As a sole proprietor, it’s simple to receive your own personal and company expenses muddled up. Although your company is probably legally separate from your own personal assets, a bank that considers giving you a business loan will probably request individual collateral if your company has little real price. In the end, if you don’t clearly distinct company and individual expenses (using separate banking accounts and credit cards for each), you’re discover that it’s difficult or impossible to receive a business loan should you ever need one.

11 photos of the "Personal Finance Spreadsheet Template"

Related posts of "Personal Finance Spreadsheet Template"

A sales forecast will have the ability to assist you construct your general company budget. It is an essential part of a business plan. Your sales forecast will change each month. Business plan sales forecast is a potent tool to commence an original finance enterprise. Consider spending twice as much time researching to ascertain your...

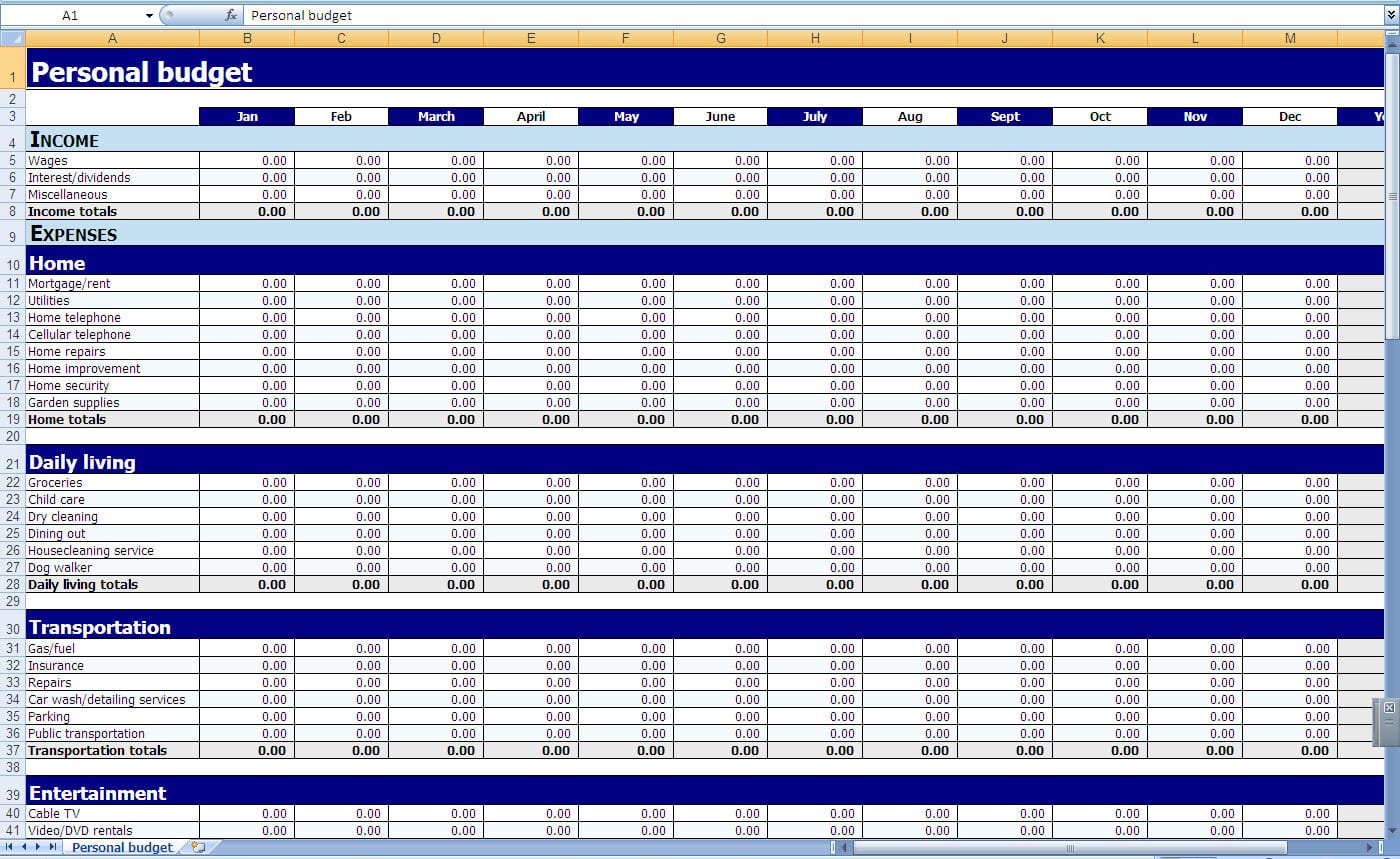

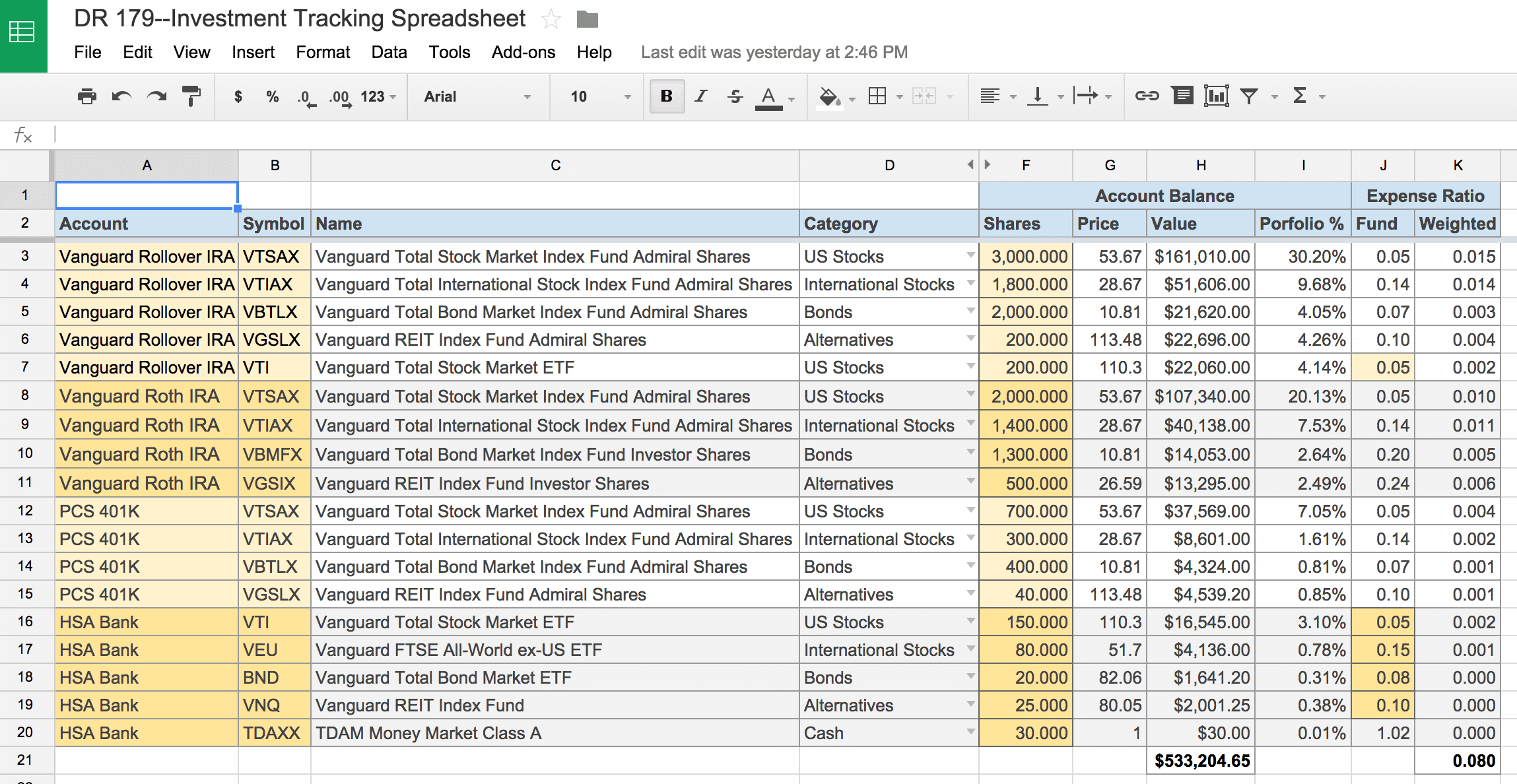

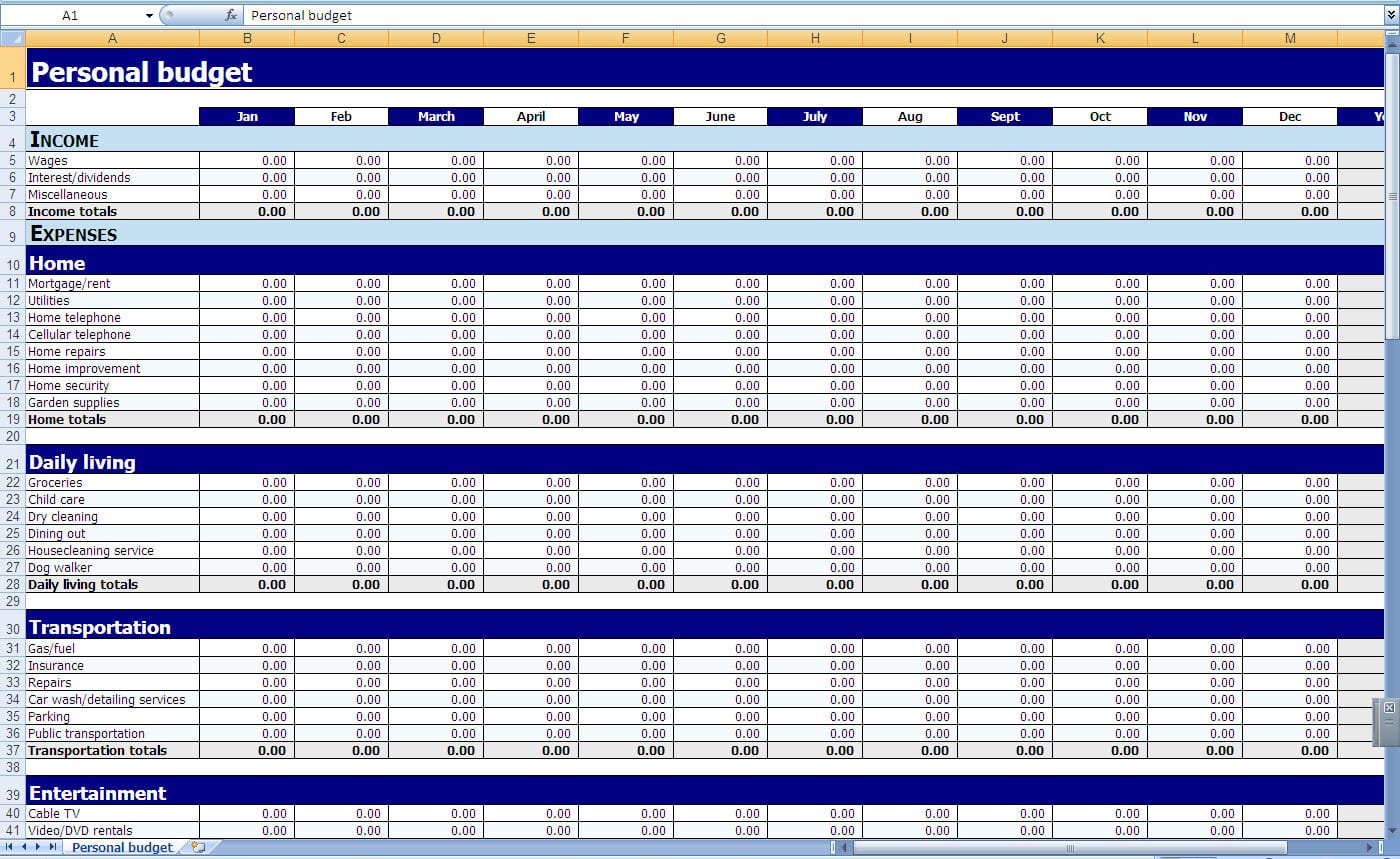

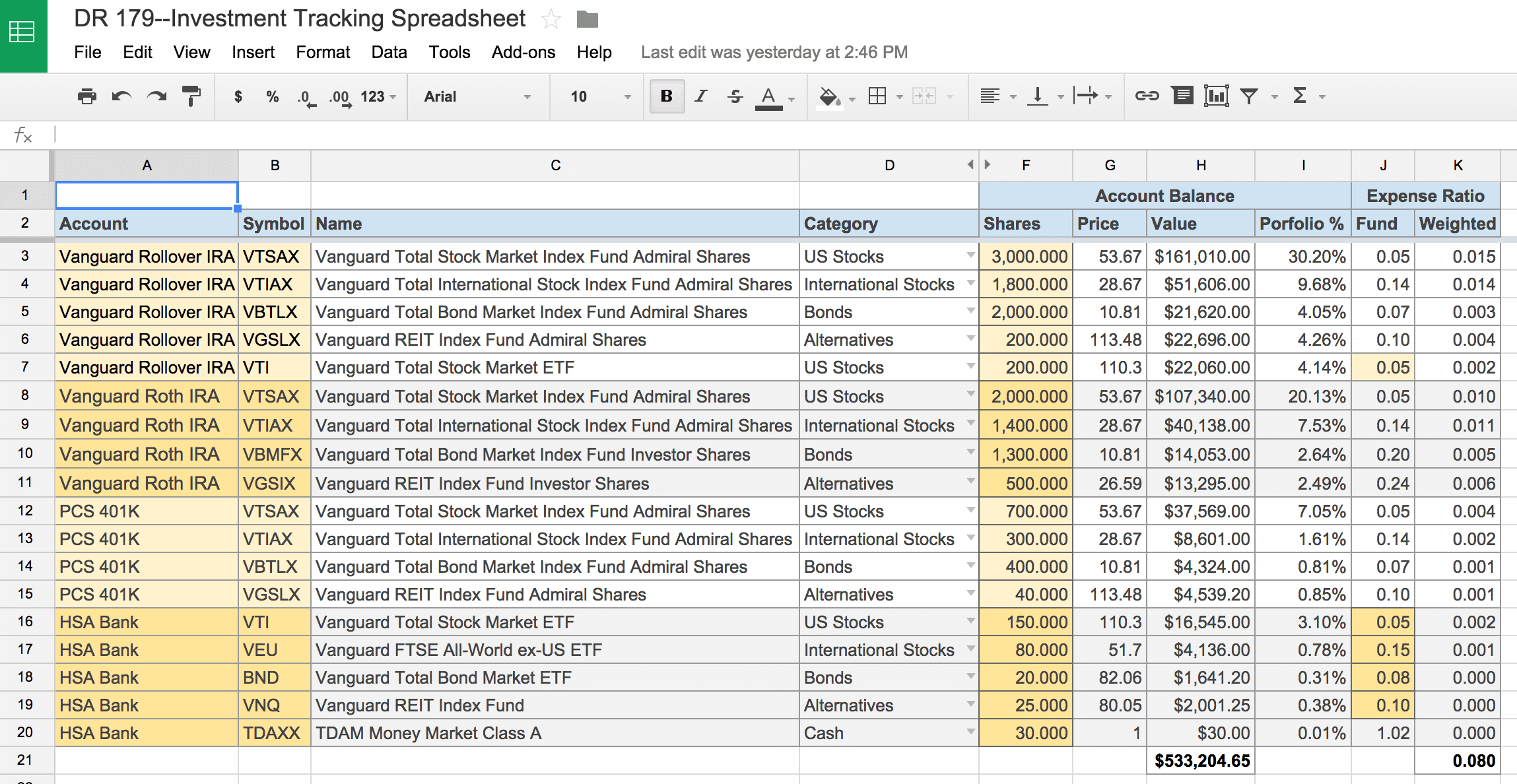

From our example, you can add a few things you might need to finish your spreadsheet. The spreadsheet is advised for real estate investors who intend to purchase and hold rental property. It is designed for monthly income and expenses. Therefore, a very simple spreadsheet beats a complicated one almost all the moment. Decide how...

Consider the wording you're likely to utilize in your invoice. The invoice may also be utilized to supply the customer with payment information, so they'll know precisely how to generate their payments. To make an invoice at your own you only need to download a fundamental template form the net. An easy billing invoice for...

You may even track down the spreadsheet on... Should you would love to use the spreadsheet, then you will need to click empower content. In case you compare spreadsheets, you must go for the ones that need you to cover since they are much dependable and frequently contain further attributes that may help you in...