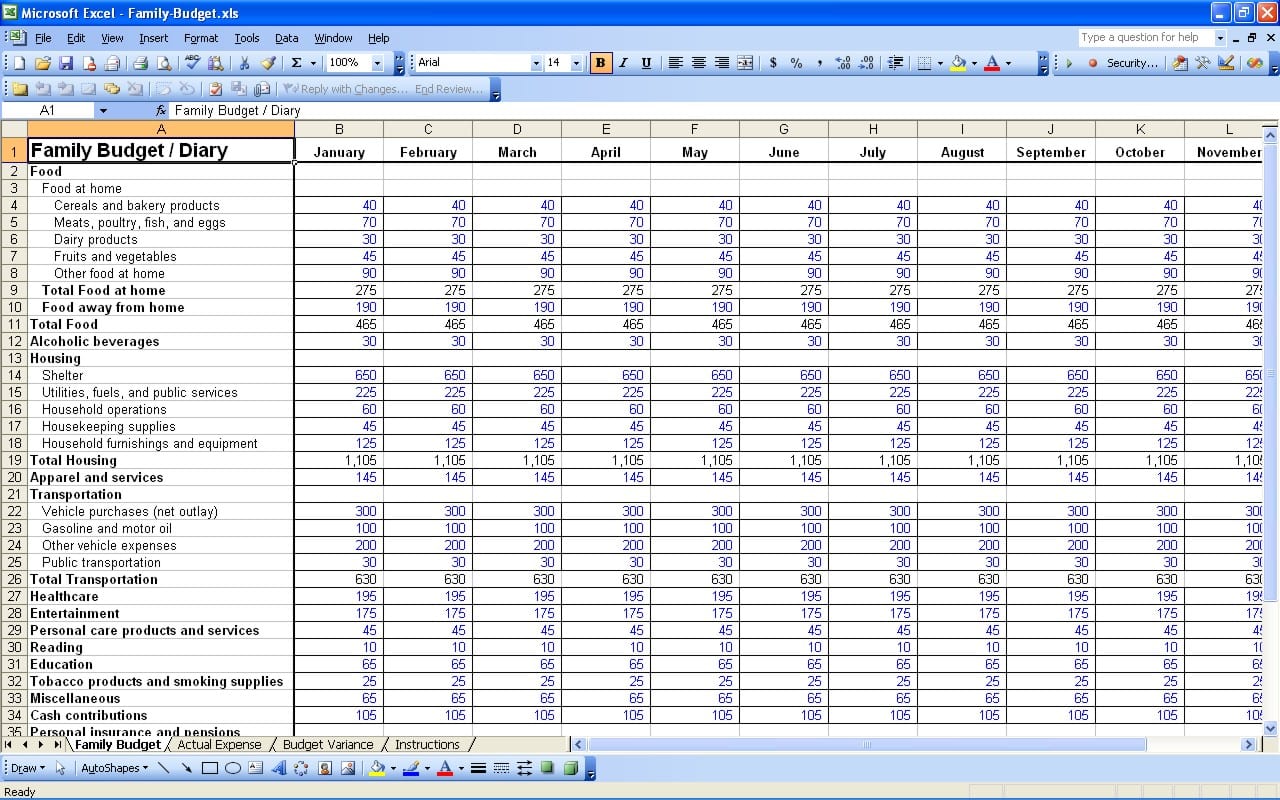

Once you own a budget, be disciplined and stay with it. The first couple of things which you should have in your budget are the things you know will be due that you can’t avoid. A personal budget is only a budget of an individual.

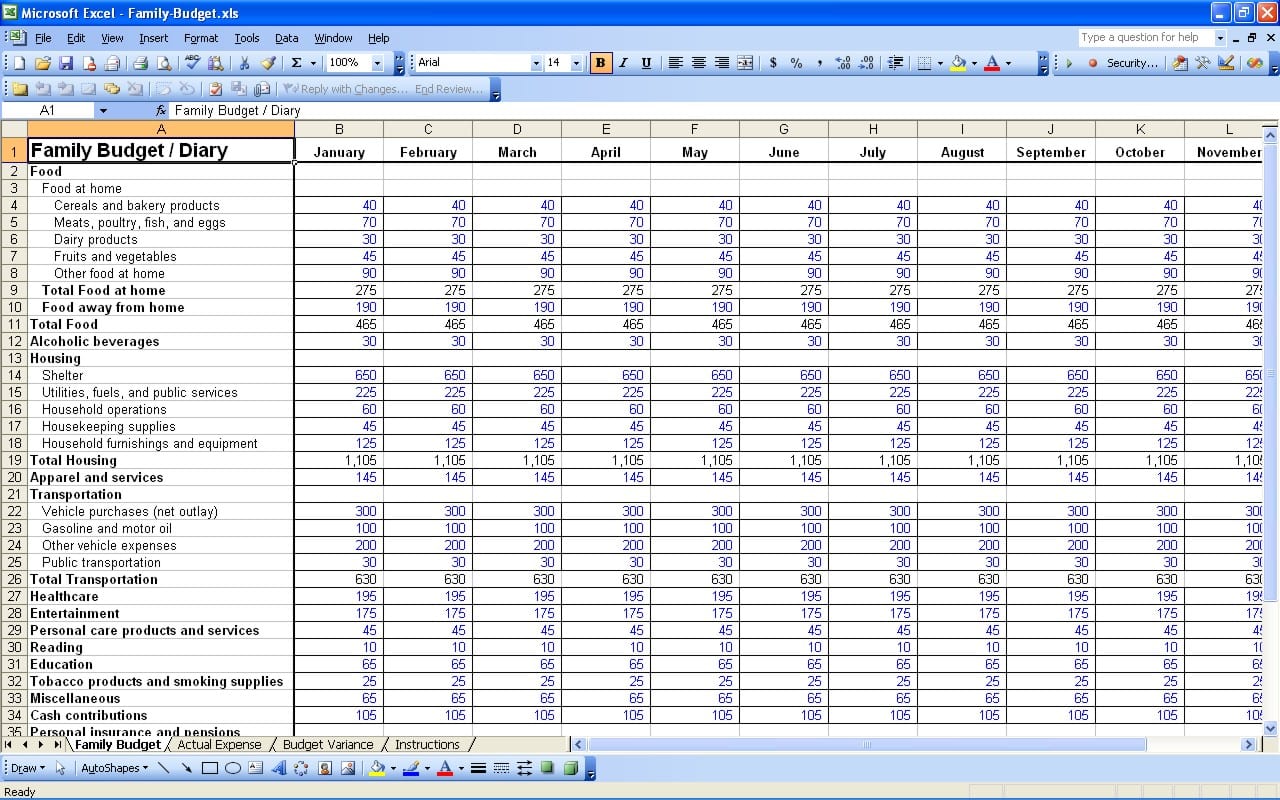

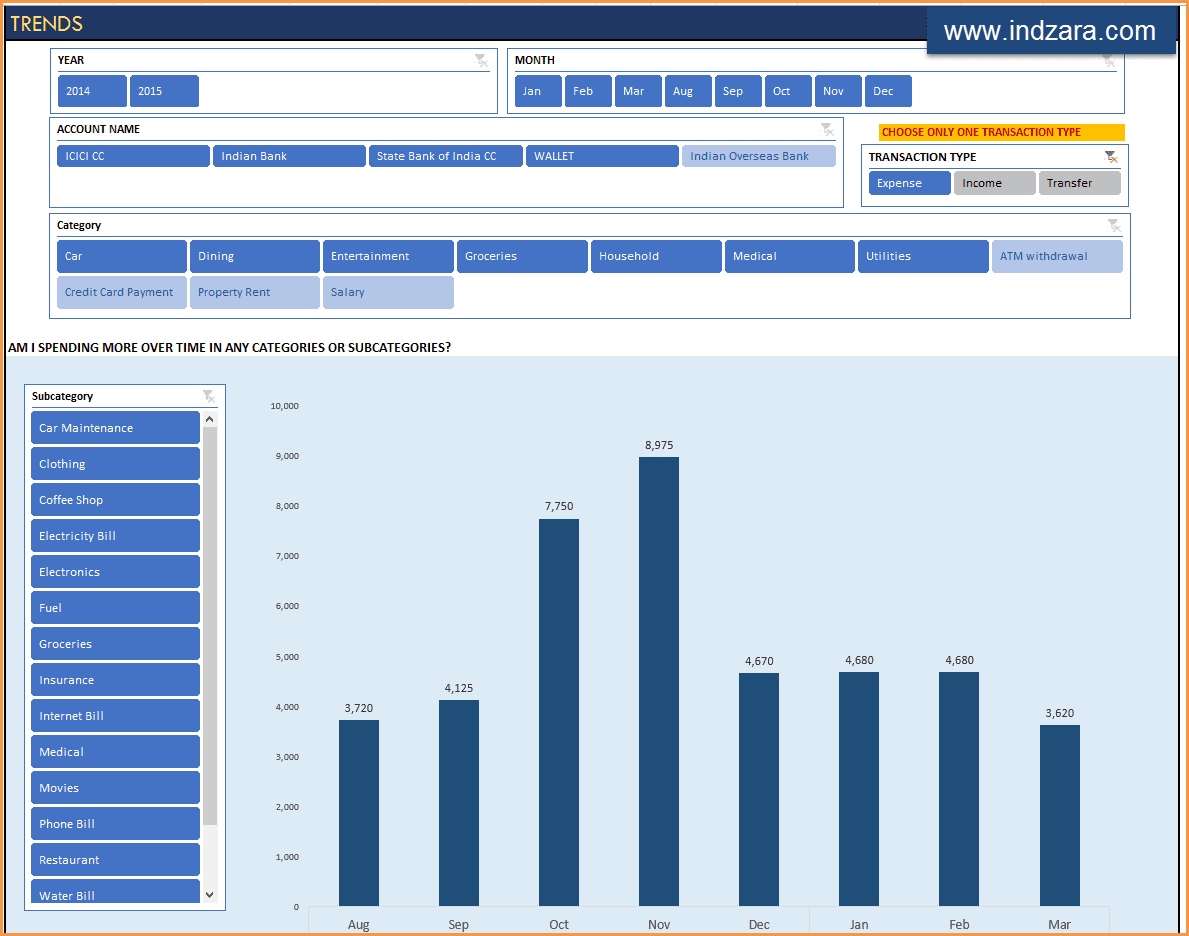

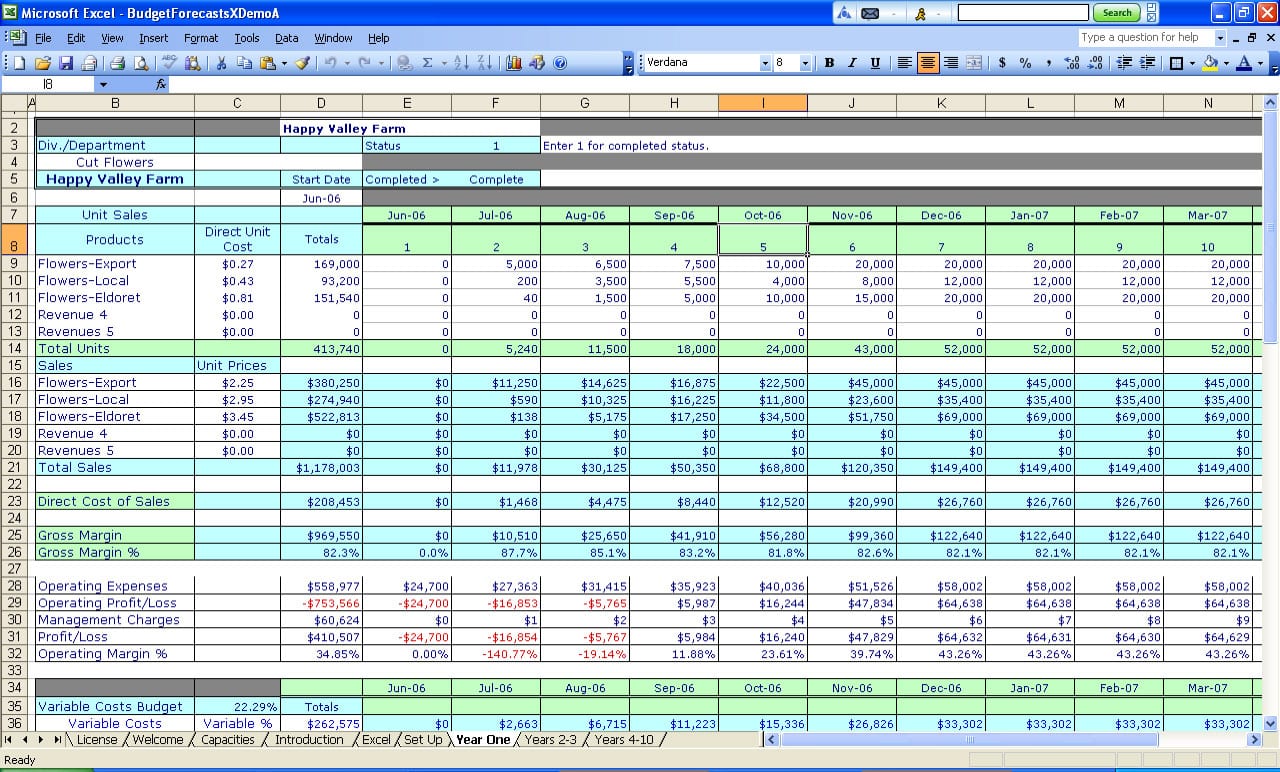

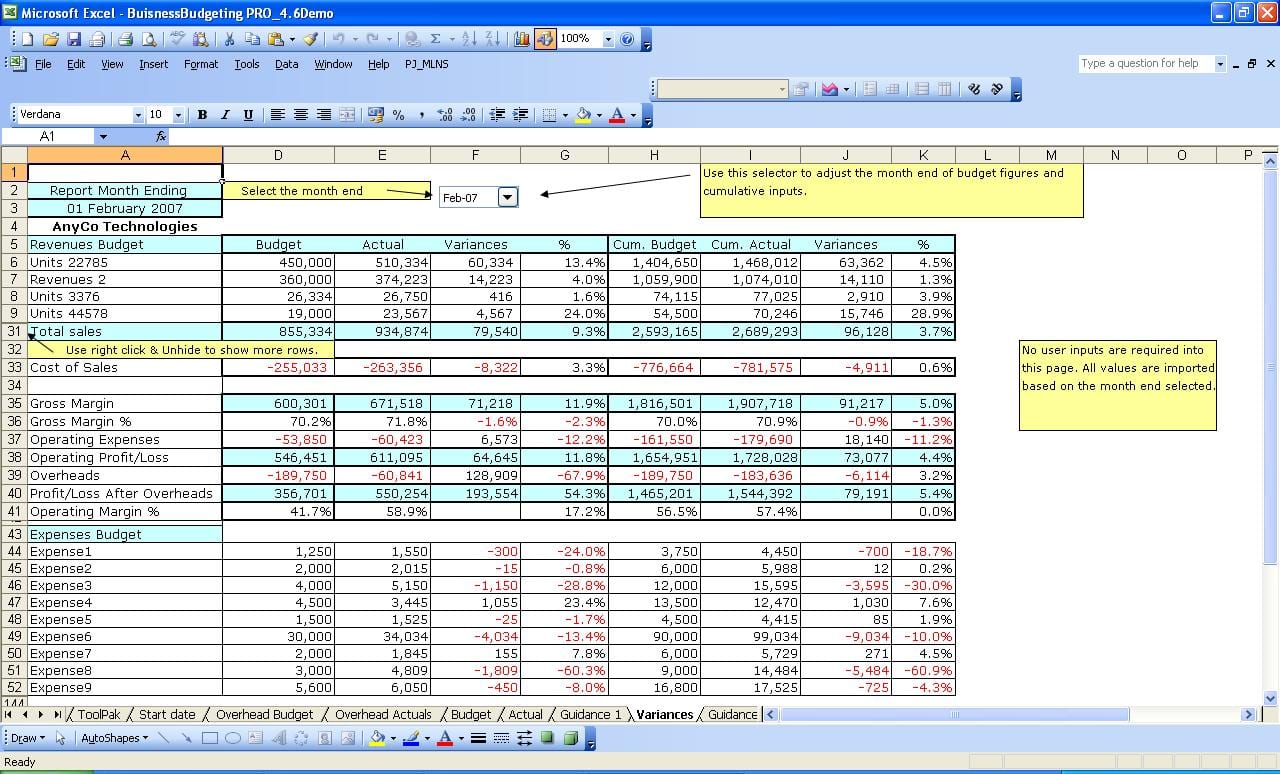

A spreadsheet is truly only a calculator, but with much more flexibility. Spreadsheets might also be stored as HTML. The very first issue to do is make a spreadsheet of all of the important office supplies your business should operate.

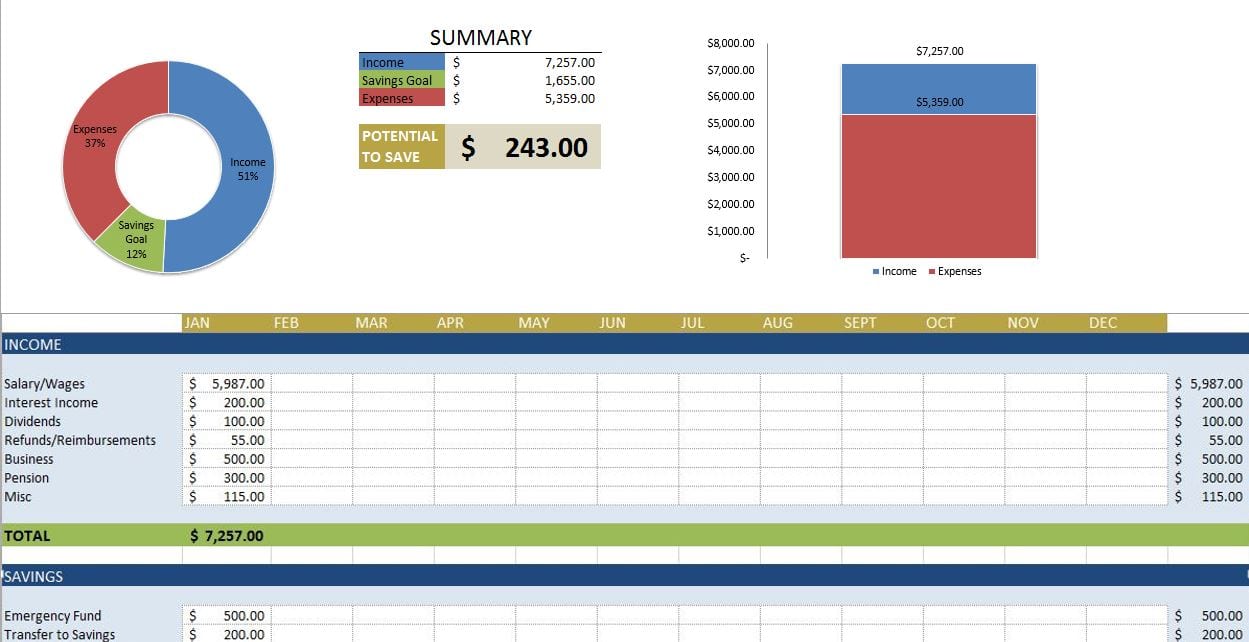

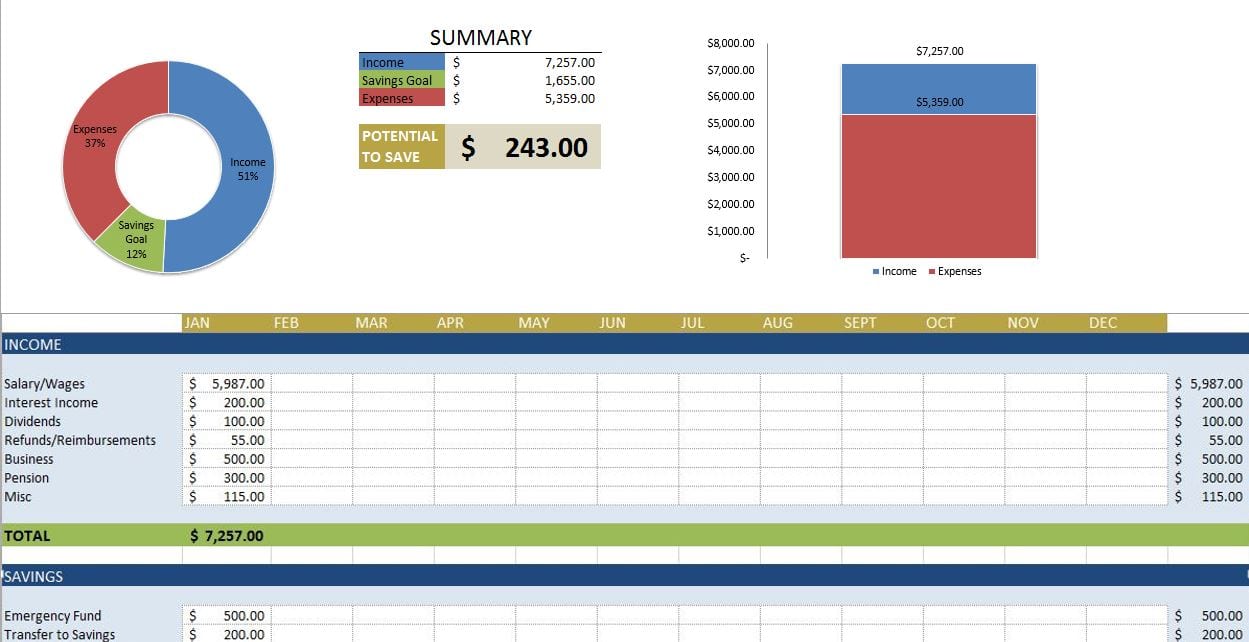

Know where your hard-earned money is going. You will be pleasantly surprised by how quickly your money will expand and how inspired each new deposit is likely to make you. As a way to spend less, you will need to have money readily available to save.

Getting clear on your values and what you wish to accomplish with your money. Money can acquire tight for everybody from time to time. Subtract to see whether you have anything left over and put that money in a distinct account which you don’t have easy accessibility to use, such much like a debit card or if there’s a nearby withdrawal location. As much as possible you may wish to devote your own money instead of taking out huge bank loans for your church building undertaking, but it’s not always feasible to fund a full project with cash.

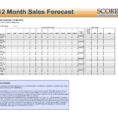

11 photos of the "Financial Budget Spreadsheet Template"

Related posts of "Financial Budget Spreadsheet Template"

The template can be found in PDF format. An absolutely free plan template is an easy document. You can make your very own free plan template on your PC. There are various ways of creating spreadsheets for meeting basic requirements and expectations but it's always best to select the assistance of completely free spreadsheet templates....

Simply take a template, do anything you desire with this. There'll be complexities that you may not have the ability to capture in the template I provided or specific reports that you're not certain how to collect. If you're on the lookout for a template and checklist to aid you with your Salesforce metrics download...

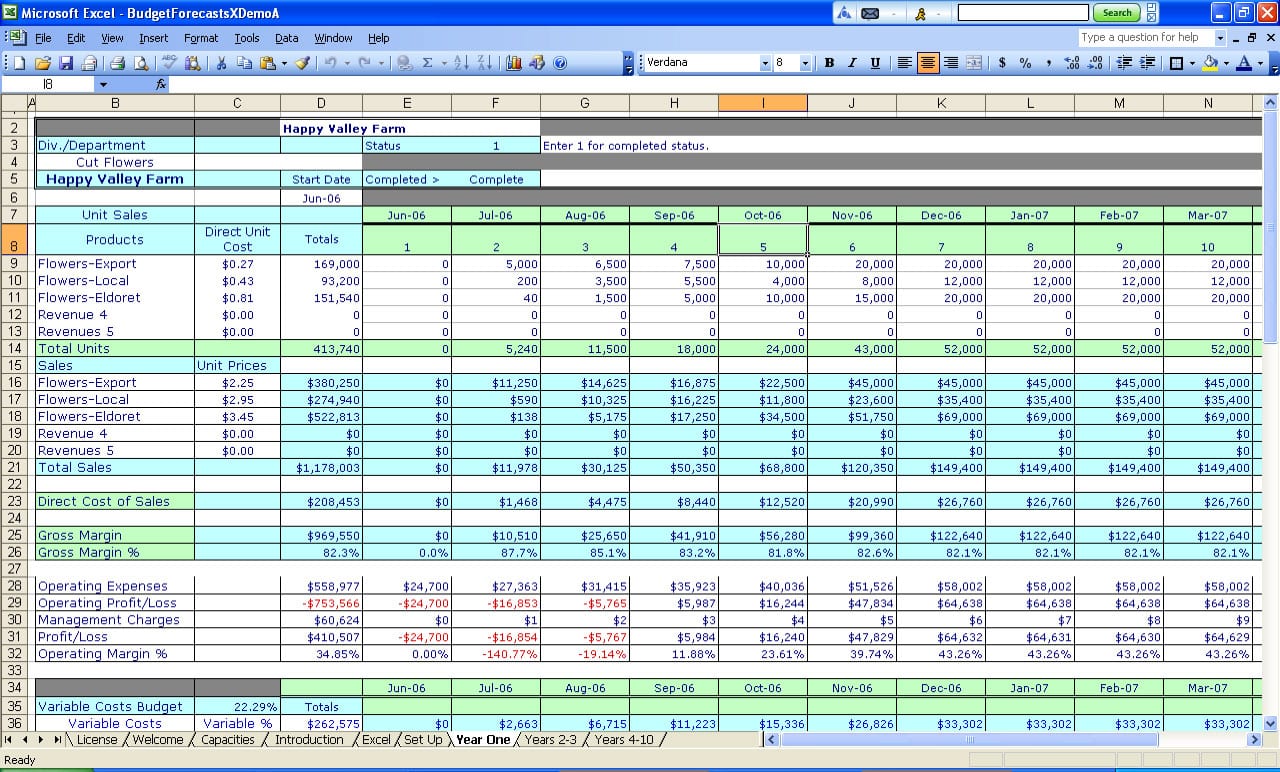

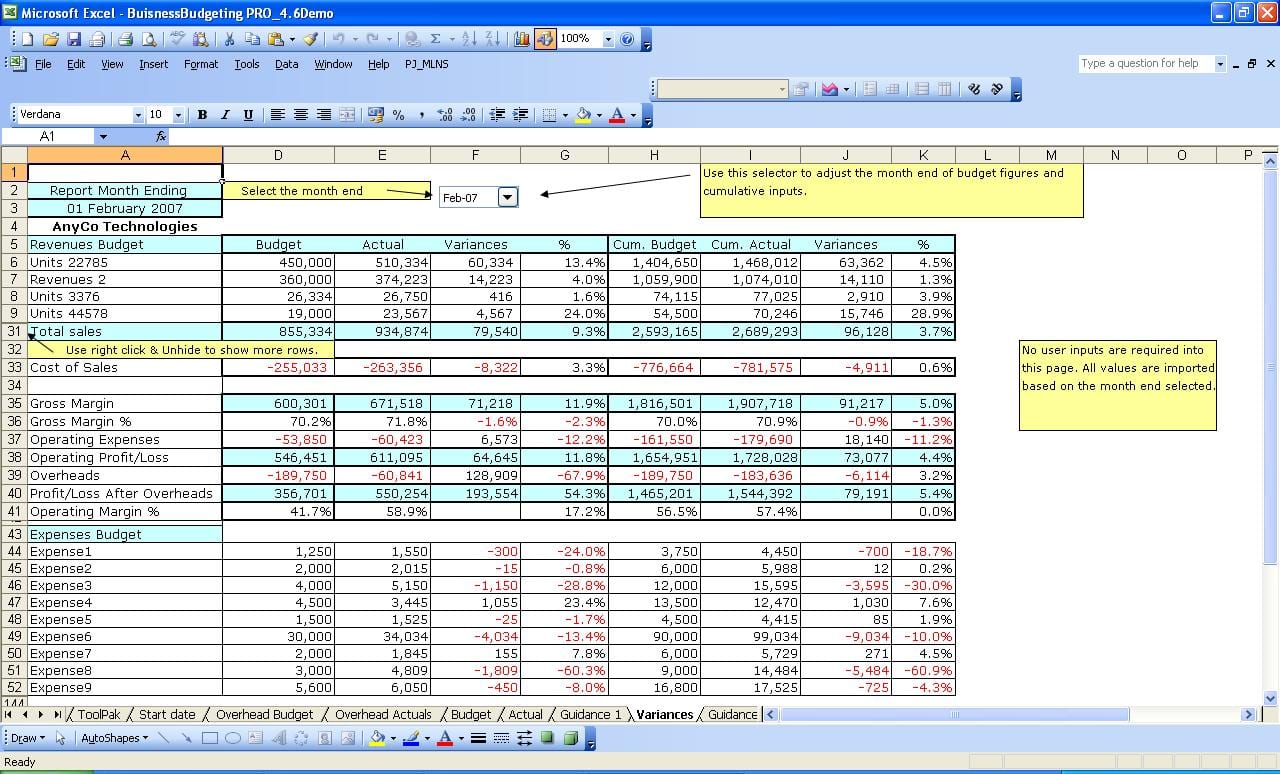

The biggest thing you have to think about is where your expenses are, and should you want to rethink your spending. A business expense is whatever goes directly for your company. To begin with, however, you will need to work out what's a business expense. You wish to make sure the financial info in the...

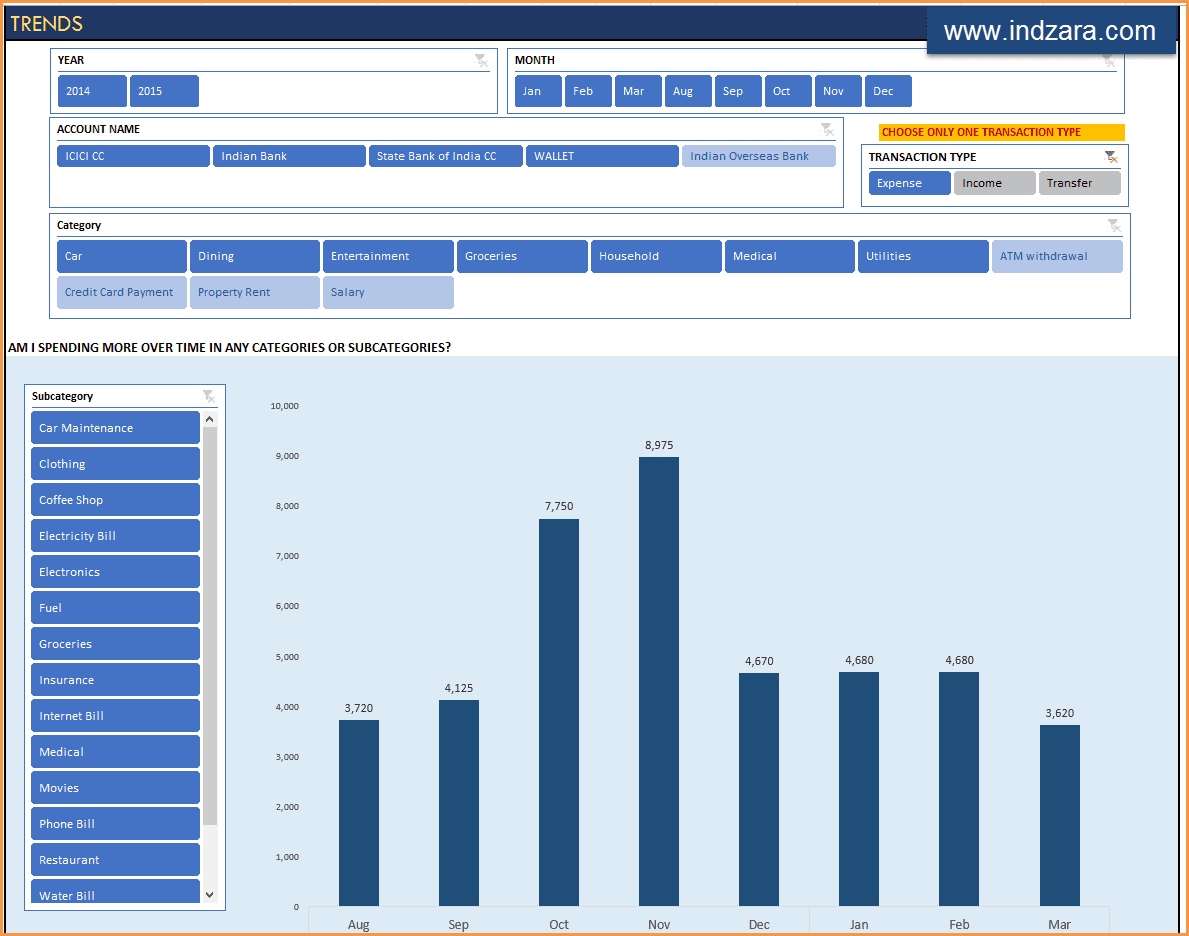

The spreadsheet is organised so that you can instantly compare and contrast similar costs for as many as ten properties on exactly the same page, while also enabling you to delve into the particular cost types to every one of your properties. Although it enables you to keep complete records, it has been designed so...