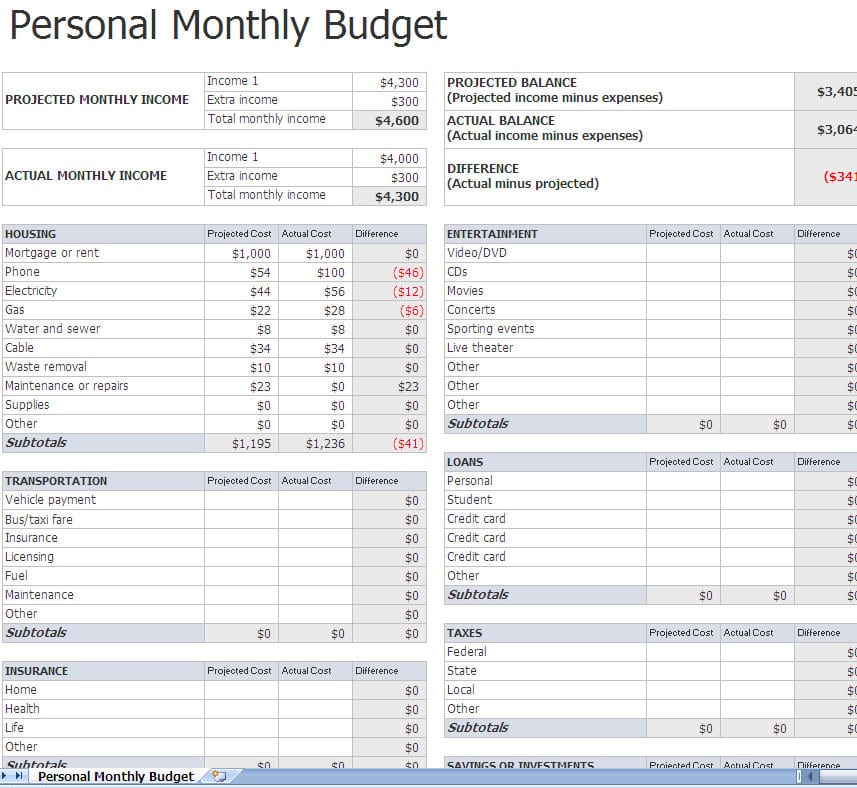

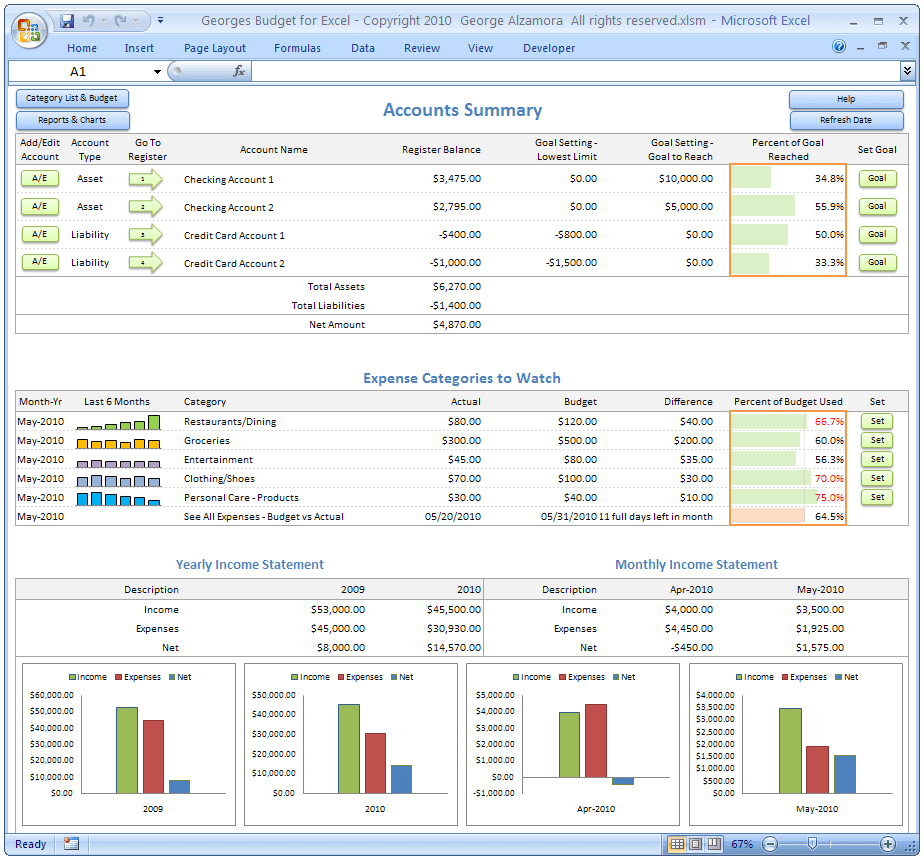

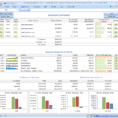

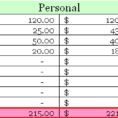

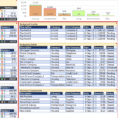

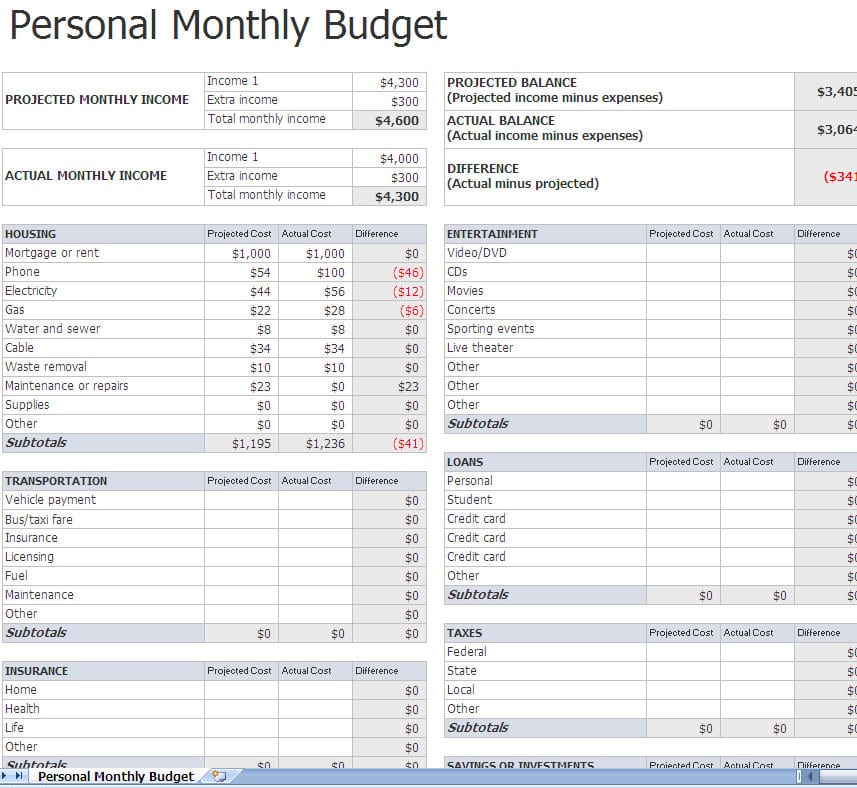

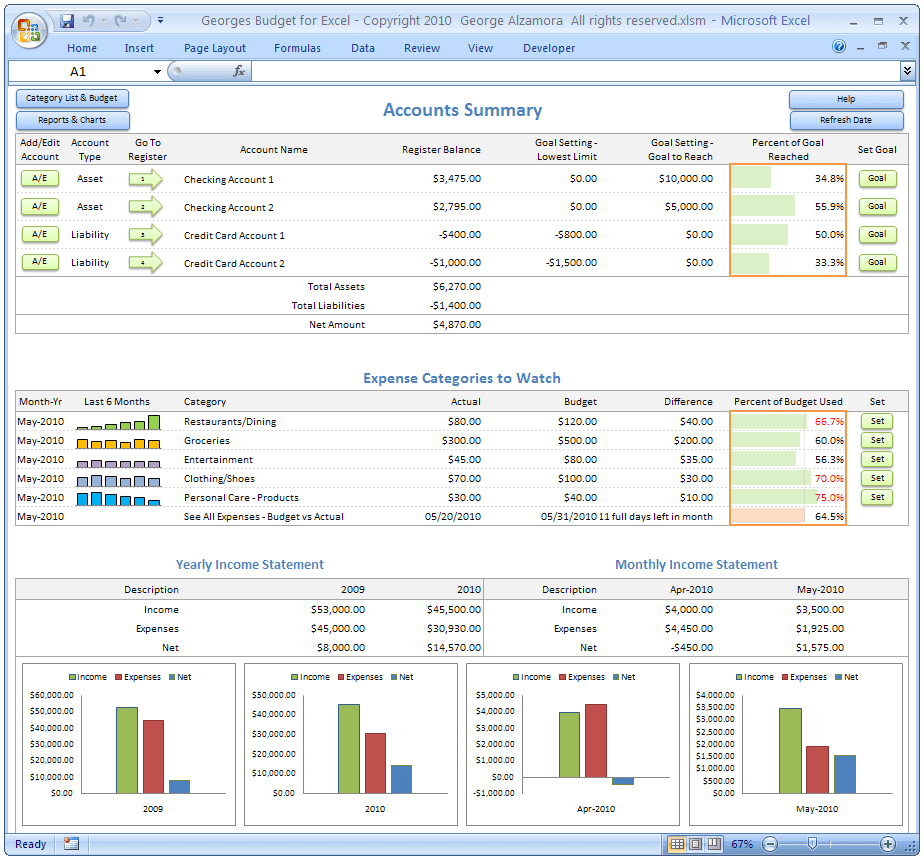

Search for areas you are able to cut in your budget to improve your debt payments too. Your budget is just one of the biggest tools that can help you succeed financially. Developing a budget with a template will be able to help you feel more in charge of your finances and permit you to conserve money for your targets.

These steps can allow you to create a budget. At first, it appears that making a budget is a simple endeavor. The very first step in making a budget is to recognize the quantity of money you have coming in.

Having documented your earnings and spending, you can begin to observe where you have money left over or where you are able to cut back so you have money to put toward your aims. When you understand how your hard-earned money is moving through your individual finances, you can start to make adjustments to the way things are finished.

Without the program, you may spend your money on things that aren’t important to you, but you want in the present time, and wonder why it is you’re never reaching the financial milestones you need to set. While making minimum payments, you focus excess money on a single debt at one time and move all of the money you were paying on the very first debt to the next debt.

16 photos of the "Personal Budget Finance"

Related posts of "Personal Budget Finance"

You're busy running your organization. So, instead of assisting you to find businesses on the net, Aabaco helps you get your business on it. Any on-line business is successful only when it has a significant number of quality visitors to your site. For instance, if your small business should remain HIPAA compliant, PCI compliant, or...

The charts can be readily maintained provided the activities continue being static. Gantt chart is the recognized bar kind of charts which are invaluable in project management system. Gantt charts are employed in many distinct industries, for tracking both the production of physical goods, and the progression of software and other less tangible deliverables. They...

The template is just a starting point. Even though it is a good example of an income statement for a company that purchases inventory and processes it into a last item, you can customize it to reflect your company situation. The social media calendar template is the perfect resource for helping you scale and streamline...

Most templates permit you to include both hourly and fixed labor expenses. They include itemized material lists where you can enter the price per unit and the number of necessary units. There are several free excel templates available that are intended to help your company. From time to time, a business isn't going to be...