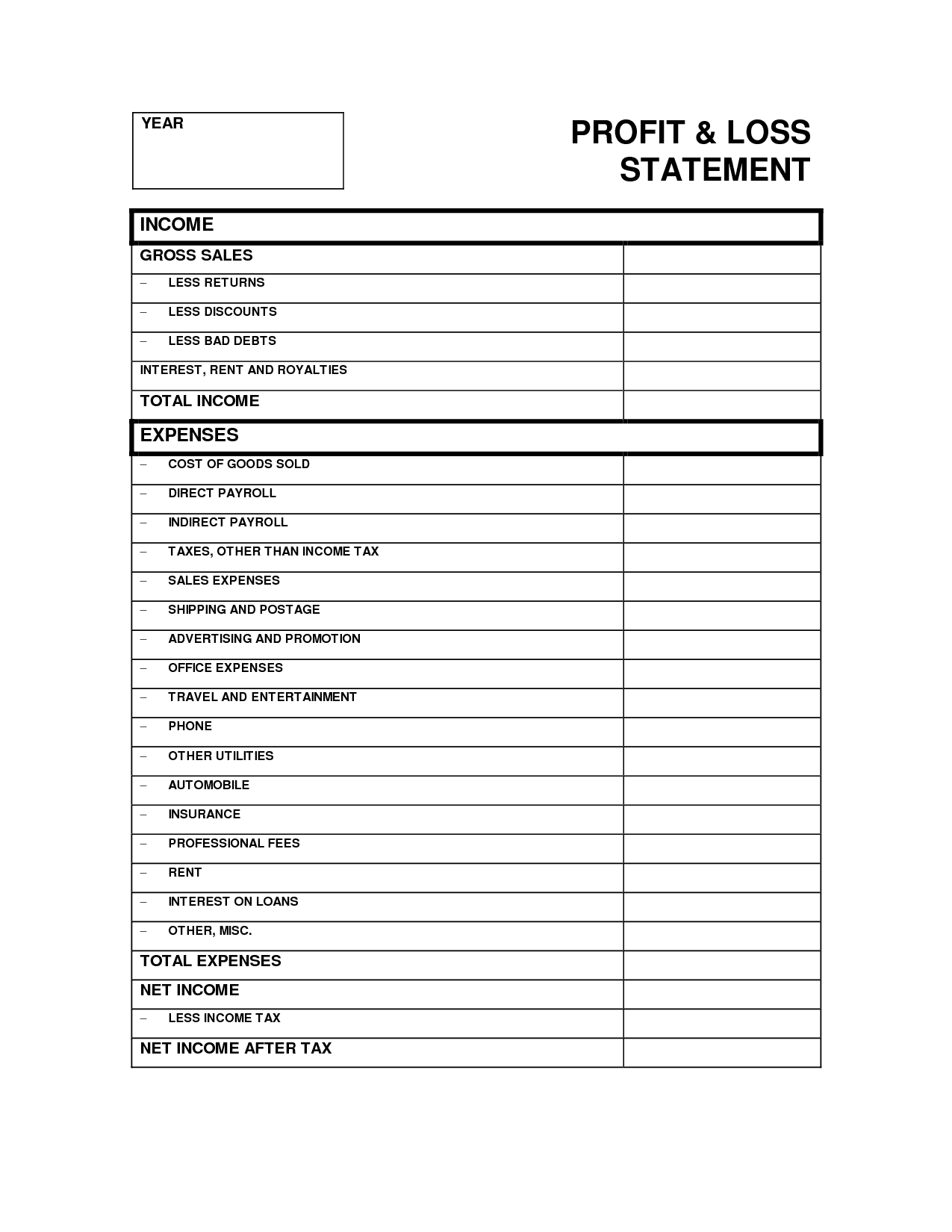

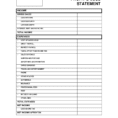

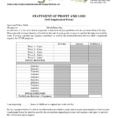

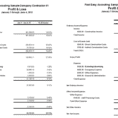

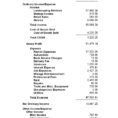

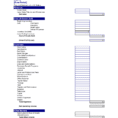

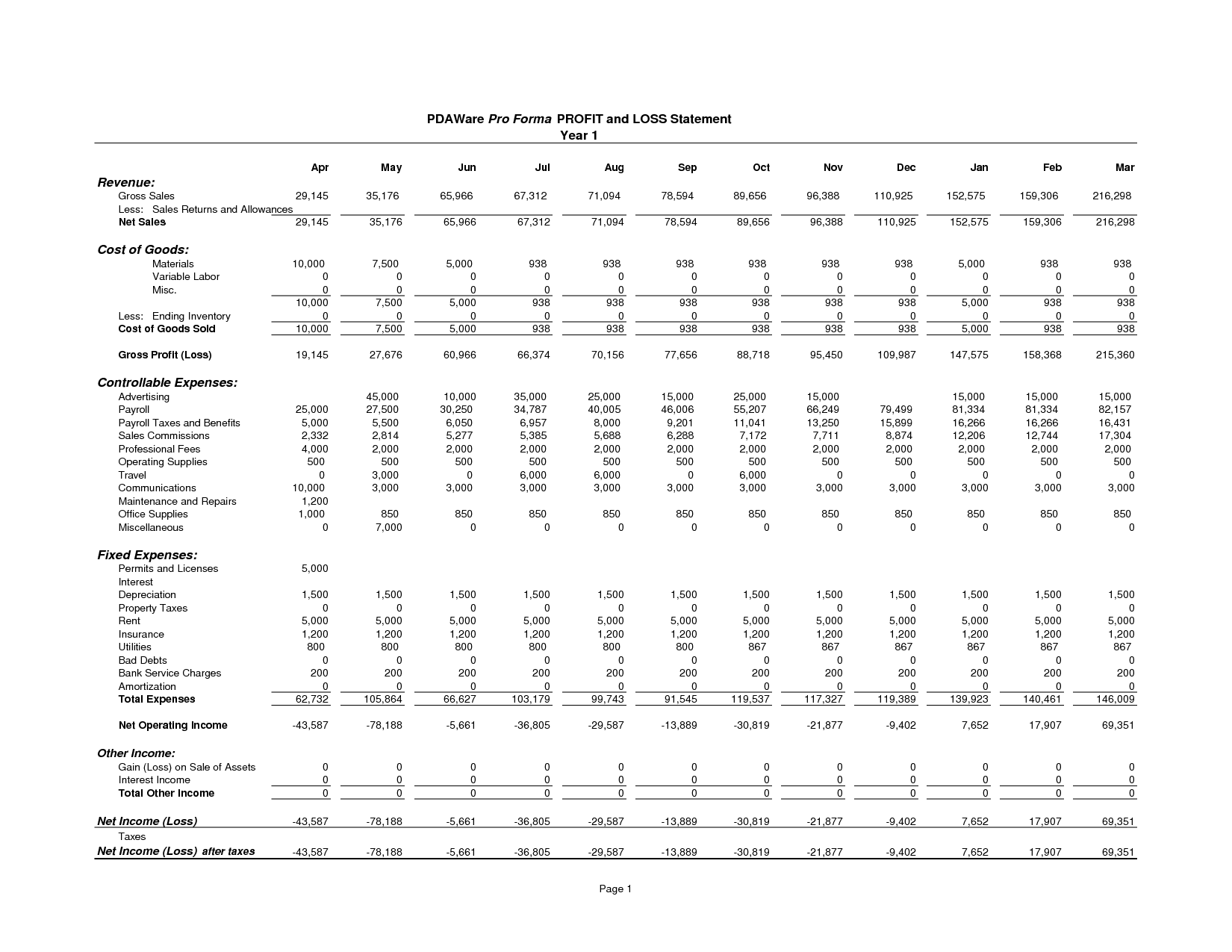

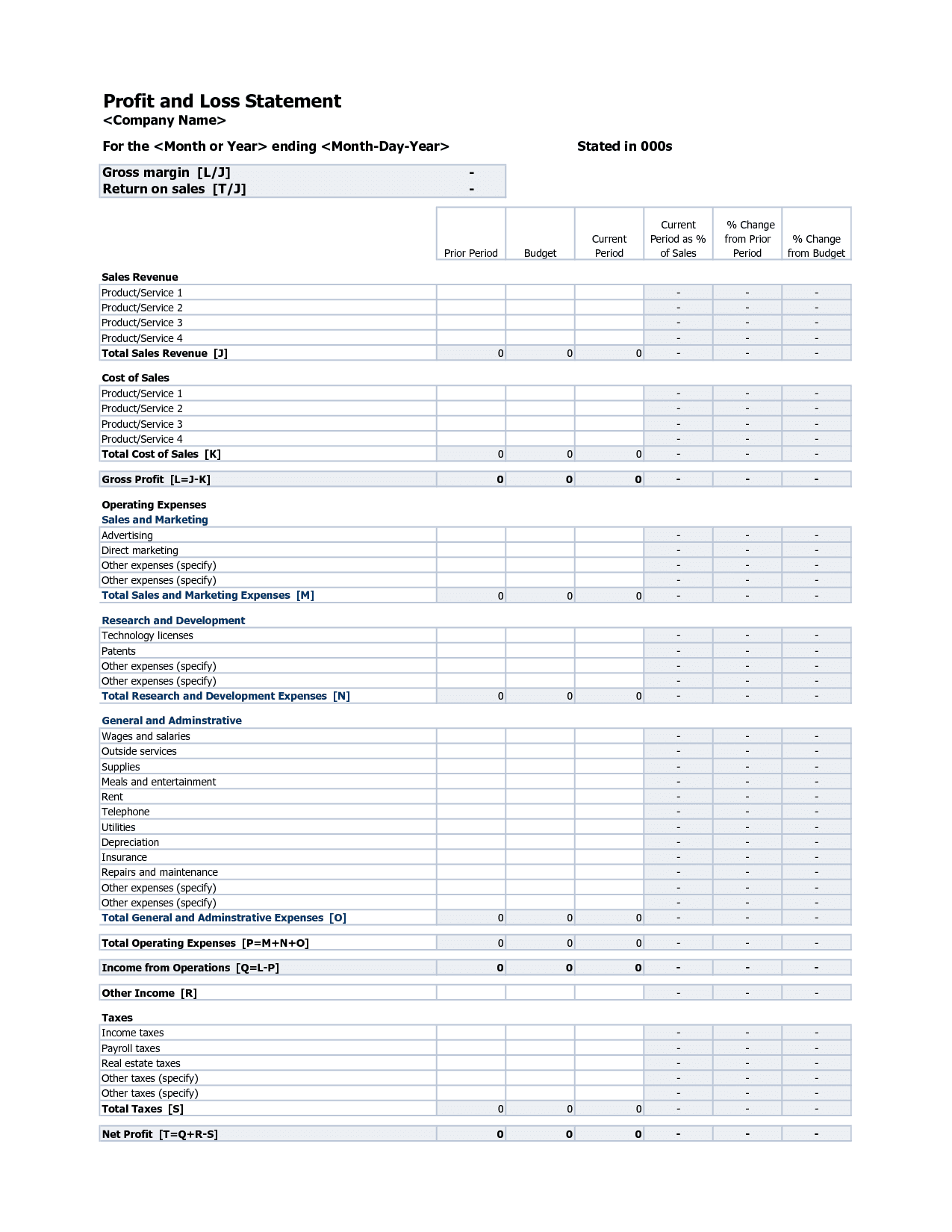

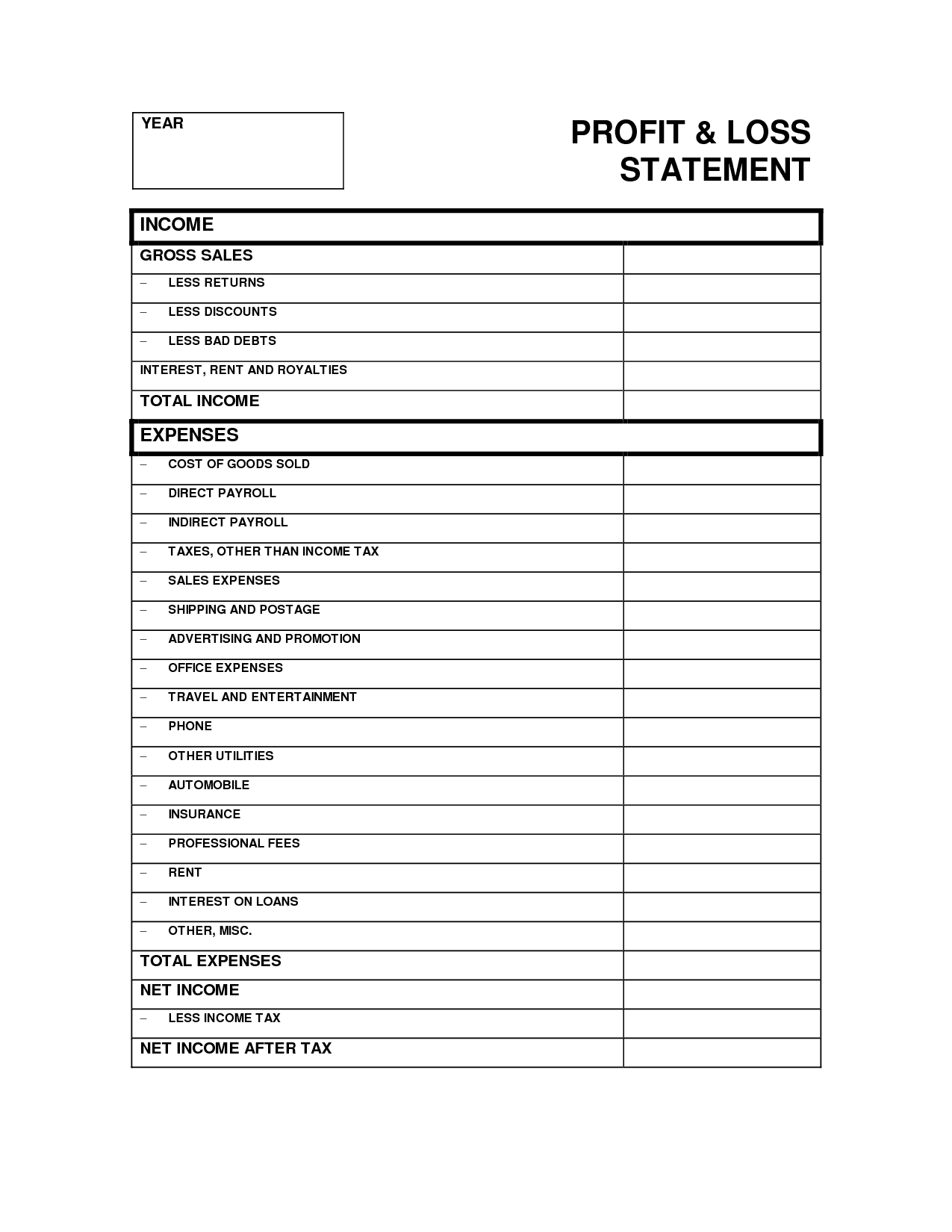

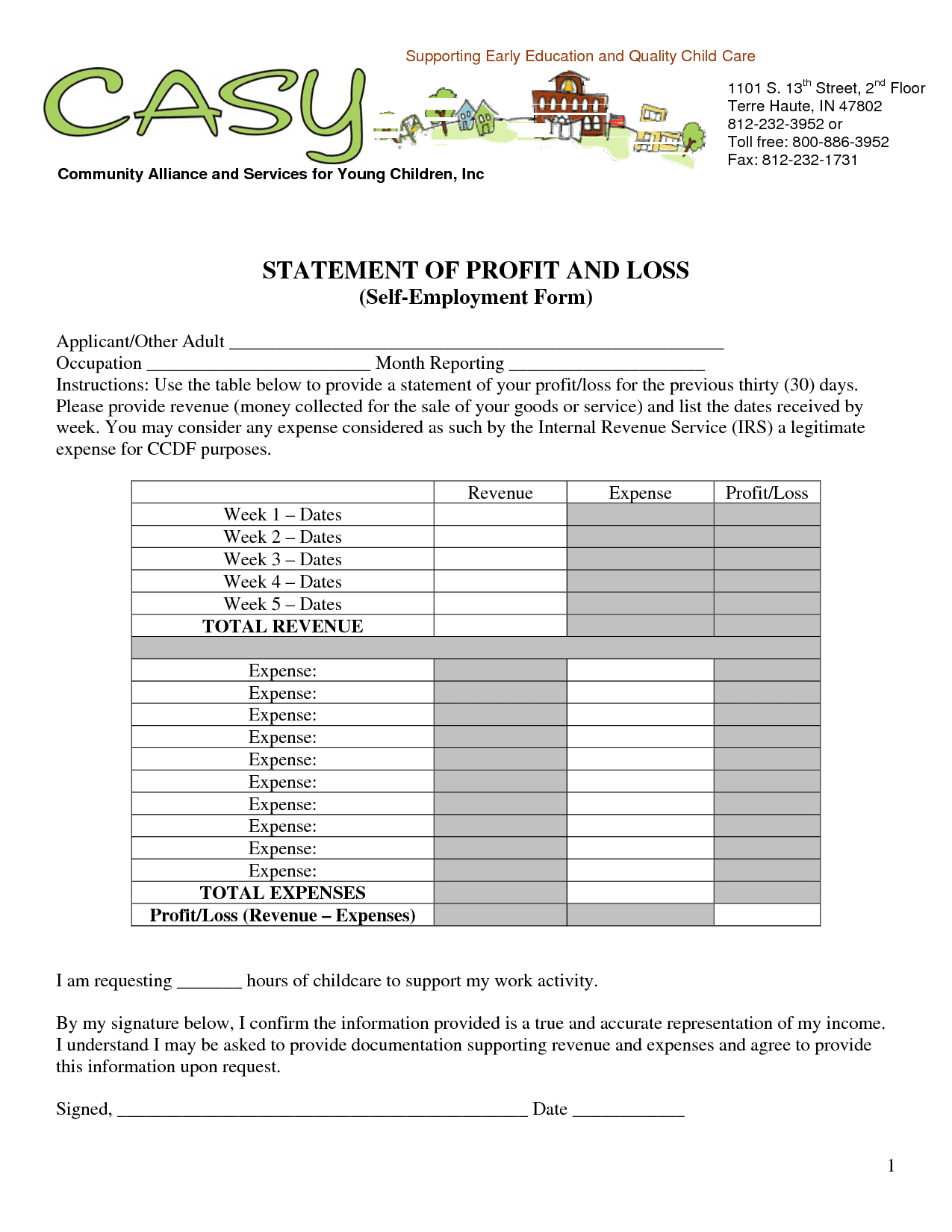

The profit statement demonstrates the way the company is performing. Profit and loss statement is a crucial small business document that lists overall sales and expenses incurred of an organization or company during a fixed period of time. It is one of the most important financial statements of the company to reveal a company’s overall financial health.

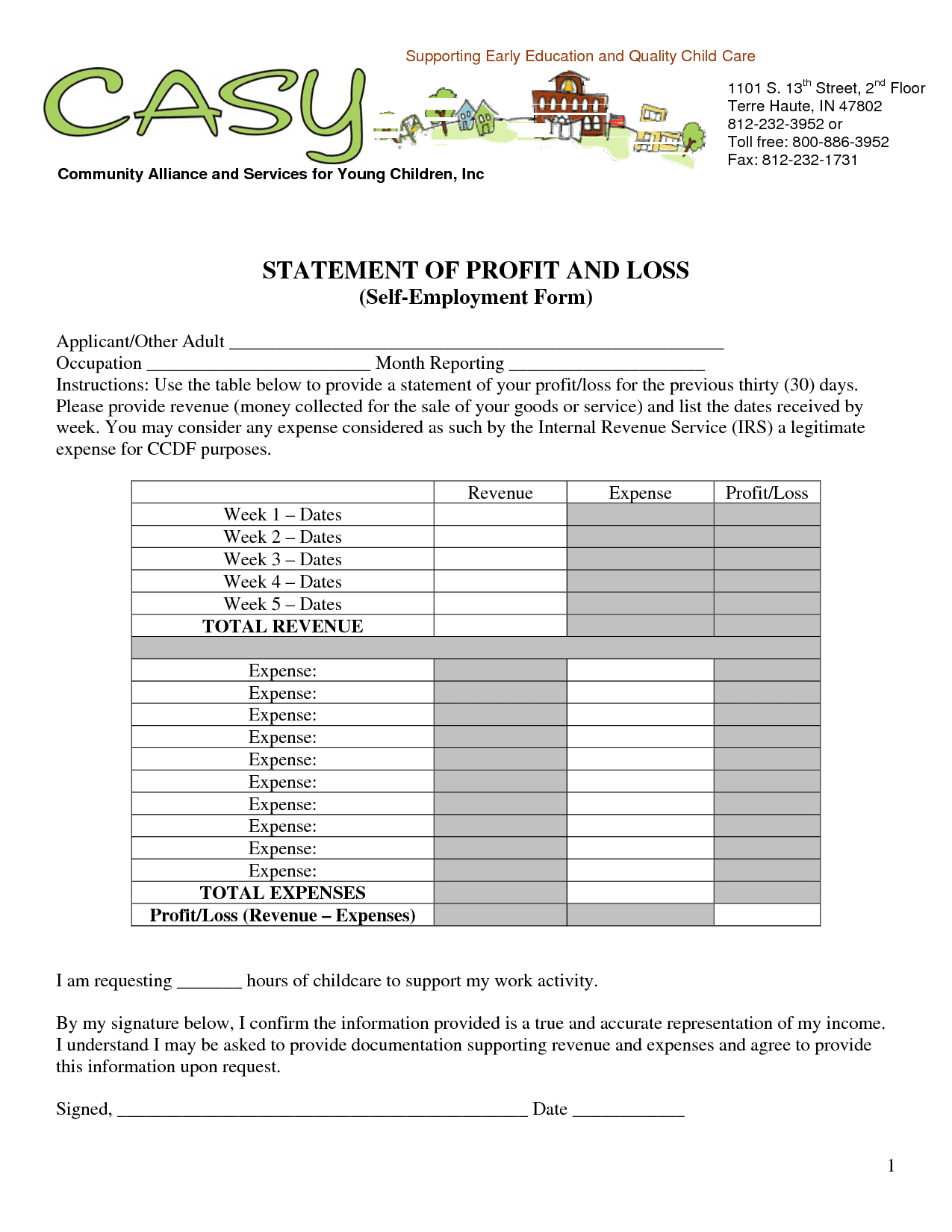

It is a brief overview of company’s performance over a particular time period. It is one of the vital financial statements of the business or company and usually prepared to show company leaders and investors whether the company was profitable during the mentioned period of time.

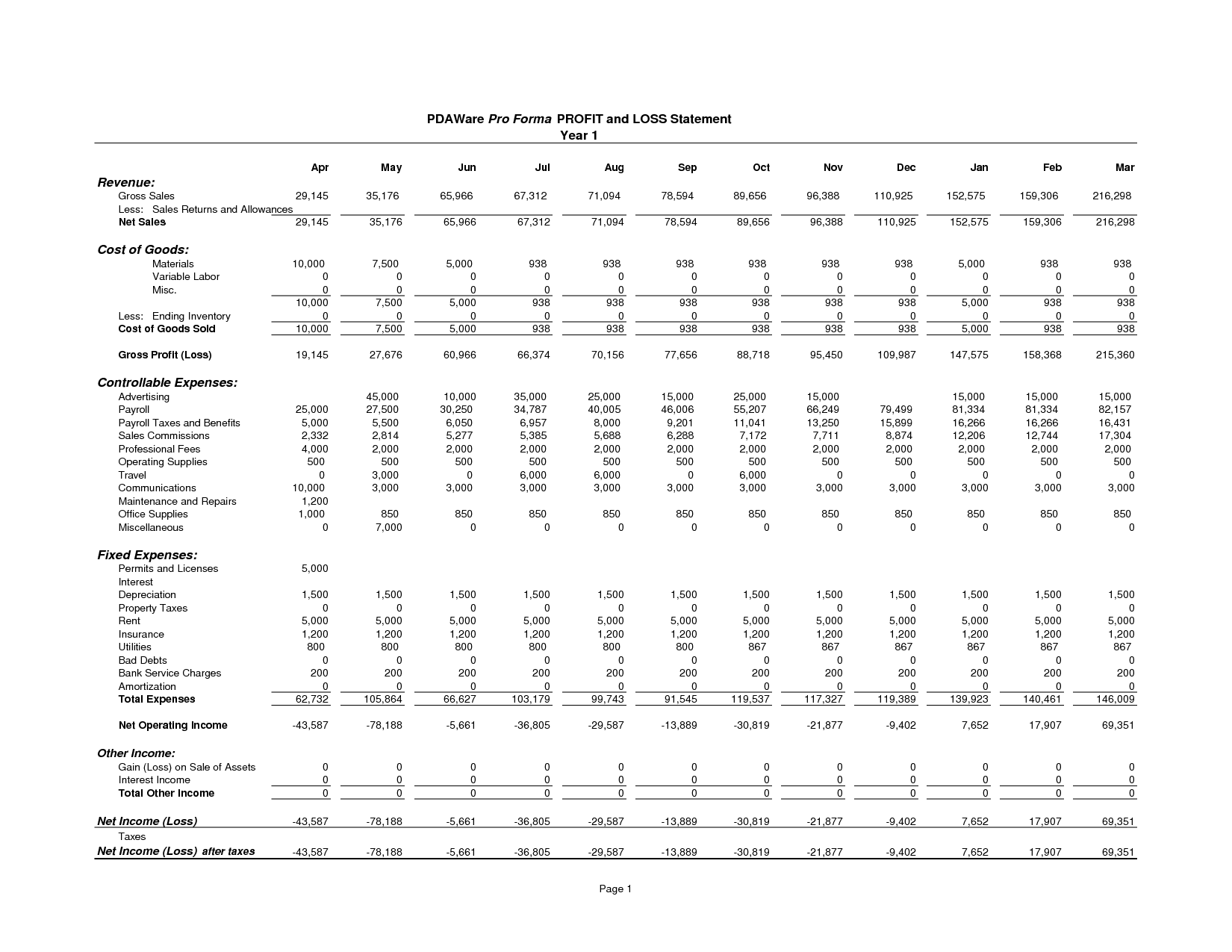

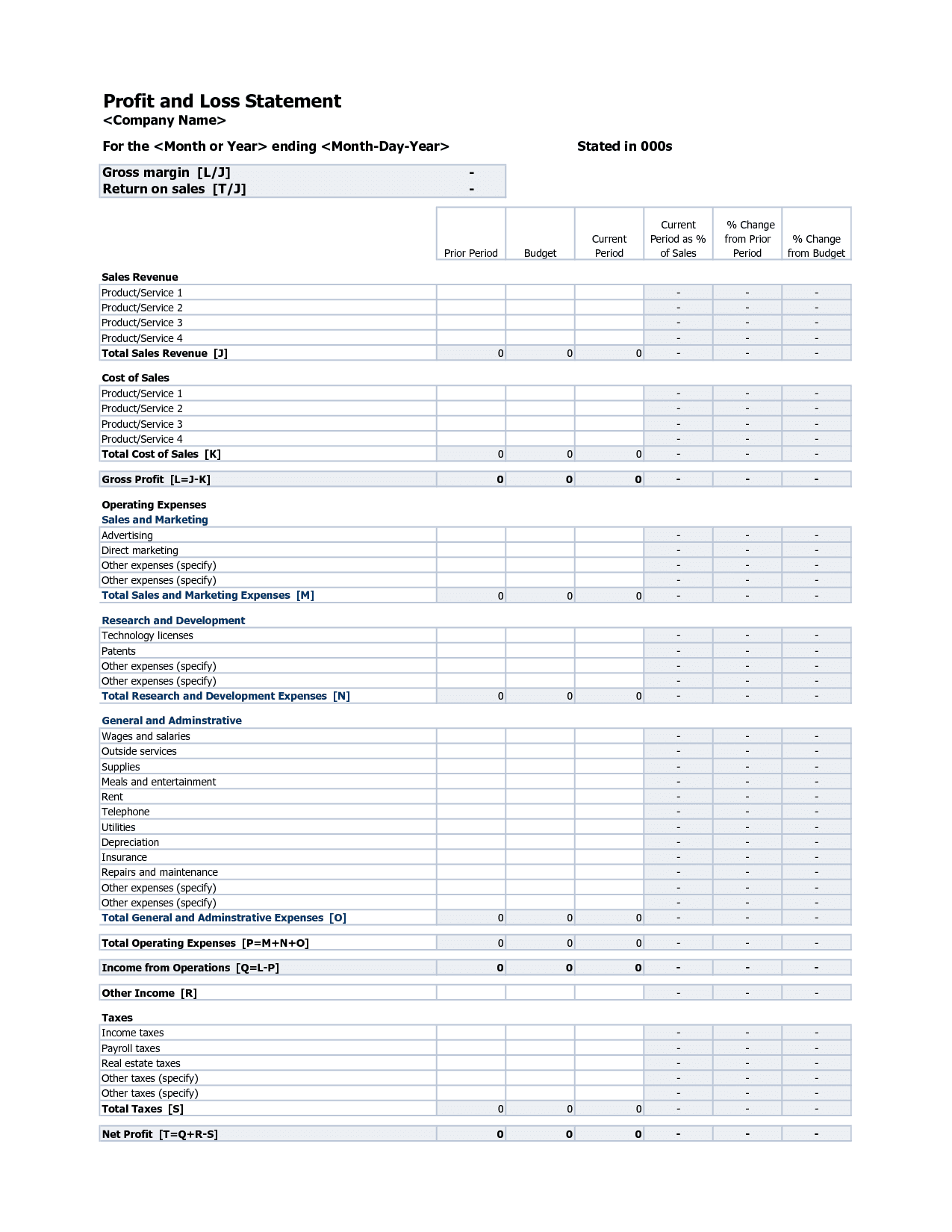

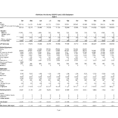

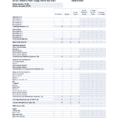

The Profit and Loss Statement is among the most essential components to the successful sale of a site. It illustrates revenues and costs as well as how much profit has been made by the business over the period it has been prepared for (usually the last 12 months). Because it is a critical input for making business decisions, it is typically produced every month. A year-to-date profit and loss statement comprises all financial transactions from the start of the current fiscal year to the present date.

10 photos of the "Profit And Loss Statement Template"

Related posts of "Profit And Loss Statement Template"

At this time you should start filling in your timeline. Timelines provide you with a general breakdown of important milestones and key events that everyone on the team needs to be aware of. As you dive into building your advertising timeline, there are some targets to stay in mind. You ought to be in a...

Since Excel is a superb report-generating tool if you understand how to utilize it, it is a wonderful means to display visual reports relatively simply. Therefore, excel plays an important role in accountancy. Microsoft Excel is a perfect program to utilize as a way to organize and manipulate huge amounts of information. Numerous kinds of...

Every organization, however small, should secure an accounting system. Small businesses starting up can take whole benefit of Excel until they're in a place to afford bookkeeping computer software. Especially if you're just starting your organization! When you establish a bounce house rental business, though it is a rather straightforward business model, it's still true...

The statement summarizes a corporation's revenues and company expenses to supply the huge picture of the financial performance of a business with time. An income statement is easily the most vital accounting tool which you are able to have for your business be it a big or a little organization. A normal revenue statement begins...