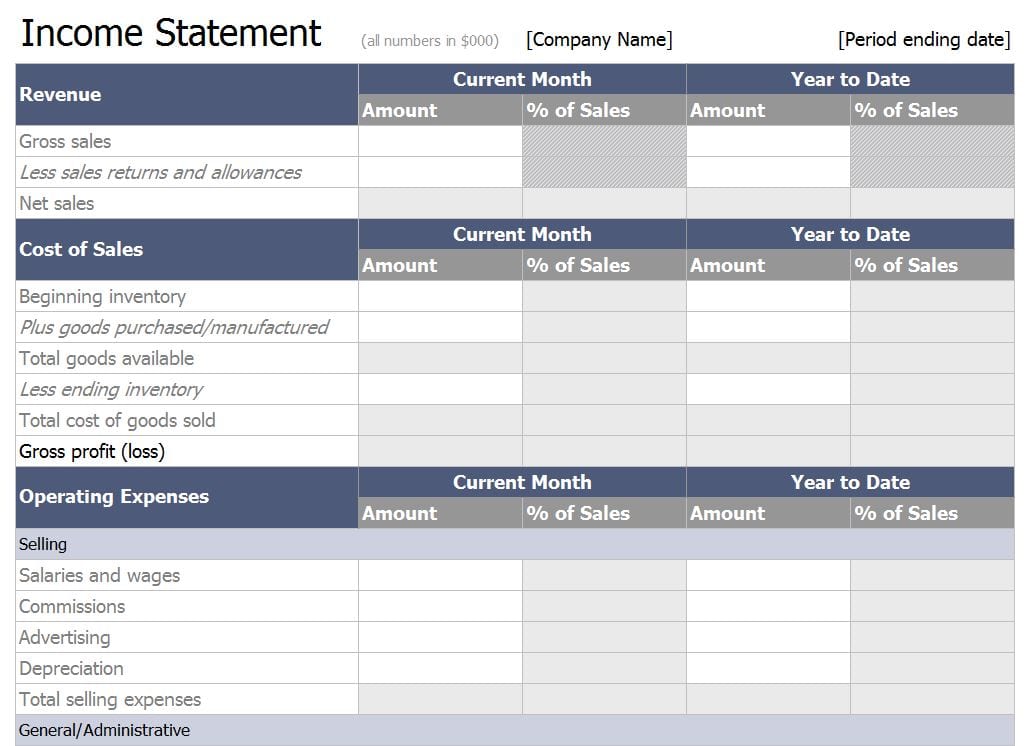

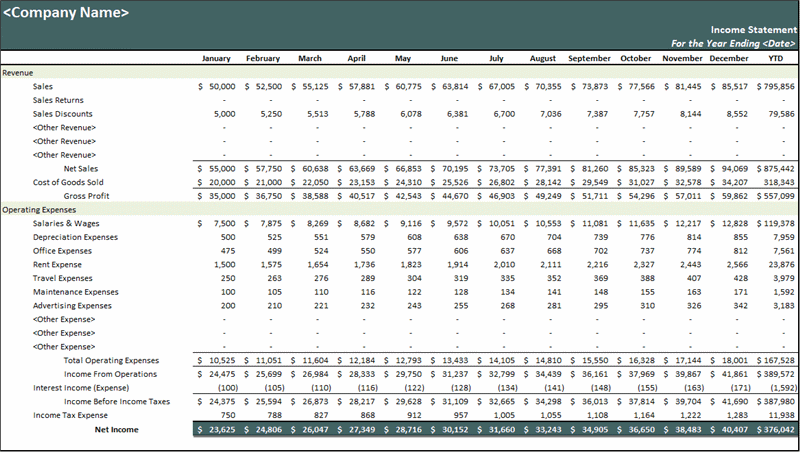

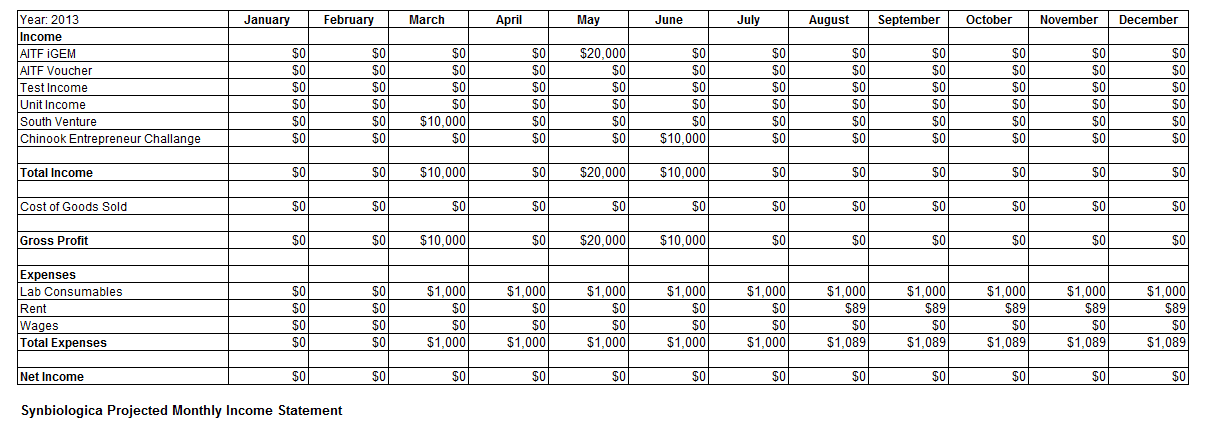

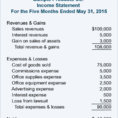

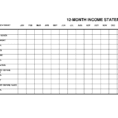

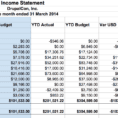

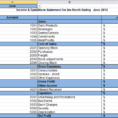

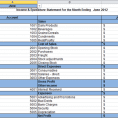

If you employ the income statement to assess your operations, choose any period that is appropriate for you. The income statement is a recap of your organization’s income and expenses over a predetermined time period. A month-to-month revenue statement is a fantastic method to keep an eye on your finances and know just how your hard-earned money is being spent.

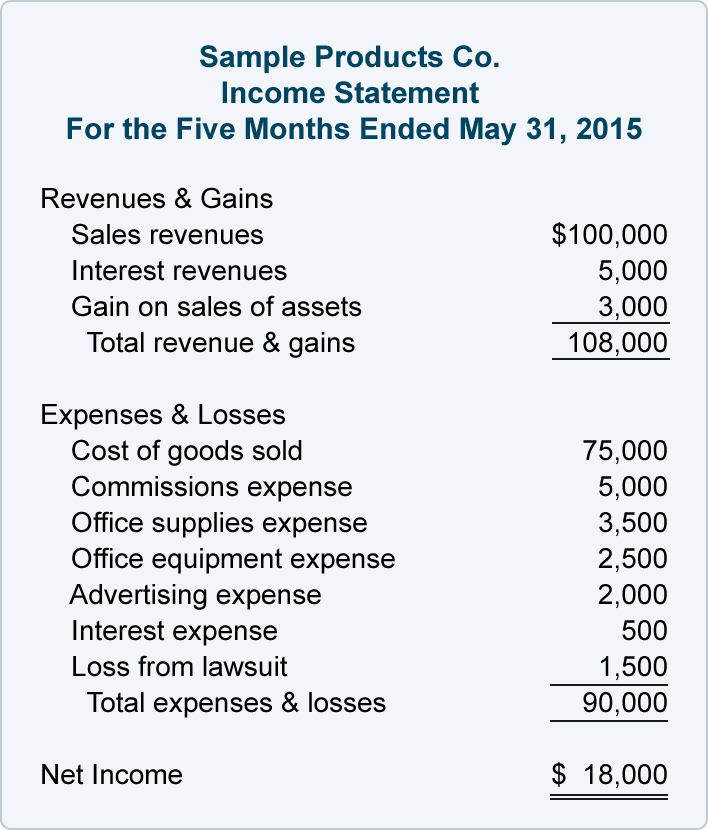

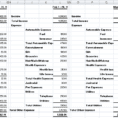

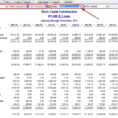

Spreadsheets are getting more and more obsolete now. Well, they will not allow you to do that. Yes, drafting a spreadsheet will be a part of the procedure, but there’s much more besides. Spreadsheets don’t allow access to everyone and suitable documentation into a single, shared site. The statement is commonly used at the conclusion of a company period (monthly, quarterly or annually). An income statement is a fundamental report that contributes to the development of the business. Even though it is one of the easier statements to review, many people have questions about them. The term format income statements are extremely easy that people analyze the expenses of a business and compare with the peers.

If you stay with it, you will wind up saving yourself a great deal of money, which is among the goals of giving birth to a personal revenue statement. In reality, without a monthly revenue statement it can occasionally be exceptionally difficult to know just how you’re spending your money. By putting extra towards the smallest debt first it will almost certainly be paid in full quickly and you’ll have money freed up in your financial plan. You would like to know where you are spending the most money for money. The very first issue to do is to quit spending money. The additional money needs to be saved or invested.