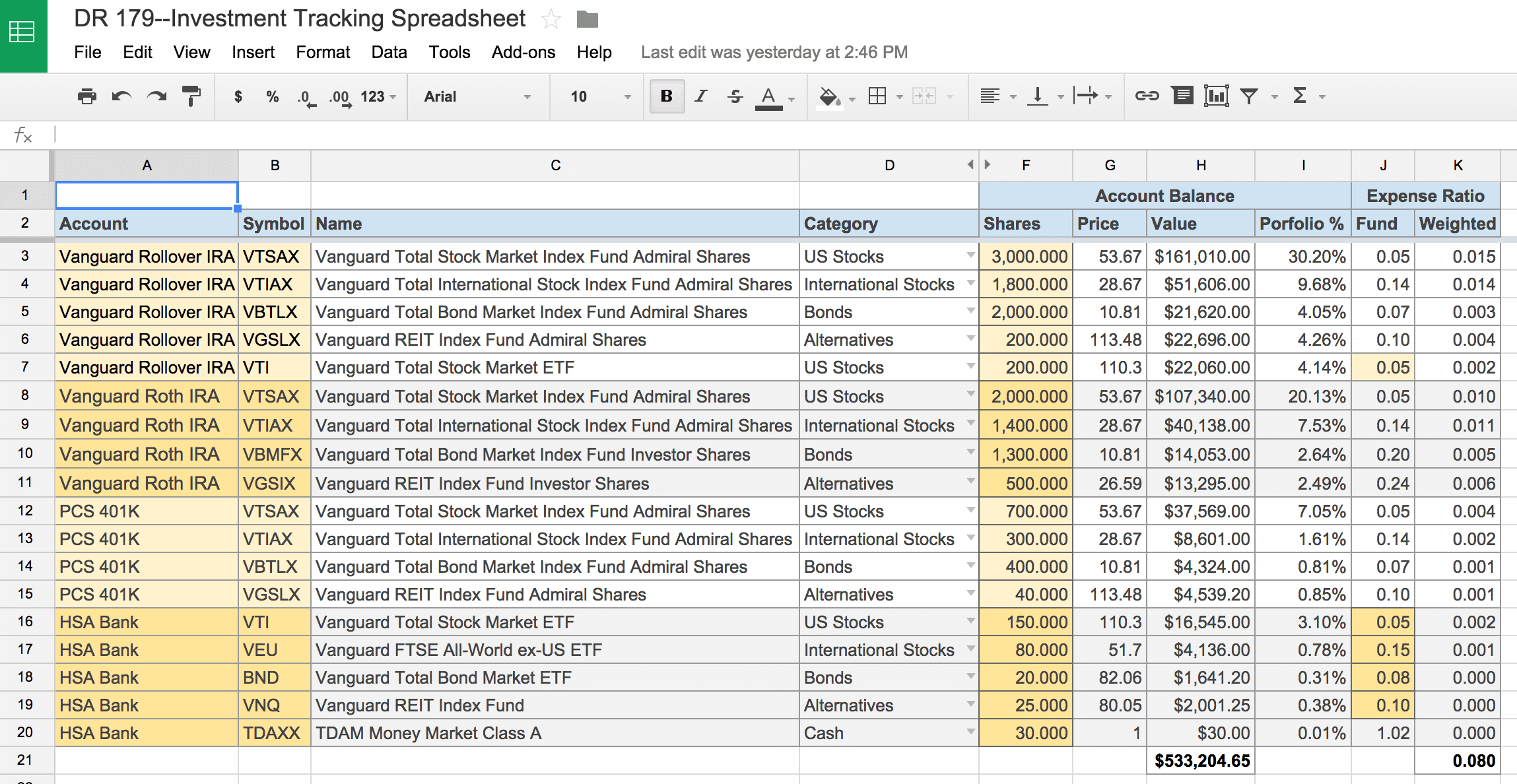

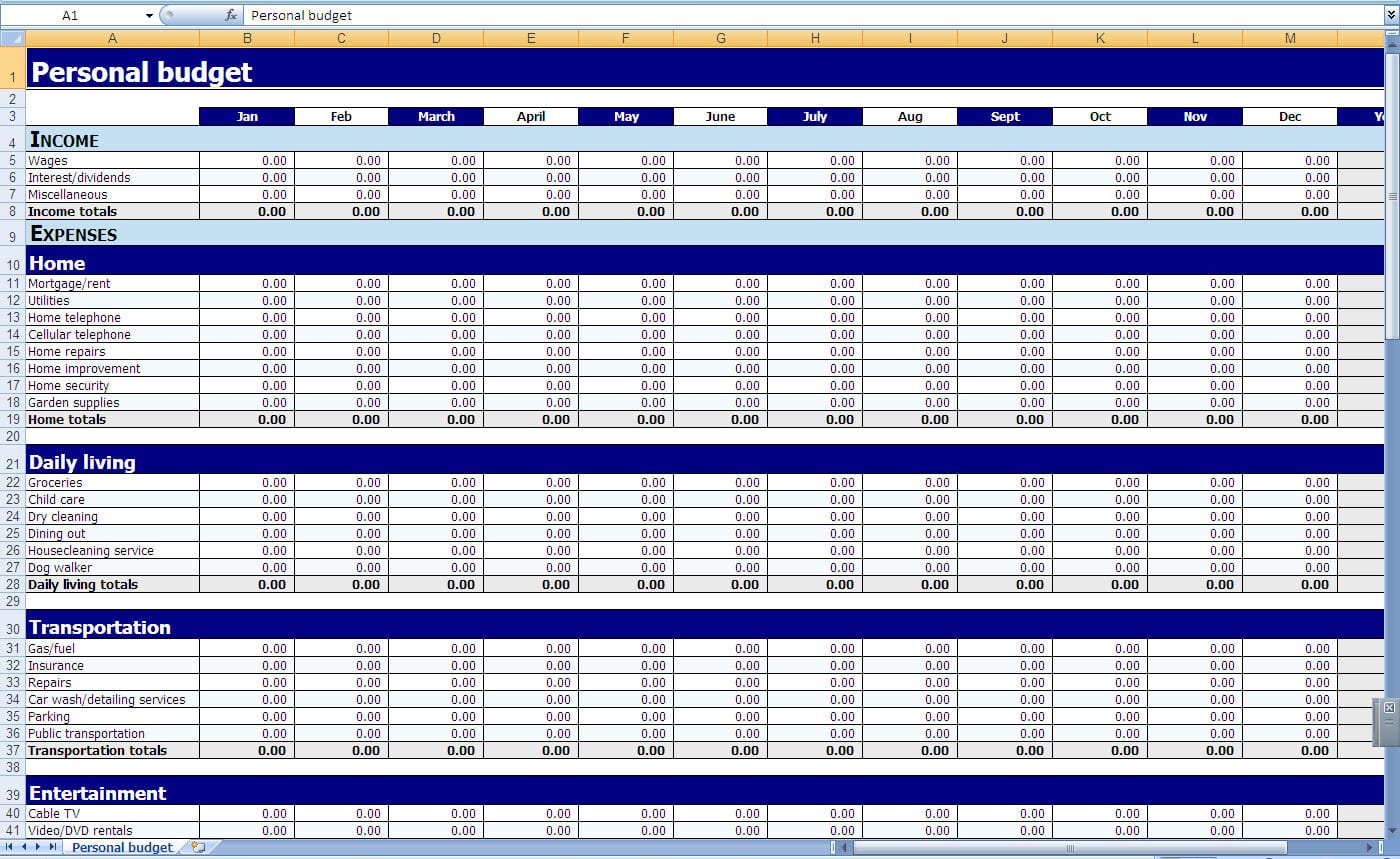

11 photos of the "Personal Finance Spreadsheet Template"

Related posts of "Personal Finance Spreadsheet Template"

Budget enough so that you can live in your budget. A very simple budget is the secret to having an effective spending program. It is a great place to start if you are trying to get a handle on your finances. Planning a month-to-month budget is just one of the main jobs for a family....

The template is simple plug and play, which usually means that you do not even have to make any changes, unless you would rather customize it to your particular requirements. It will hasten the plan process and enhance the customers workflow, allowing the organization to get started selling nearly instantly. The templates made to utilize...

All said and done if there isn't any program. Nevertheless, an accounting program that's integrated provides a type of protection not available with Excel. Wonderful program that will help you keep organized. Additionally, there are programs which could disable the password. In addition, there are online programs which you'll be able to download to delete...

Send out your invoices on time after lawn care services are rendered, it's important to deliver an invoice once possible to your clientele. A work invoice is a list of the things which you did together with the complete price tag of the job. A work invoice is a particular sort of invoice which is...