There are many sorts of spreadsheets. Provided that the spreadsheet remains just a spreadsheet, only a few of people and a few departments may use the spreadsheet. It is designed to do a lot of the basic work for you, while being customizable. The other revenue schedule spreadsheet has a maximum of 200 lines, so that you may only claim for 200 donations on a single spreadsheet at once.

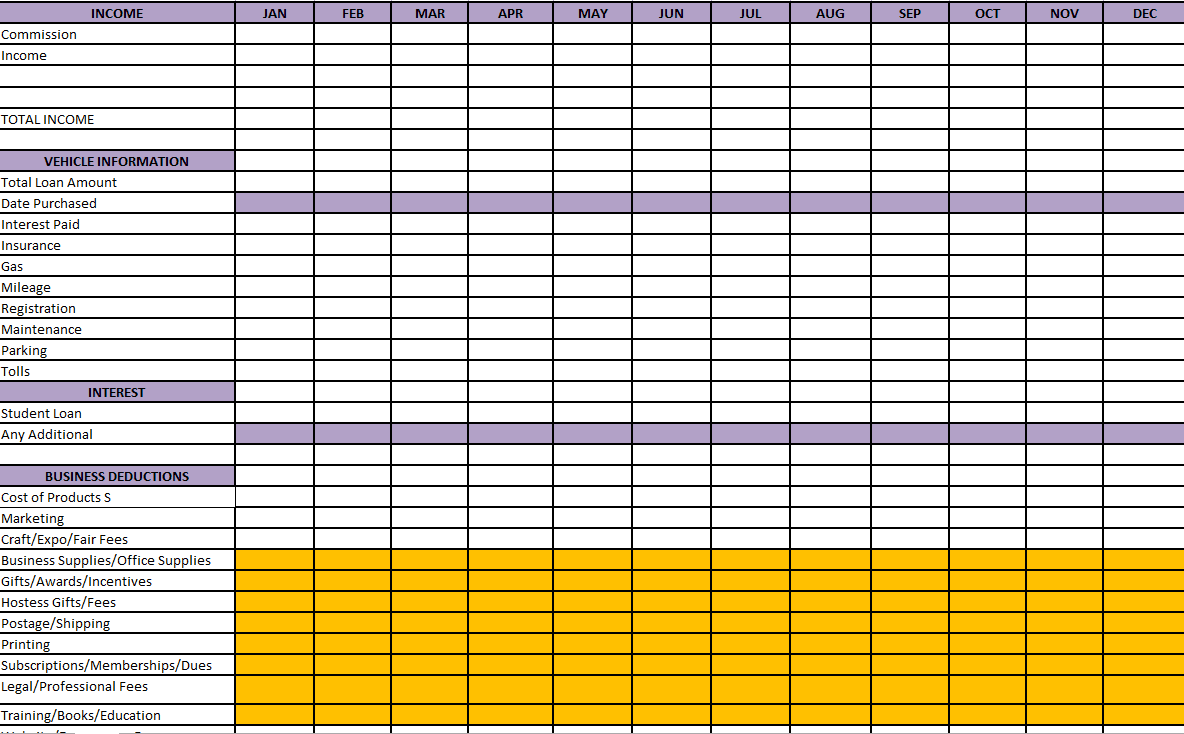

Items here need to be spent for your company, and they will need to be things that are ordinary and necessary (useful) in your individual business enterprise. A company with a huge moat will do well even under mediocre management. The better part of the times, companies decide to supply stocks to their employees in the form of reimbursement.

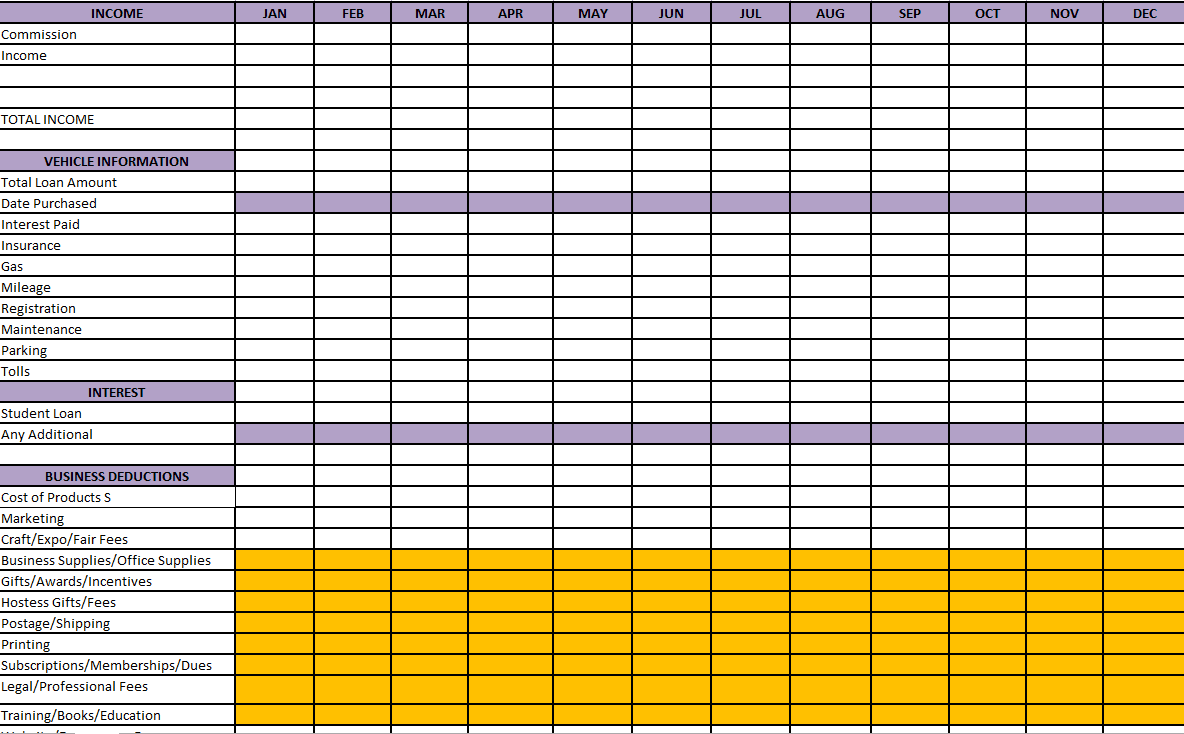

So as to assess the success rate of any profiteering business, expenses want to get tracked. In the event the expenses can be credited to a business with the aim of producing a profit (instead of a hobby), the expense is probably at least partially deductible. An essential expense is one which is helpful and appropriate for your trade or company. An ordinary expense is one which is common and accepted in your trade or company. Rental property expenses are almost always hard to organize and track. Then net income is subtotaled before you commence taking a look at expenses. If you truly get stuck, don’t be reluctant to employ a great tax professional for support.

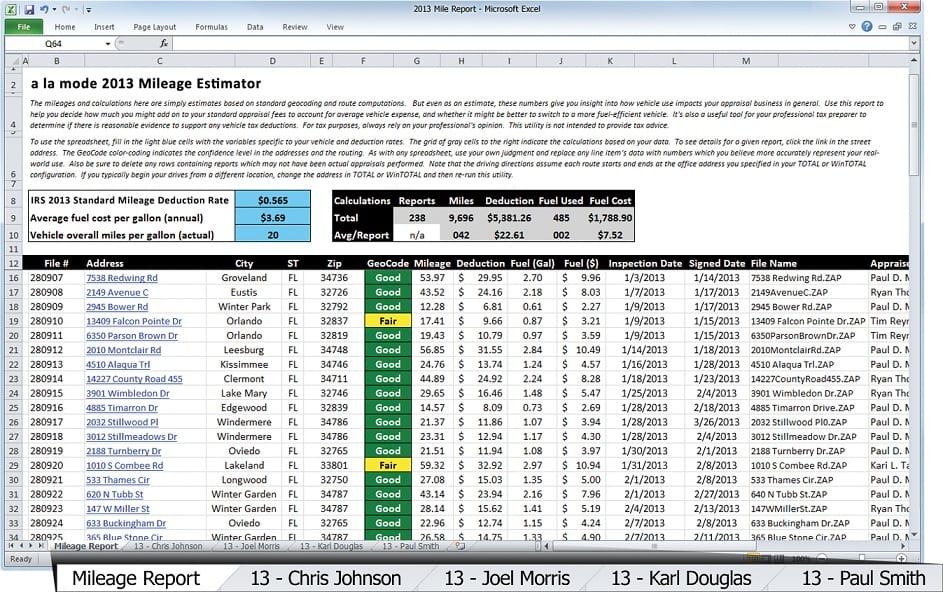

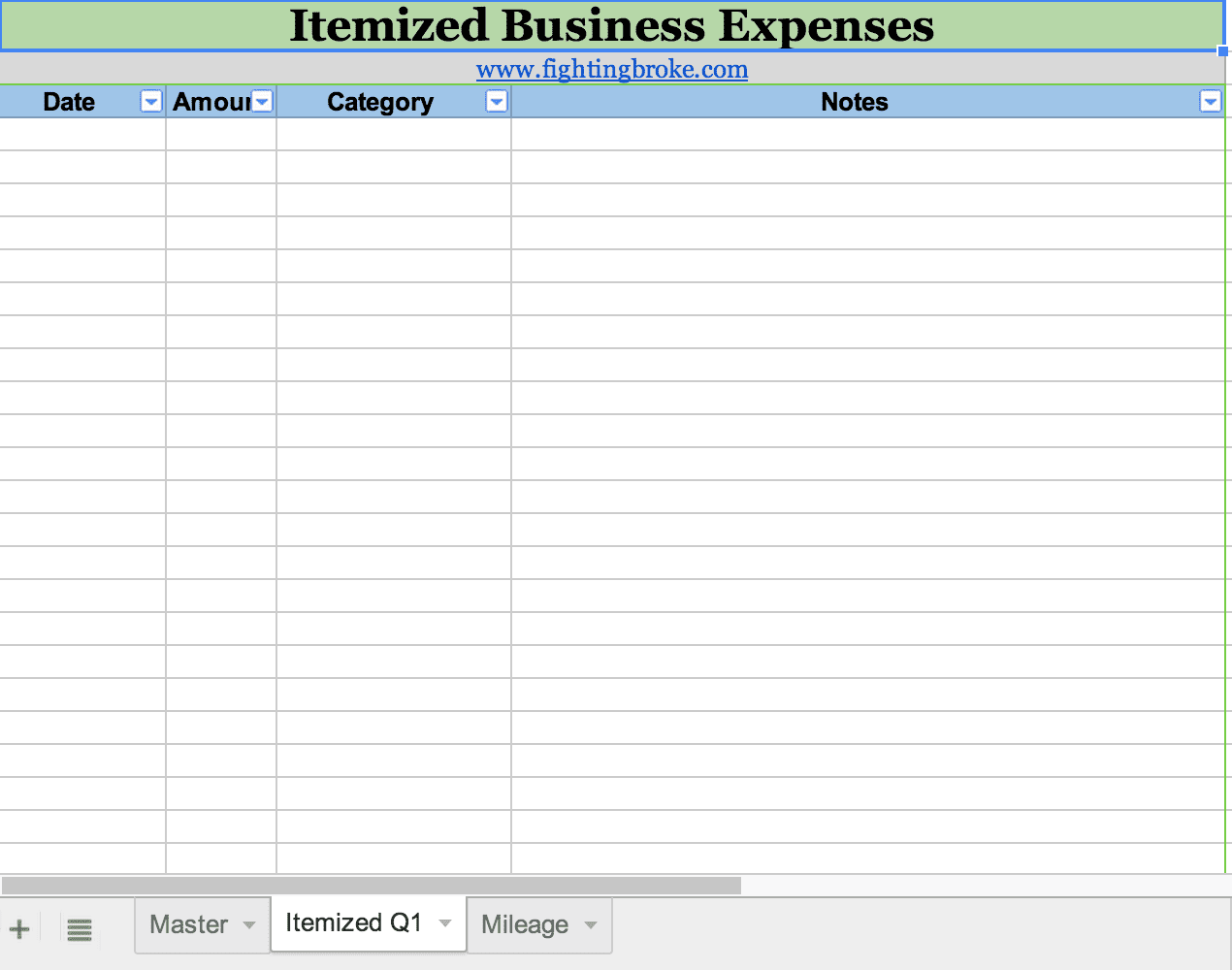

13 photos of the "Spreadsheet For Tax Expenses"

Related posts of "Spreadsheet For Tax Expenses"

If you're a teacher, you are aware that your job involves a lot more than simply standing in the front of the classroom and instructing your students. All should be taken into account when creating a teacher resume. A teacher resume template ought to be written keeping the essence of job in mind. Don't neglect...

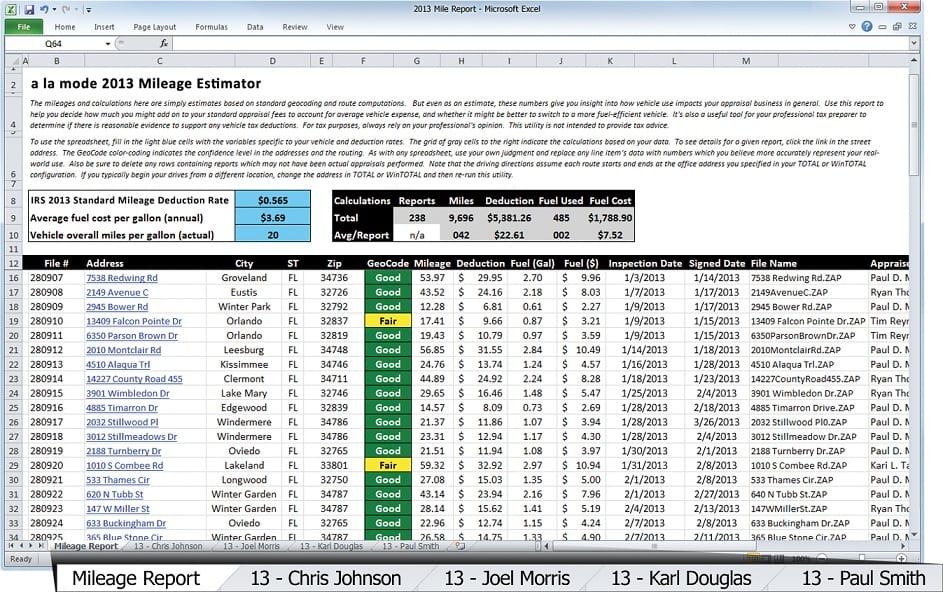

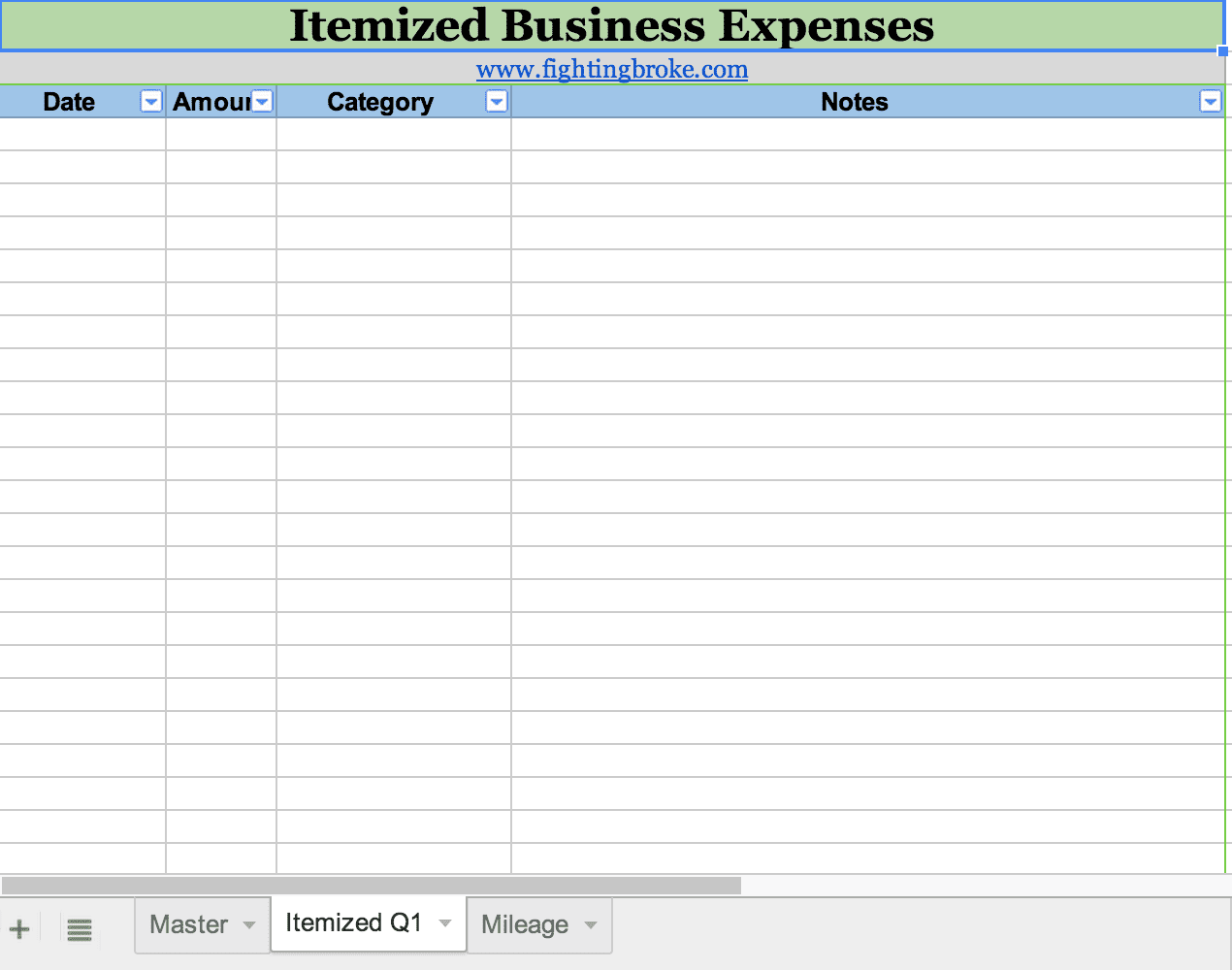

You may even track down the spreadsheet on... Should you would love to use the spreadsheet, then you will need to click empower content. In case you compare spreadsheets, you must go for the ones that need you to cover since they are much dependable and frequently contain further attributes that may help you in...

If you are able to track your expenses religiously, you may actually lessen your expenditures and get started saving. You may also clearly see where you're in a position to decrease expenses if necessary. Also, it's important to be aware that when entering an expense to be certain to incorporate the negative sign so it's...

You can earn a template to incorporate the aim of the trip, with a section comprising reminders for Customize your organization travel planner template, in accordance with your requirement. To accelerate the proposal writing procedure, you may use pre-designed templates and get ideas from sample proposals. A yield template isn't an easy calculator. Your specific...