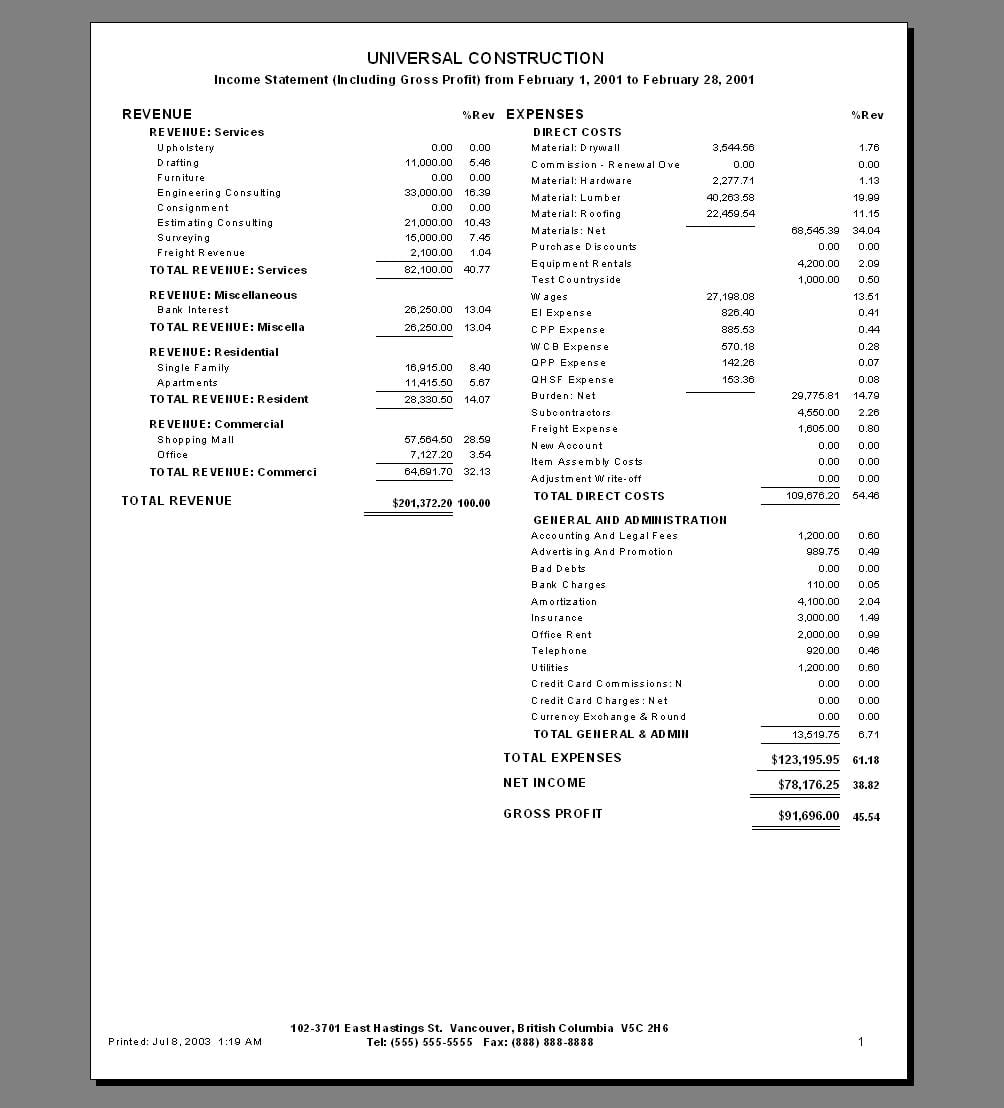

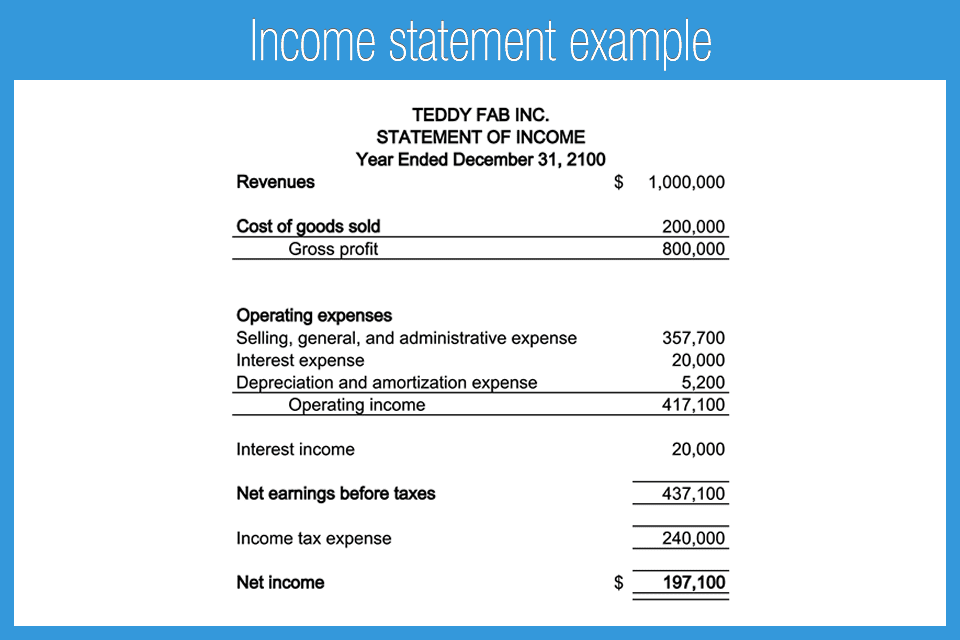

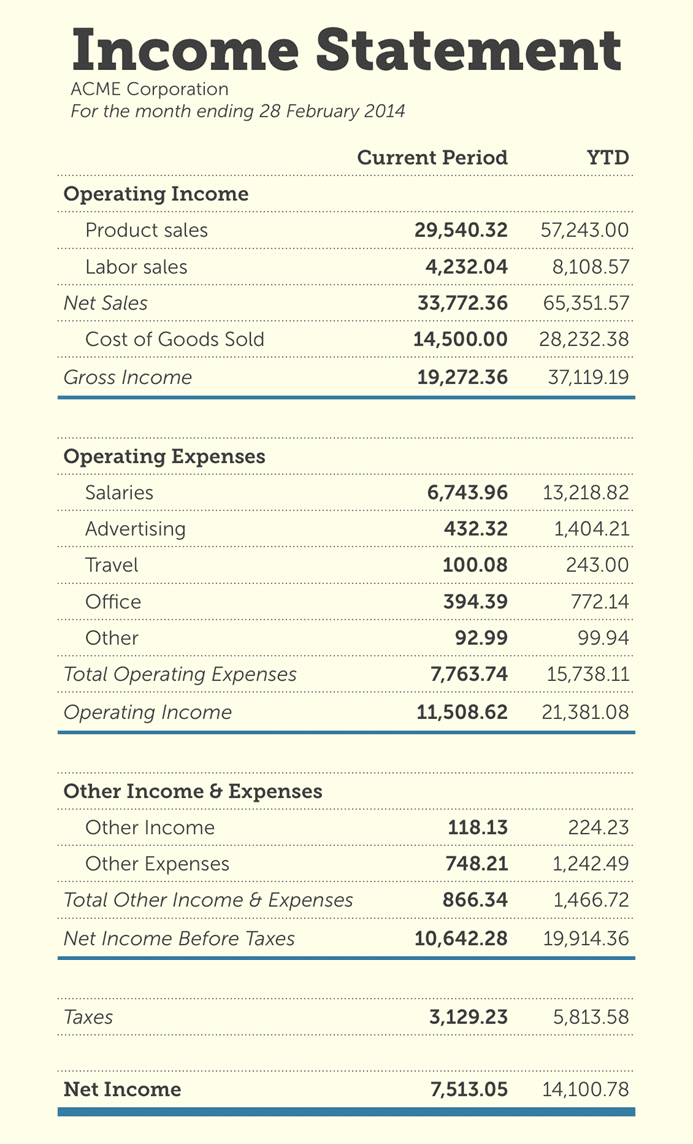

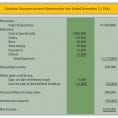

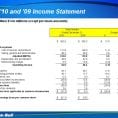

Income statements include several monikers. Knowing an income statement is vital for investors so as to analyze the profitability and future development of a business, which ought to play an immense part in deciding whether to invest in it. The income statement is a critical portion of analyzing a stock. Utilizing the Comparative Income Statement is quite straightforward.

Even if a business has a good balance sheet doesn’t indicate you may automatically invest and figure to be prosperous. It must also be currently profitable if you want a good chance at continued success. So the little business is twice as affordable, and so you are more inclined to make twice as much return. Ultimately, a business owner does not operate for anyone! Well, to begin with, small small business owners have business plans. Winging it isn’t good enough for a little small business owner.

With today’s low cost computer software solutions, it’s a simple matter to establish a budget and produce an easy revenue statement. Your small business plan lets you know how and what you have to do. Each one also consists of an advertising program and executive summary template.

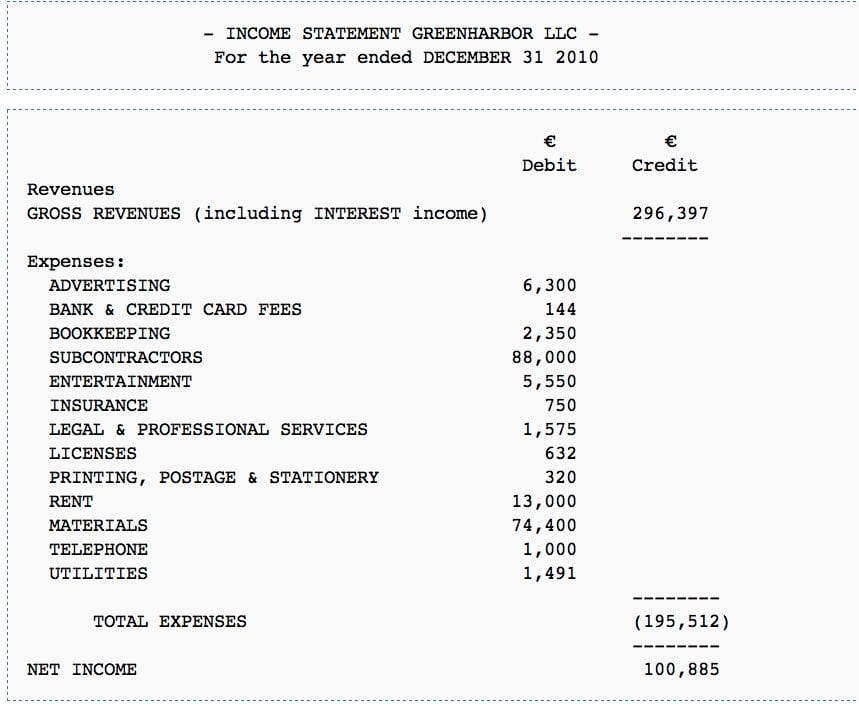

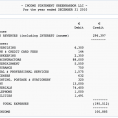

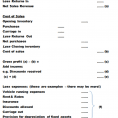

When it’s based on taxes or demands an opt-in, a means-tested program would end up overlooking a high number of individuals. The total sum of tax that should be paid by Hindu Undivided Families is too tiny. Net income is the previous line on an income statement, thus the phrase the main point. Operating costs, also referred to as overhead, refers to all the expenses required to run a company. It’s only readily available for taxpayers who itemize deductions or use the typical deduction.