As a sole proprietor, it’s simple to receive your own personal and company expenses muddled up. Although your company is probably legally separate from your own personal assets, a bank that considers giving you a business loan will probably request individual collateral if your company has little real price. In the end, if you don’t clearly distinct company and individual expenses (using separate banking accounts and credit cards for each), you’re discover that it’s difficult or impossible to receive a business loan should you ever need one.

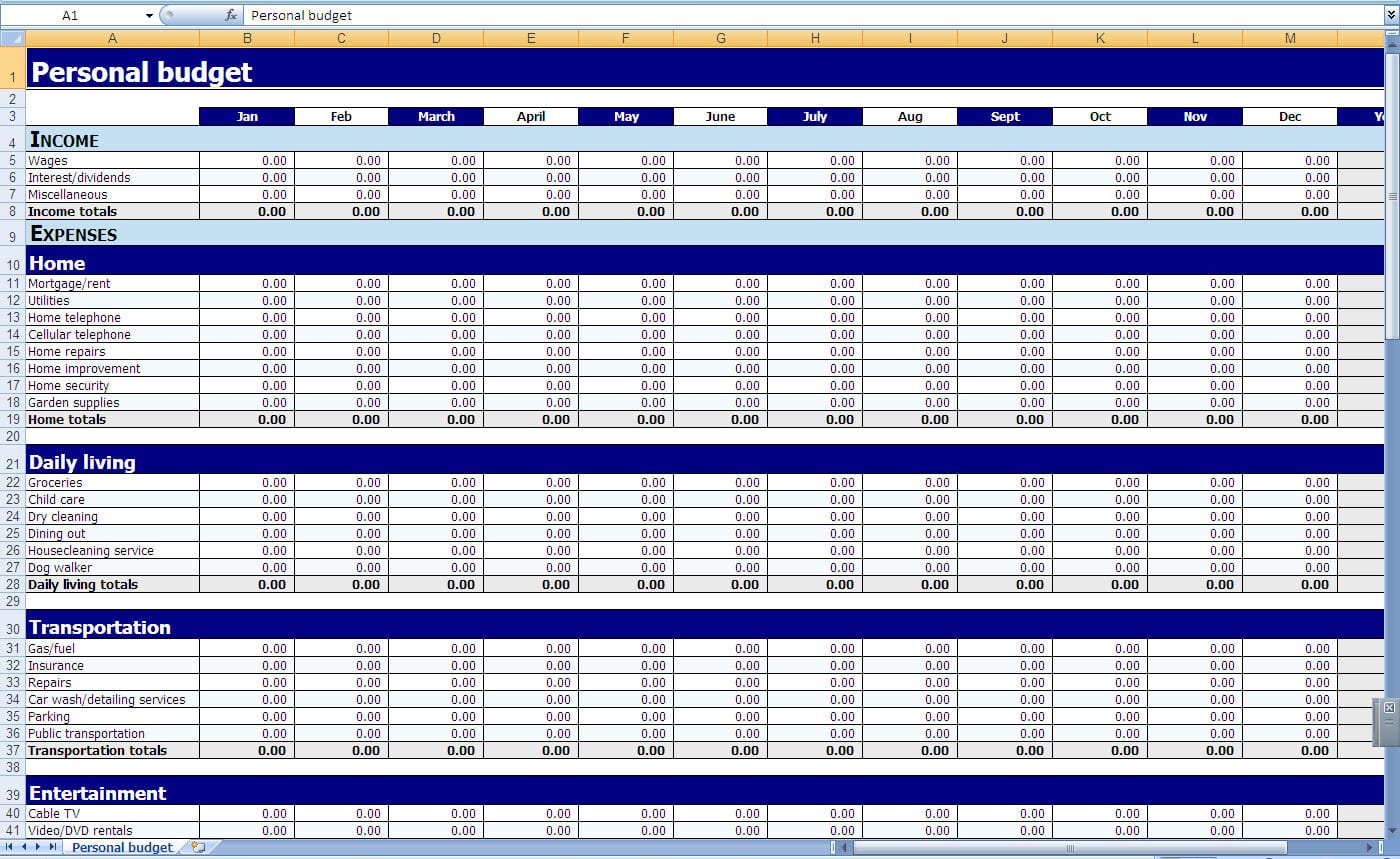

11 photos of the "Personal Finance Spreadsheet Template"

Related posts of "Personal Finance Spreadsheet Template"

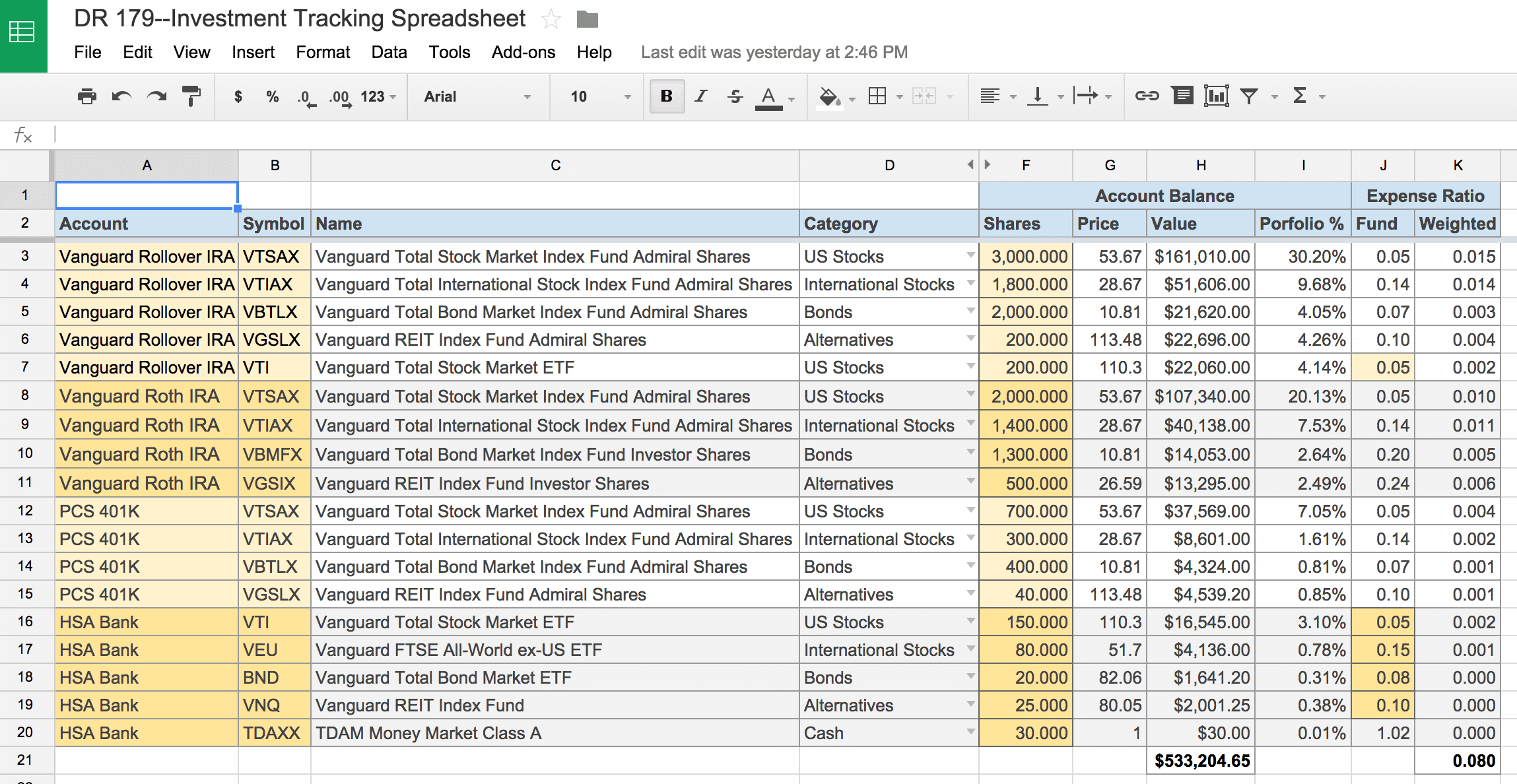

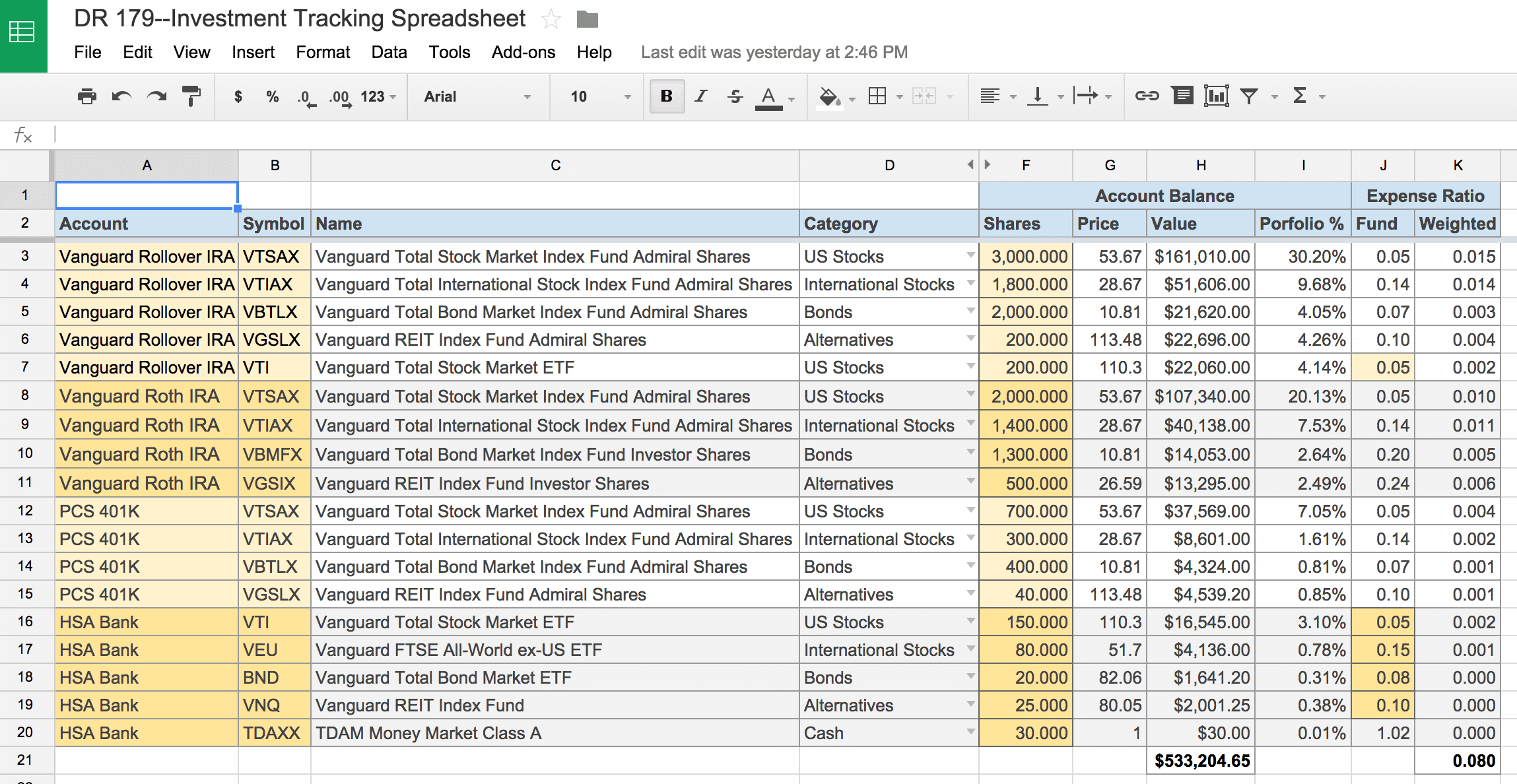

If you don't have one it is possible to obtain a spreadsheet with us. It ought to be clear that the spreadsheet provided is not a replacement for Canadian government certified software as it doesn't have every one of the forms required and only comprises the most used items. The spreadsheet gives a fast and...

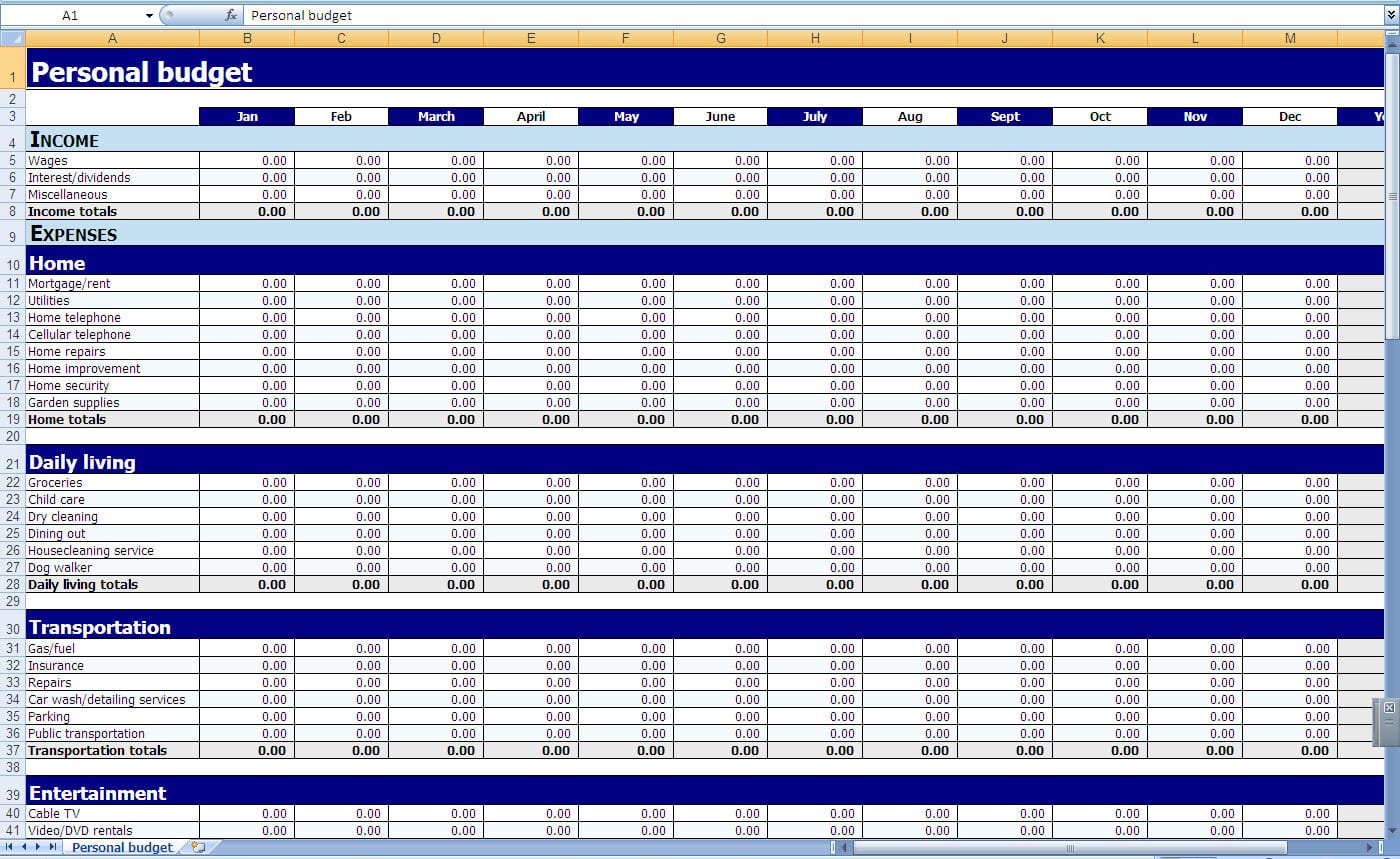

The very first step in making a budget is to recognize the quantity of money you have coming in. Putting a budget together takes a resource that assists you to organize your finances. Planning a month-to-month budget is just one of the main jobs for a family. Developing a monthly budget is truly quite simply...

Excel is mostly employed for accounting. It uses several visual indicators to show that a cell has been changed. MS Excel supplies a selection of mathematical functions. Excel functions permit you to perform calculations with cell residing on the identical worksheet, different sheets and perhaps even different workbooks. Luckily it has a built in wizard...

A cost sheet is maintained for every single job that's performed to fulfill the purchase. It also allows the accountant of a company to keep track of the costs involved in the job as it analyzes cash flow. It also helps determine the end cost to the company and helps in accounting. If appropriately organized,...