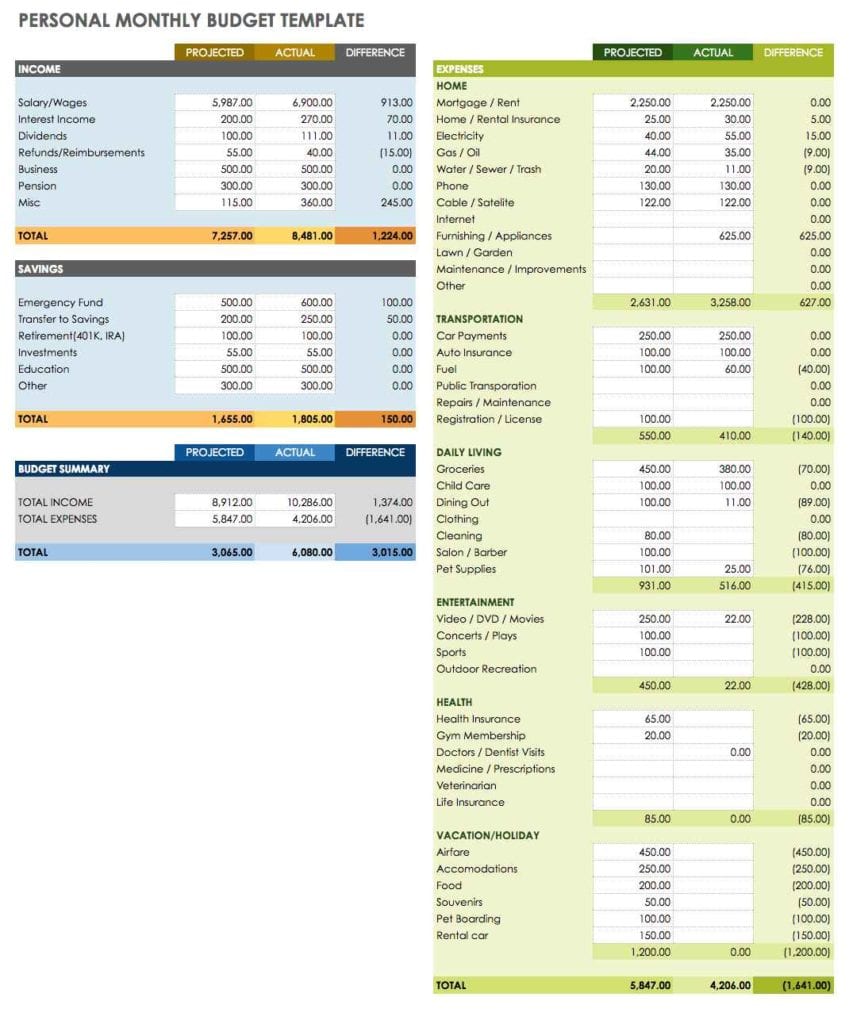

Developing a budget is easily the most efficient procedure for accomplishing your financial targets. Everyone is able to establish a personal budget. Now that you may earn a personal budget that’s well organized and structured in a means that’s very simple to follow, the next step is attacking that nagging charge card debt that’s been plaguing you for several years.

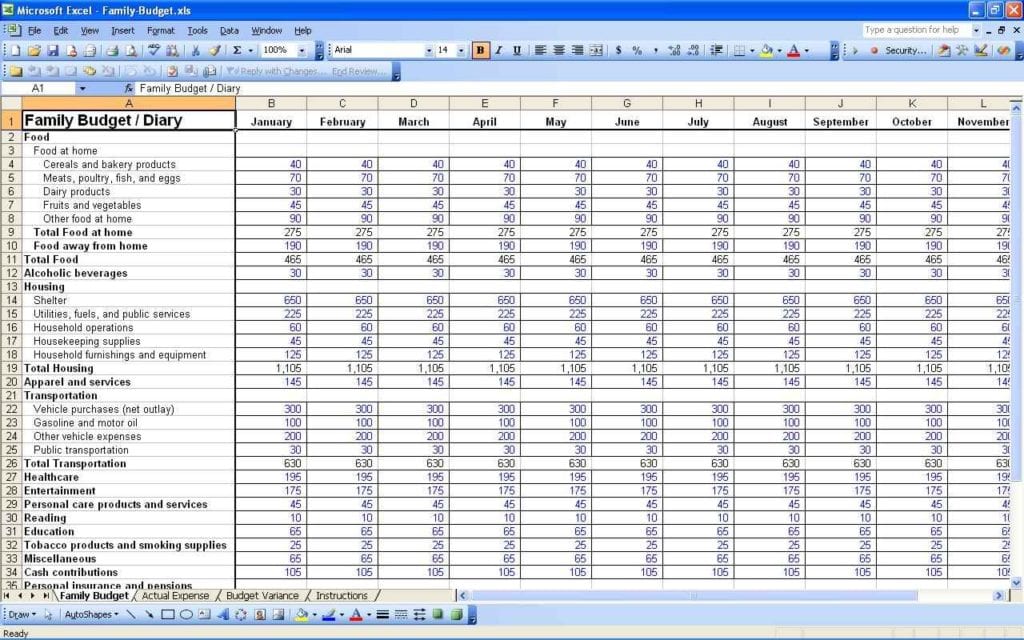

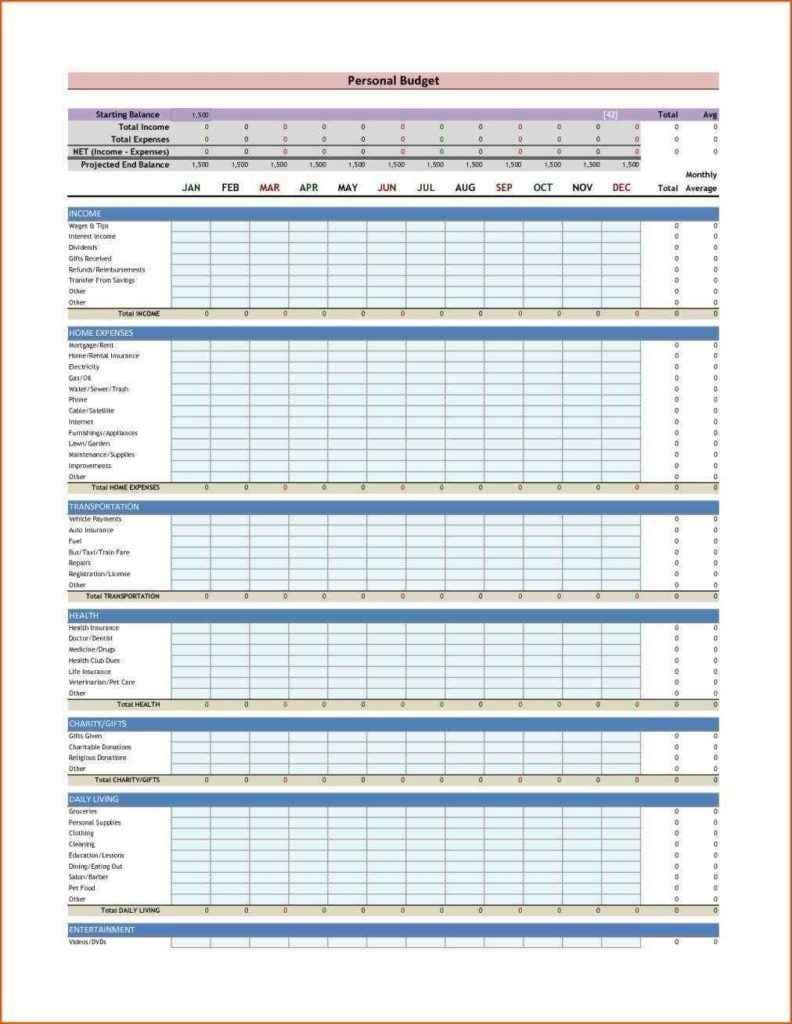

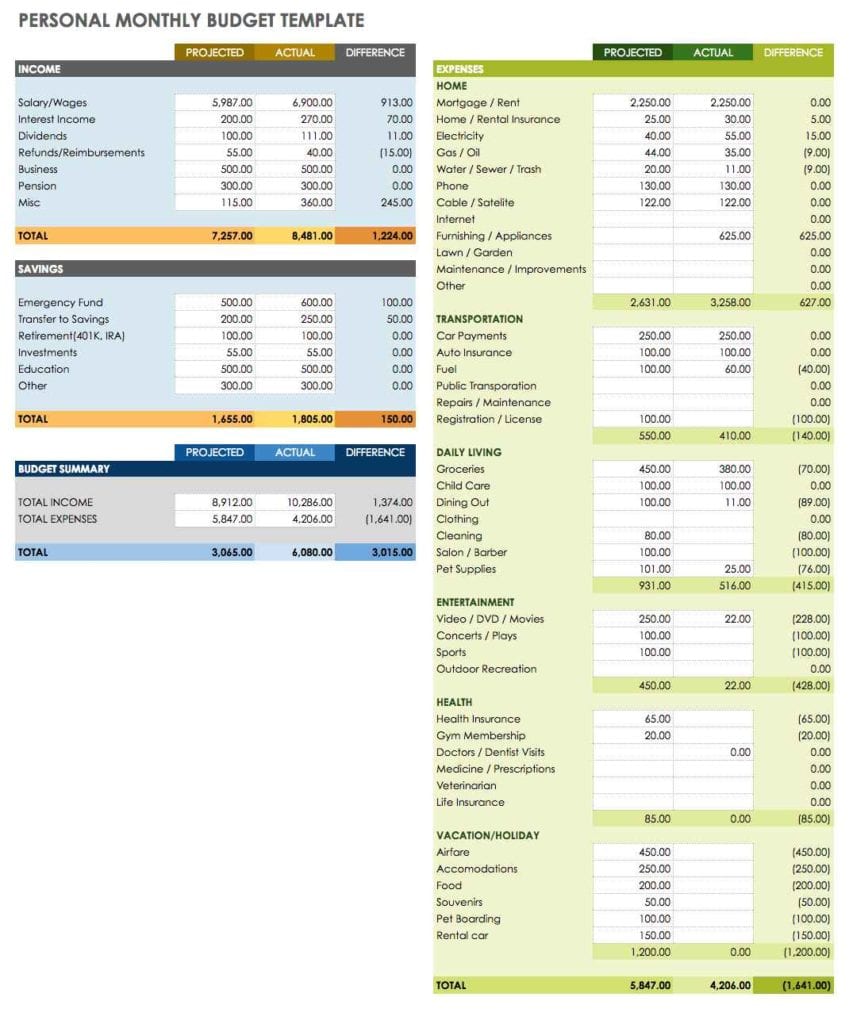

There are a lot of ways you’re able to decrease your expenses to keep them affordable. Sometimes an expense is critical, like paying for health insurance, however often we have expenses that aren’t so important that can readily be cancelled so as to spend less. You are able to cut optional expenses like the clothing budget.

When you get started considering money more frequently, you will discover that you can find more ways to save and to raise your earnings. To discover the most accurate picture, take note of whatever you purchase or spend money on for only one month. There are a number of methods to earn a bit more money.

There are a number of ways to produce money. Not hard thinking about the prospective rewards it may yield by discovering new strategies to conserve money. Make a list of all your expenses and make an estimate of just how much money you desire to save.

15 photos of the "Personal Budget Spreadsheet"

Related posts of "Personal Budget Spreadsheet"

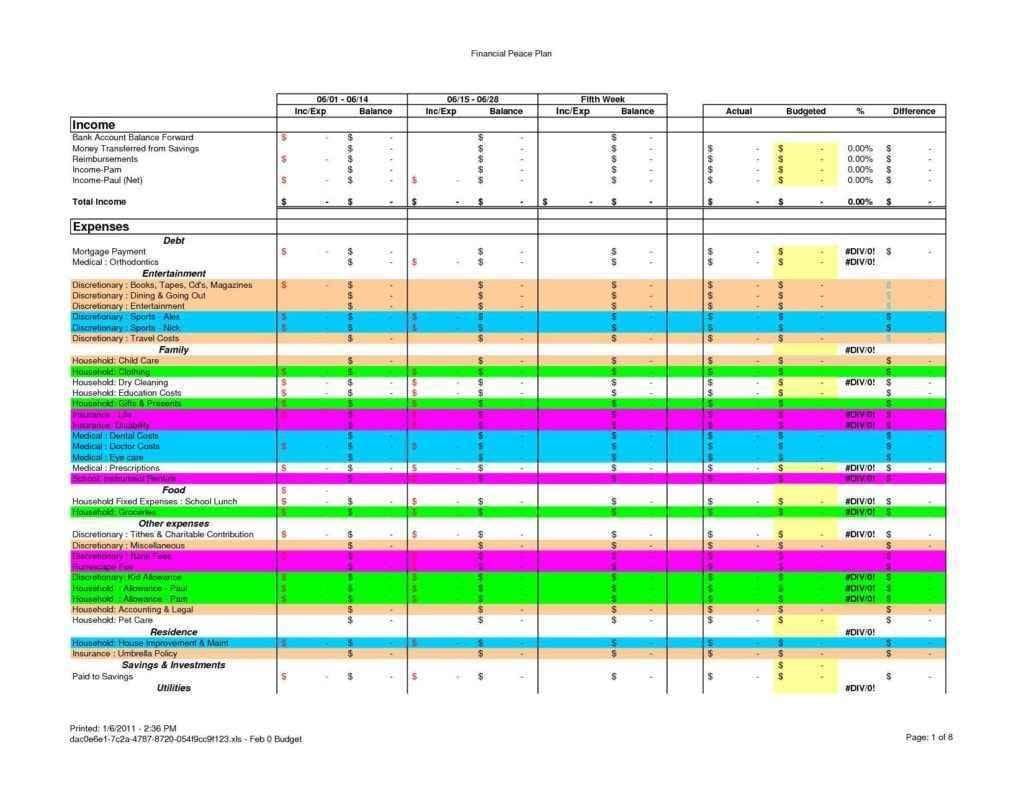

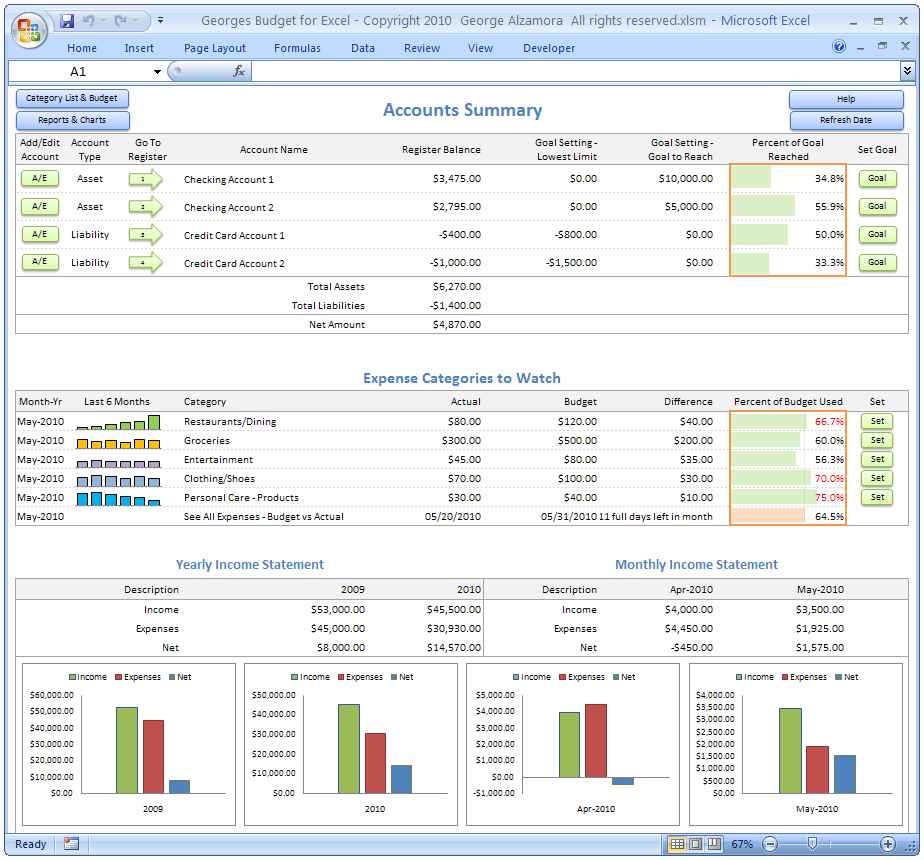

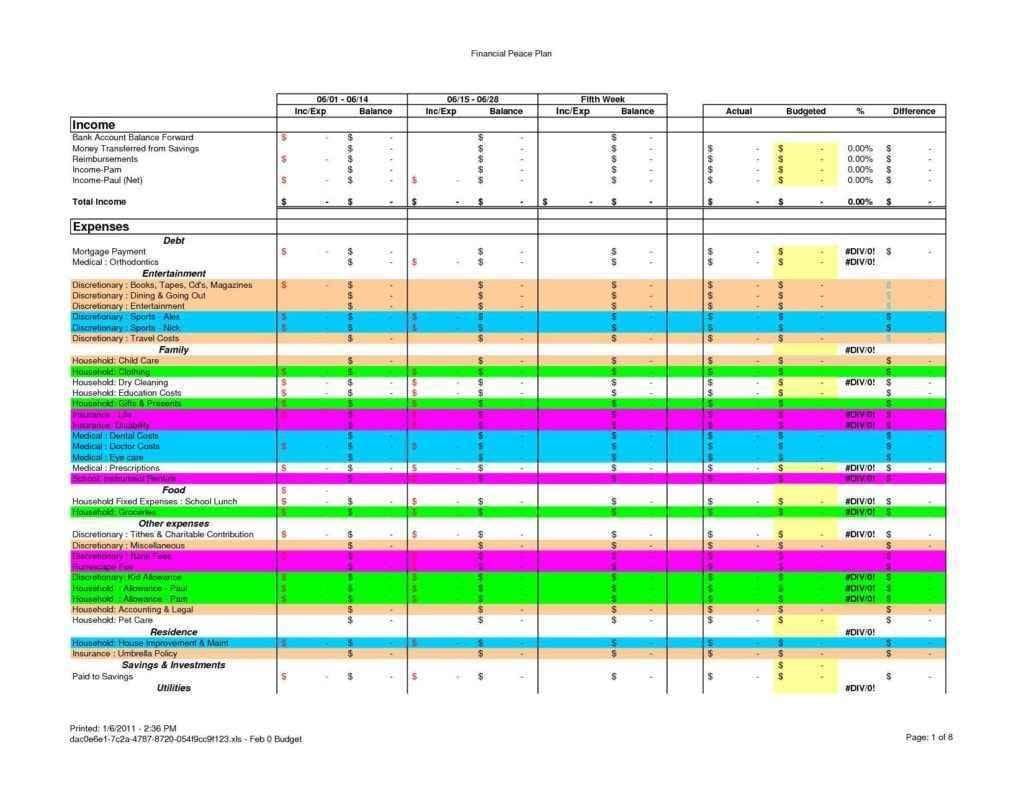

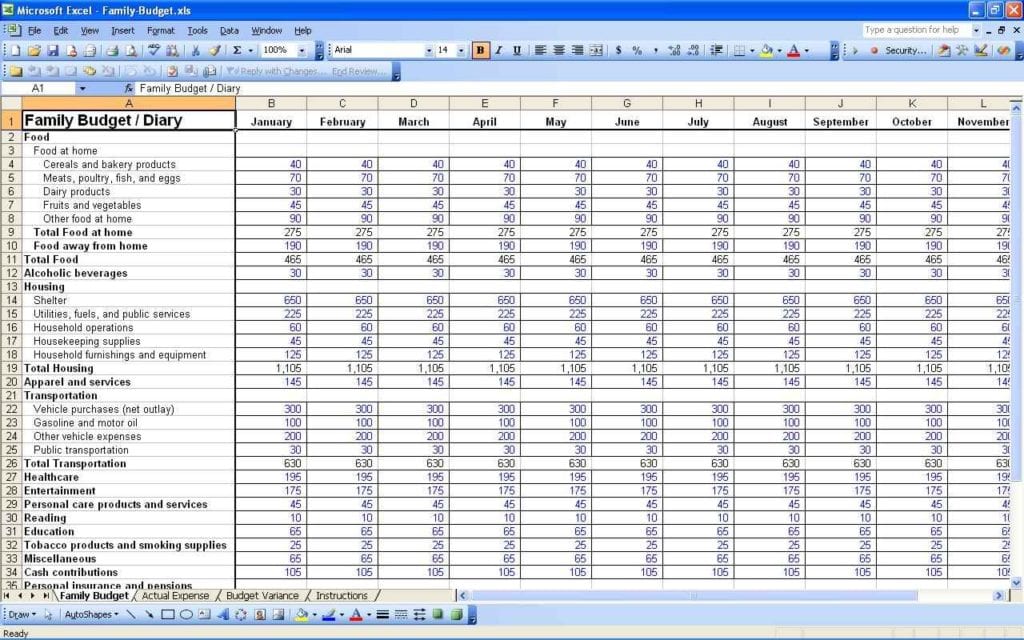

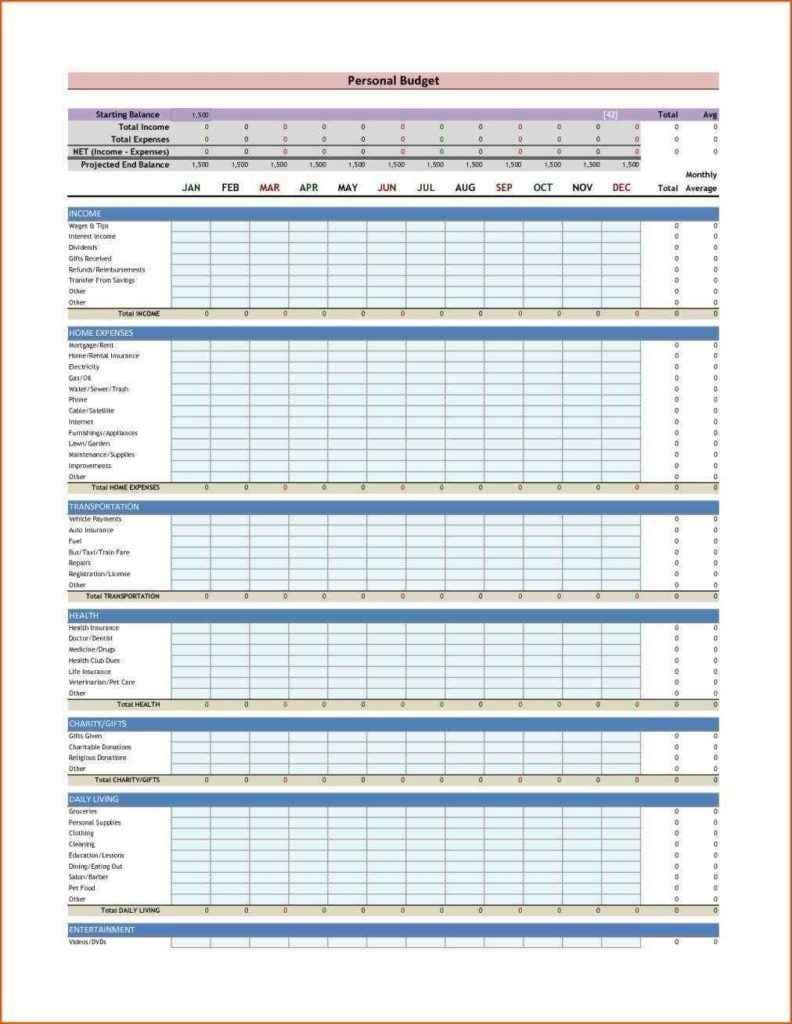

Open the spreadsheet you'd love to print. The spreadsheet has many worksheets. You could also find the spreadsheet in your... Spreadsheets might even be employed to make tournament brackets. It's very simple to make a blank budget spreadsheet, on account of the simple accessibility to free blank spreadsheet templates which can be downloaded at no...

To avoid making the erroneous assumptions about the desirability of merchandise or services, speak to your prospective customers before you begin a company or introduce a new item. After necessary editing like name of the company, logo and other details you may ensure it is appropriate to your company and circumstances so first download the...

Without it, there's absolutely no company. Although the company can be thought to be liquid and that receivables together with liabilities were maintained at a minimum, the reader of the balance sheet report needs to look in the operation of the company by securing a duplicate of the income statement. Furthermore, you're likely to want...

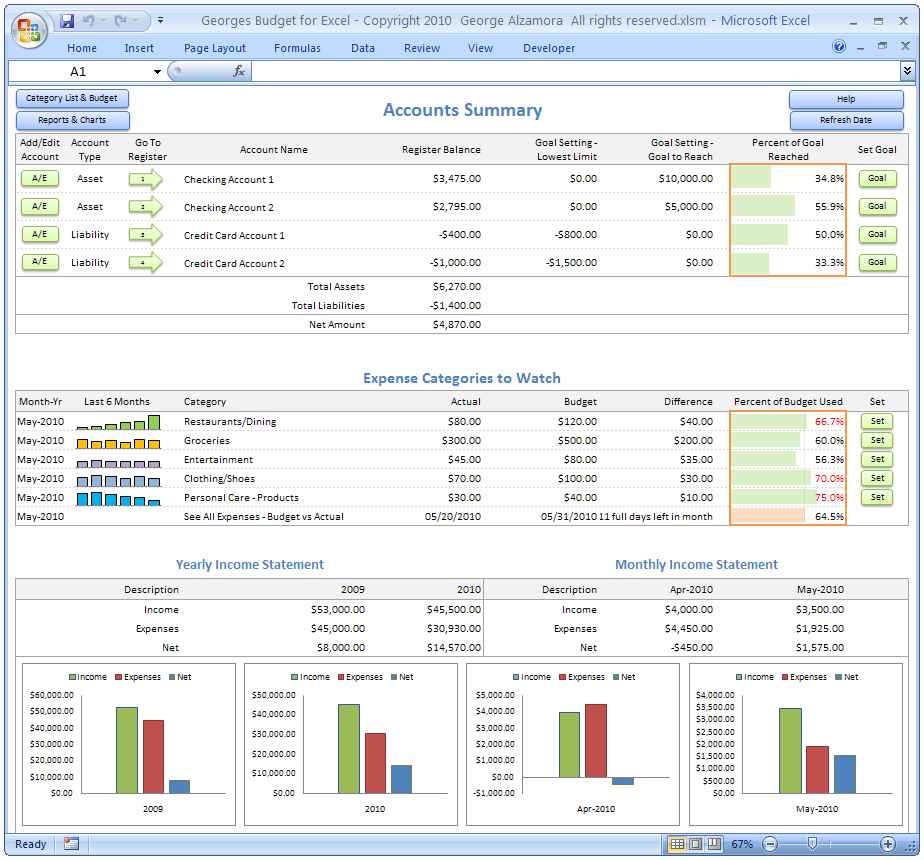

The template was created for use in the Excel desktop program, so you may ignore the message about unsupported characteristics in the browser. Numerous budget-related Excel templates are out thereyou just need to be eager to look for them. Something as easy as an Excel template that could automatically figure out the right subtotals and...