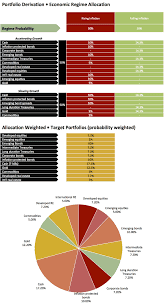

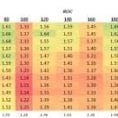

Essentially, you are going to want to raise your bond allocation as you become closer to retirement. Naturally, the proper asset allocation will change from investor to investor. Maintaining the appropriate asset allocation over time is among the 3 keys to investing success over the very long term.

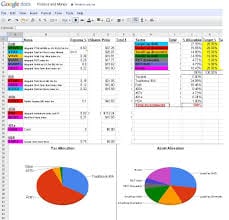

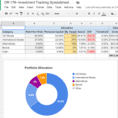

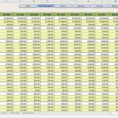

The fantastic thing about spreadsheets is getting the capability to enter a specific formula which lets you create computations coming from assorted cells throughout the spreadsheet. A spreadsheet ought to be a permanent portion of your private finance toolkit. Spreadsheets offer a handy approach to saving a significant quantity of information in 1 sheet or within a single document. For smallish companies, a very simple spreadsheet like this might be all you require. When particular steps are needed to use a particular spreadsheet, a whole sheet or some of that sheet can be committed for the directions about how to utilize it correctly.

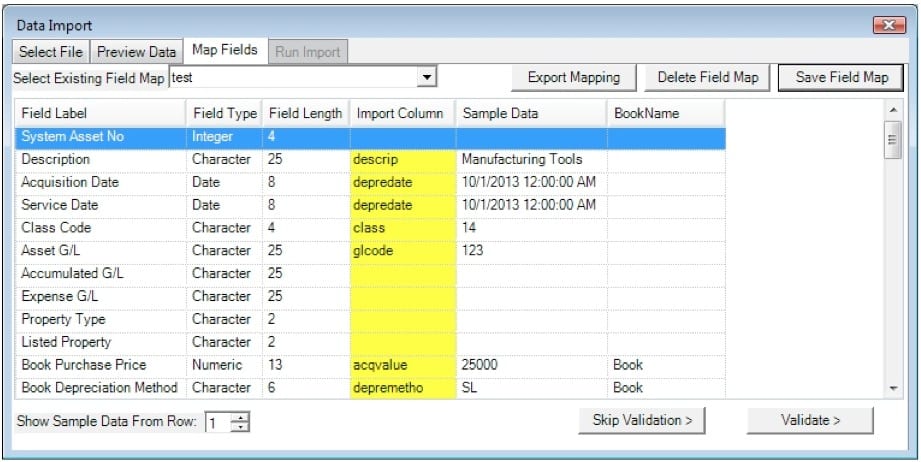

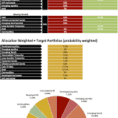

Two spreadsheets are readily available. To begin, you can observe the spreadsheet by going to this website. You could be considering sample budget spreadsheets. You might want to begin SAVING more now to boost the assets later. Figuring out how to supervise your assets to a sensible asset allocation during challenging market environments is among the more advanced elements of private finance and retirement planning. When it’s investment, visit the next step. Put simply, how much can your actual investments drift from your intended allocation before you will need to rebalance. Selection of the genuine funds is done last, which is at the base of the chart.