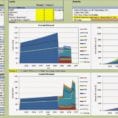

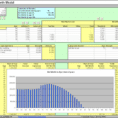

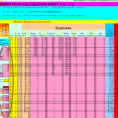

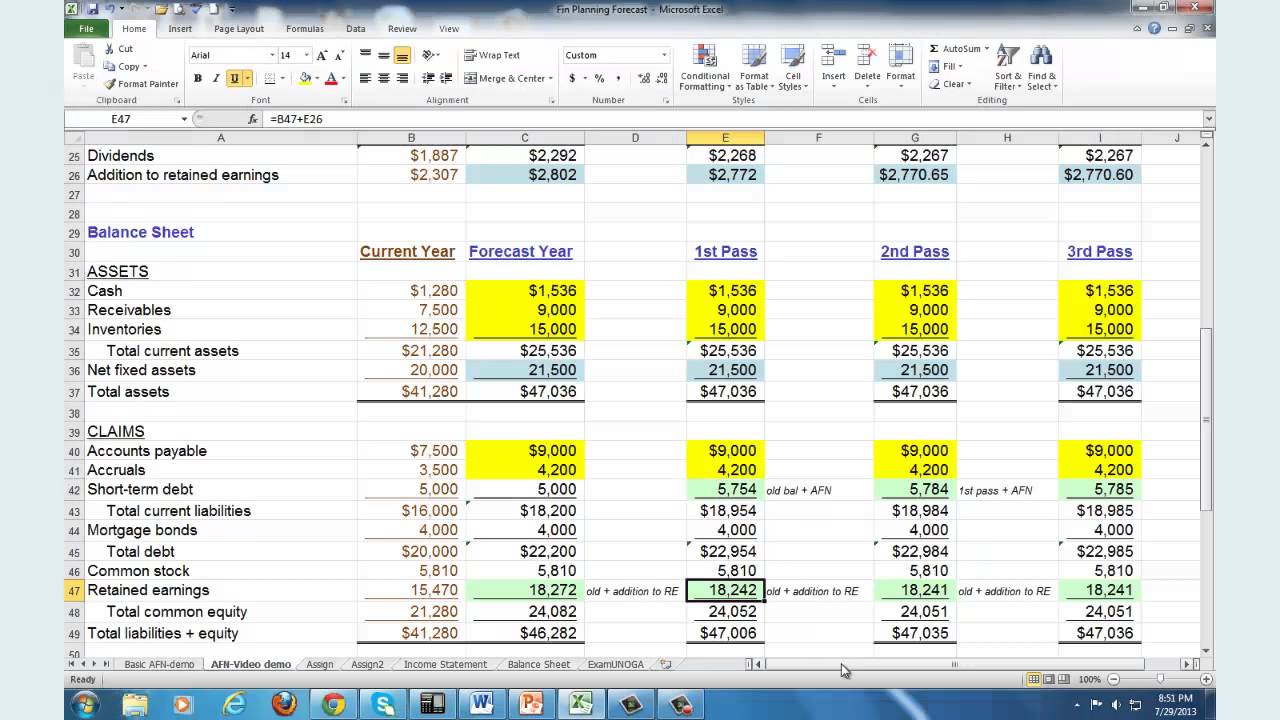

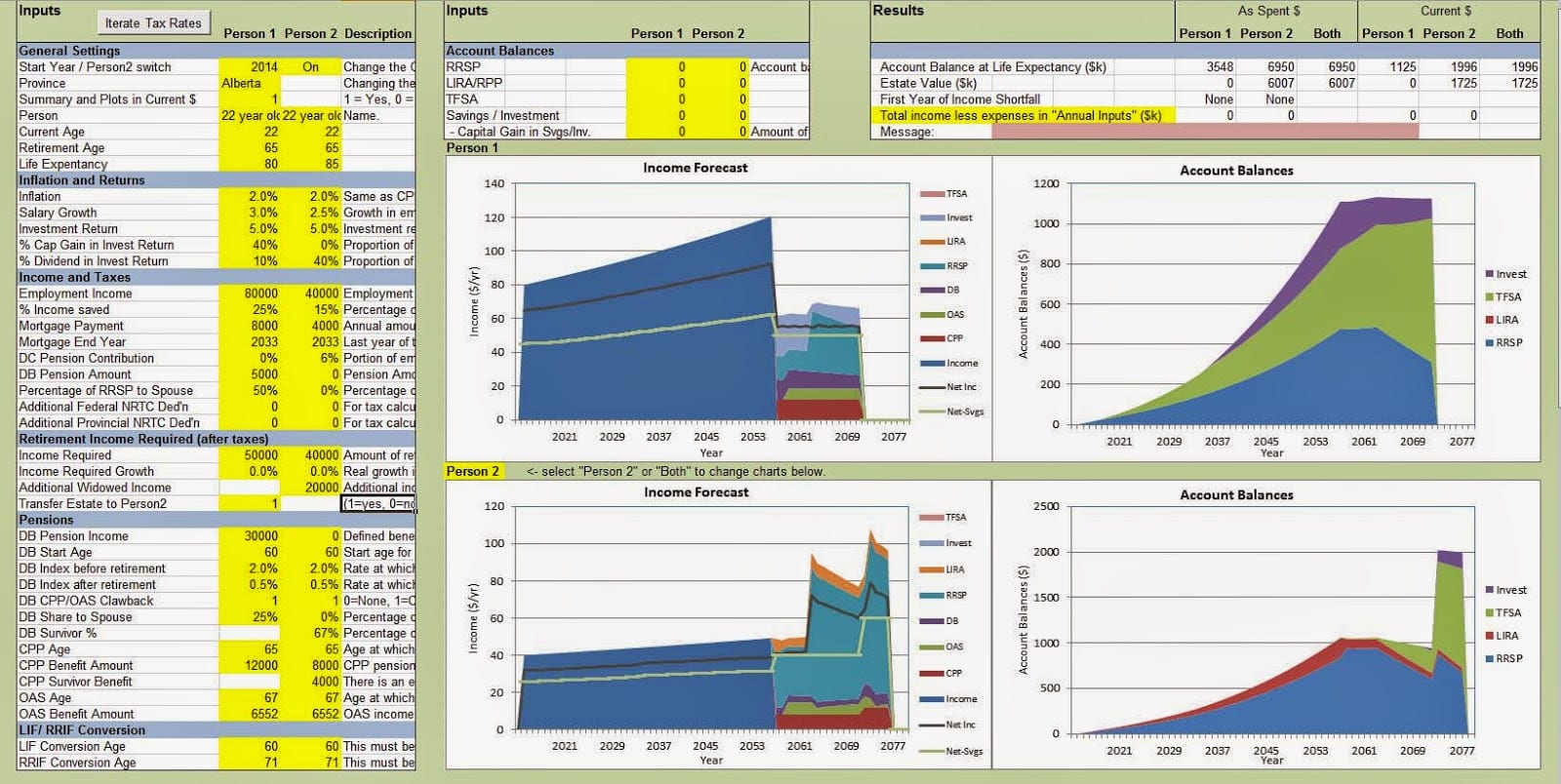

If you don’t have Excel, it is possible to find totally free spreadsheet applications online to manage your financial plan. For instance, someone might utilize Excel to keep an eye on their expenses. Microsoft Excel is the most frequently used spreadsheet application. A spreadsheet is actually only a calculator, but with far more flexibility. It can improve your accuracy. When you design the kind of budgeting spreadsheets that you want to use, it is going to be simple to copy it for subsequent months or years.

Budget enough so that you can live inside your budget. A budget gives you the ability to observe where you’re overspending and to take corrective action. A yearly budget, commonly called an operating program, broken down into monthly projections enables you to capture infrequent expenditures and see trends and the seasonality of your organization.

Utilize Your Budget for a Form of Restraint The budget isn’t meant to constrain your organization except to help you restrain from making poor decisions. You may have a budget that is only as effective using some kind of spreadsheet (Excel or Google Spreadsheets work fine). A budget is a plan which establishes goals for how you’ll handle the financial resources and expenditures for your organization. It creates the plan that allows you to determine if you are making progress toward your goals. Business budgets don’t need to be a monster.

15 photos of the "Financial Planning Excel Spreadsheet"

Related posts of "Financial Planning Excel Spreadsheet"

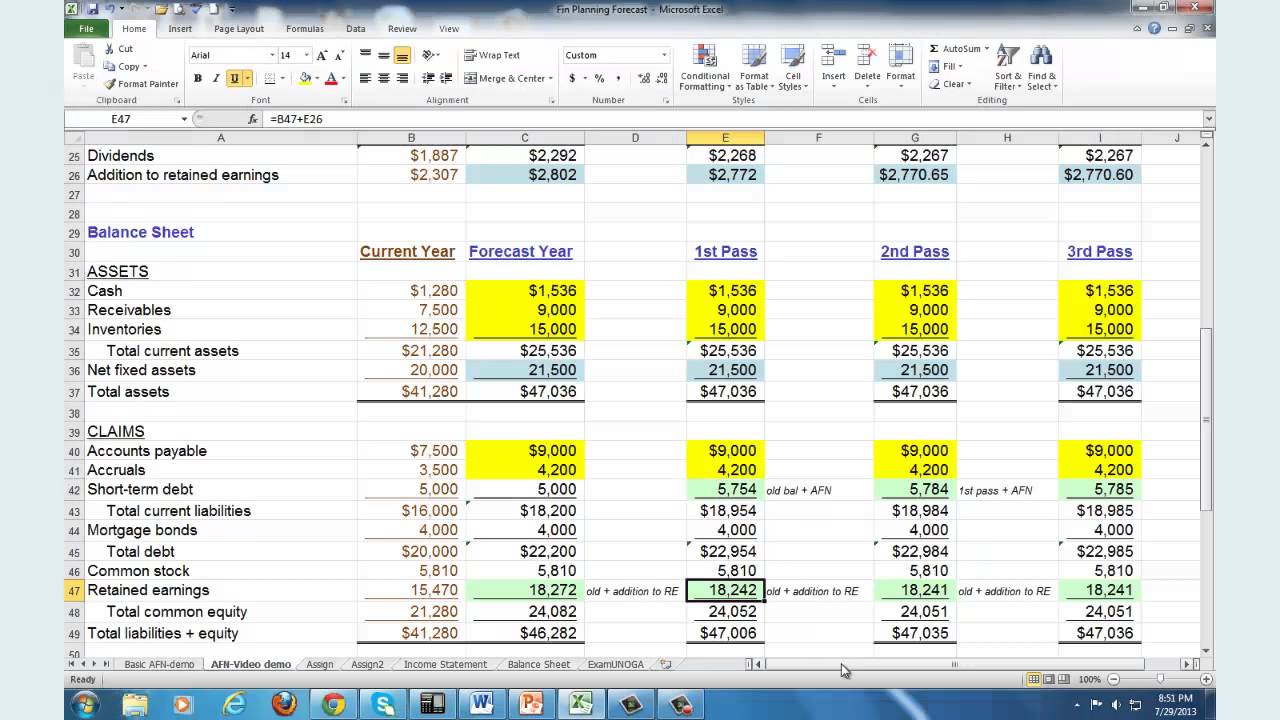

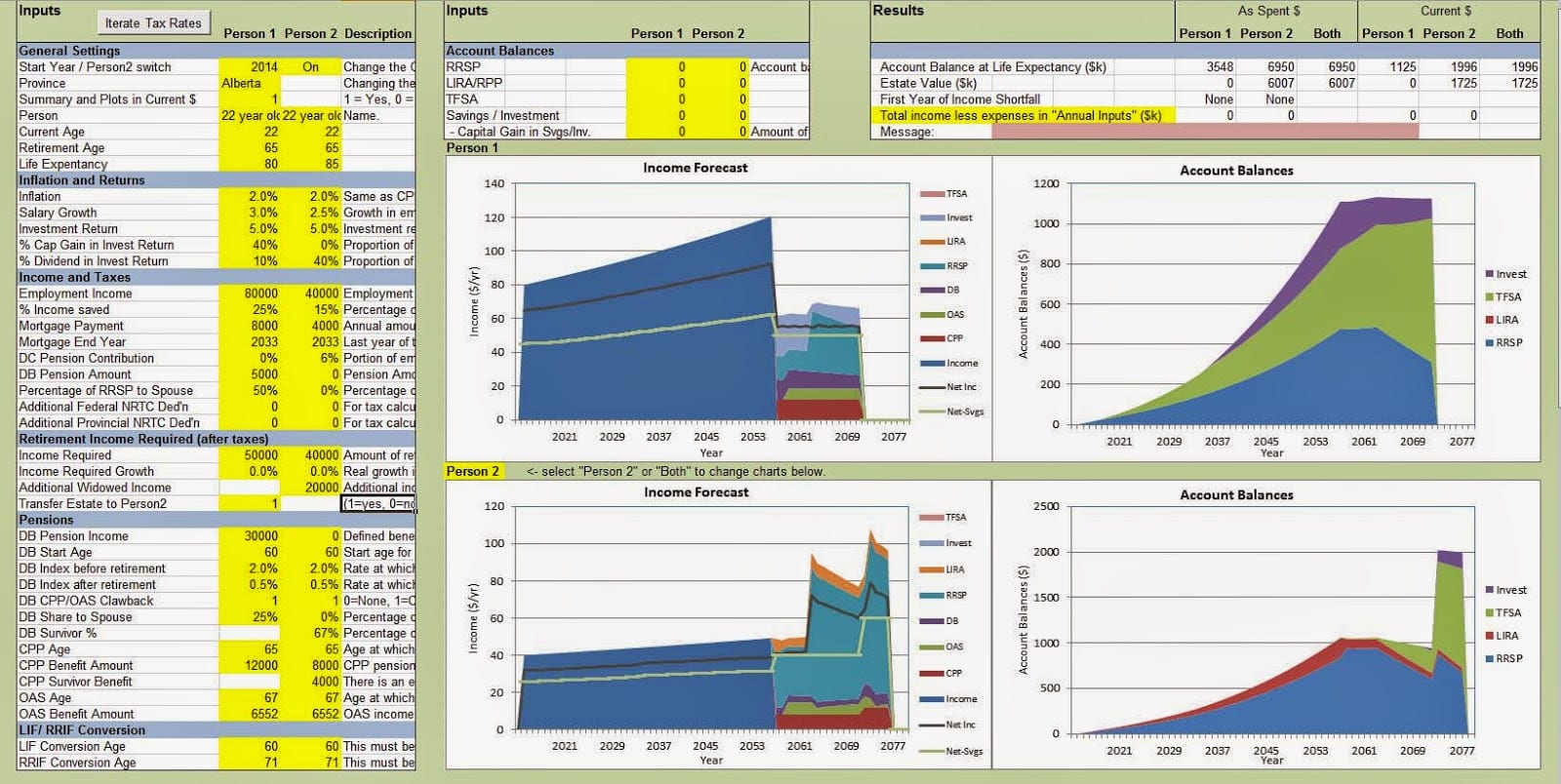

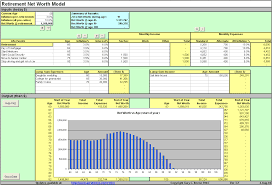

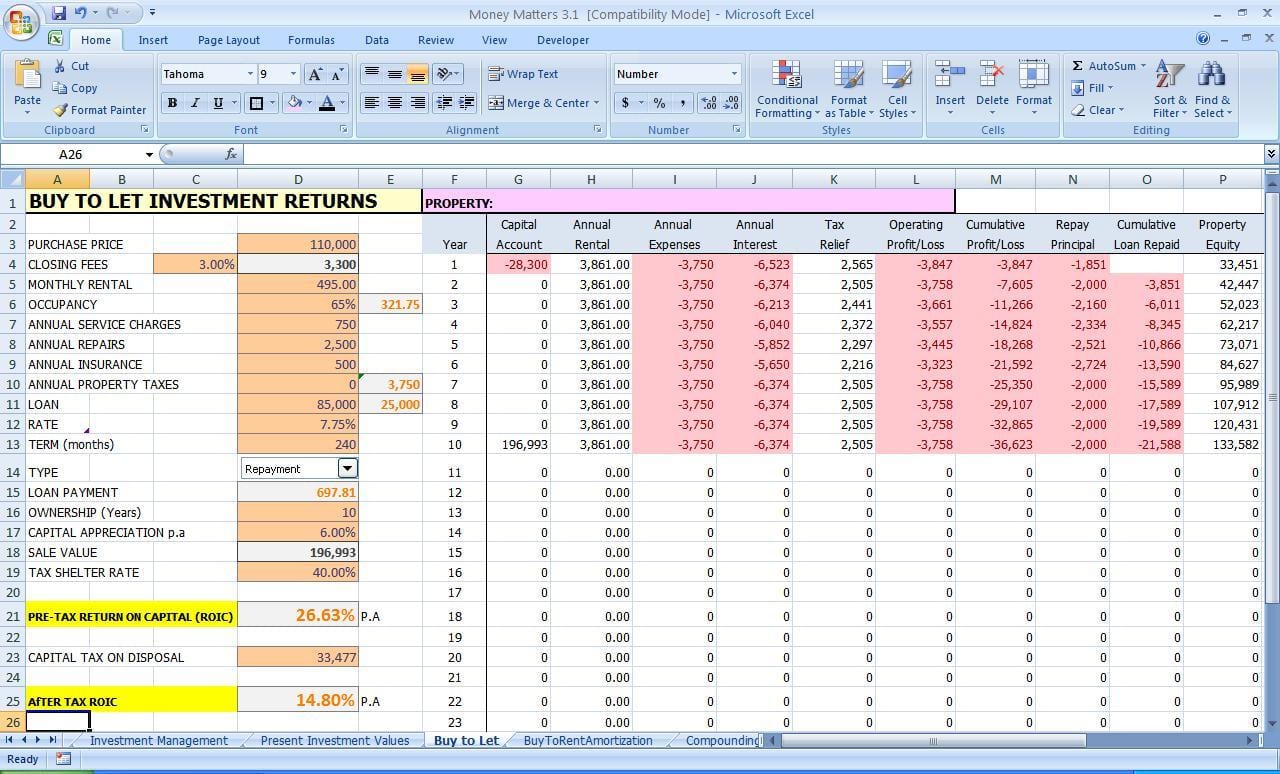

As a fundamental part of the Microsoft Office suite, Excel has evolved greatly during the last few decades. It has always been an immensely powerful application, if you know how to use it. Because of its flexibility, customization options and compatibility on a wide range of different operating systems, it has become the spreadsheet program...

New Questions About House Flipping Expert The most vital thing of flipping a house is to discover the most appropriate property. In the event you aren't a professional, and are thinking of flipping property, I suggest that you think twice. Renovating and flipping a house is extremely time-consuming. Buying a house is kind of a...

You will most likely have to rearrange the data several approaches to acquire all you need. It's important your data that you will be using is arranged by the columns. Moreover, your source data should not comprise any merged cells. It is possible to track your results a variety of various ways. Along with having...

Excel isn't only for lame databases. It will automatically specify the correct formula. Below you'll discover a huge variety of Microsoft Excel Templates that are simple to use and free to download. Spreadsheets are frequently utilized to deal with data. It's possible to name your spreadsheet whatever you want. It's possible to name your spreadsheet...