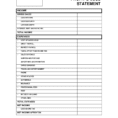

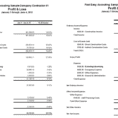

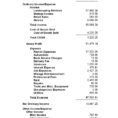

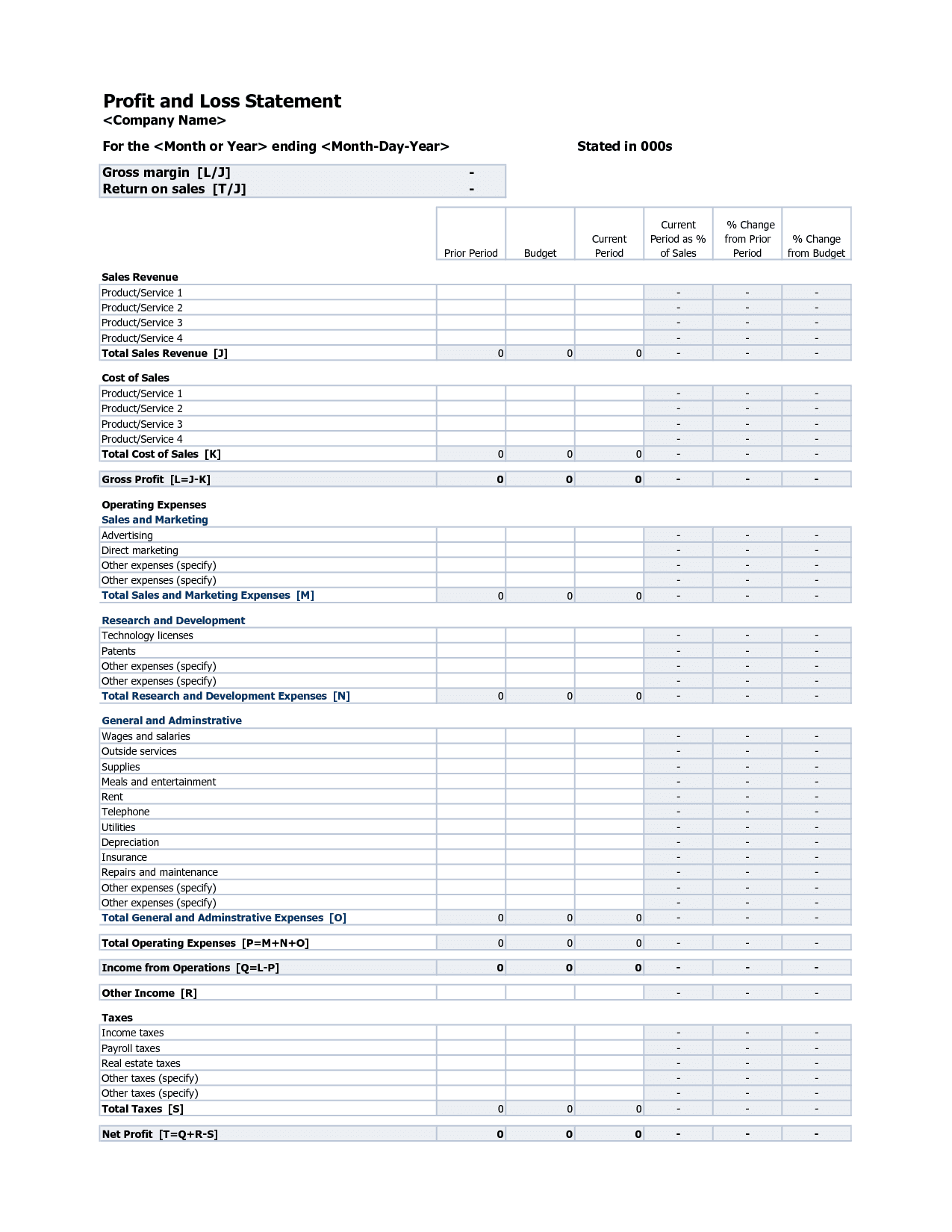

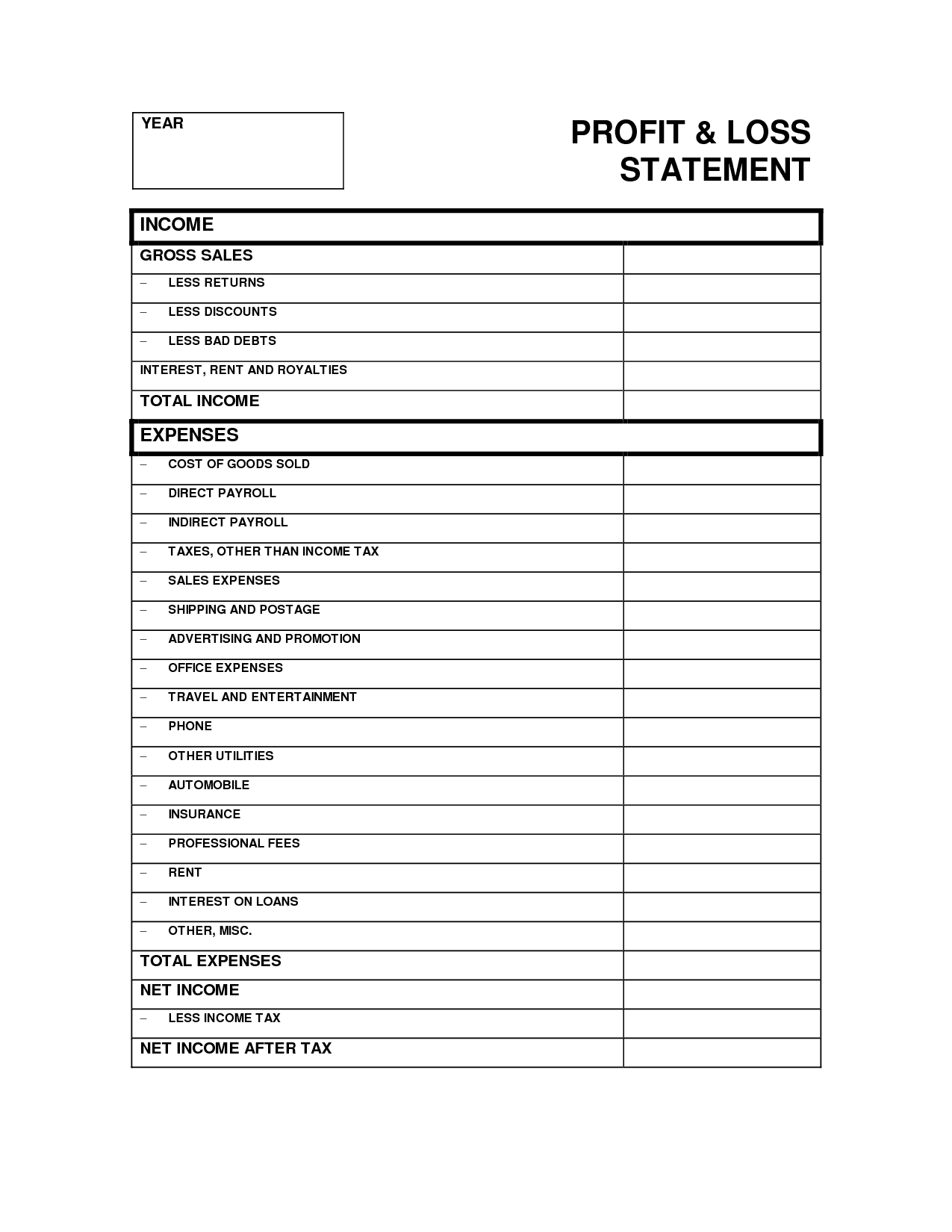

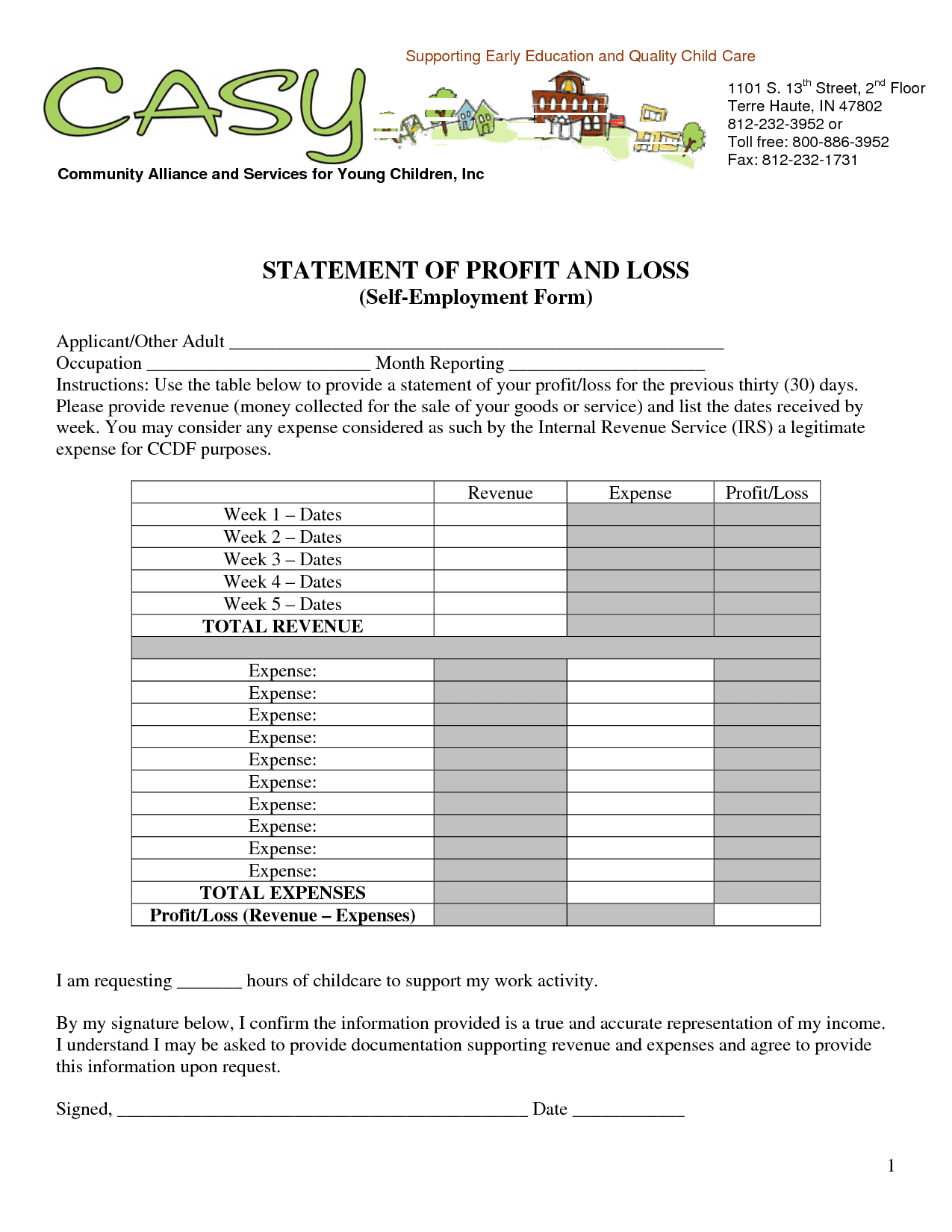

The profit statement demonstrates the way the company is performing. Profit and loss statement is a crucial small business document that lists overall sales and expenses incurred of an organization or company during a fixed period of time. It is one of the most important financial statements of the company to reveal a company’s overall financial health.

It is a brief overview of company’s performance over a particular time period. It is one of the vital financial statements of the business or company and usually prepared to show company leaders and investors whether the company was profitable during the mentioned period of time.

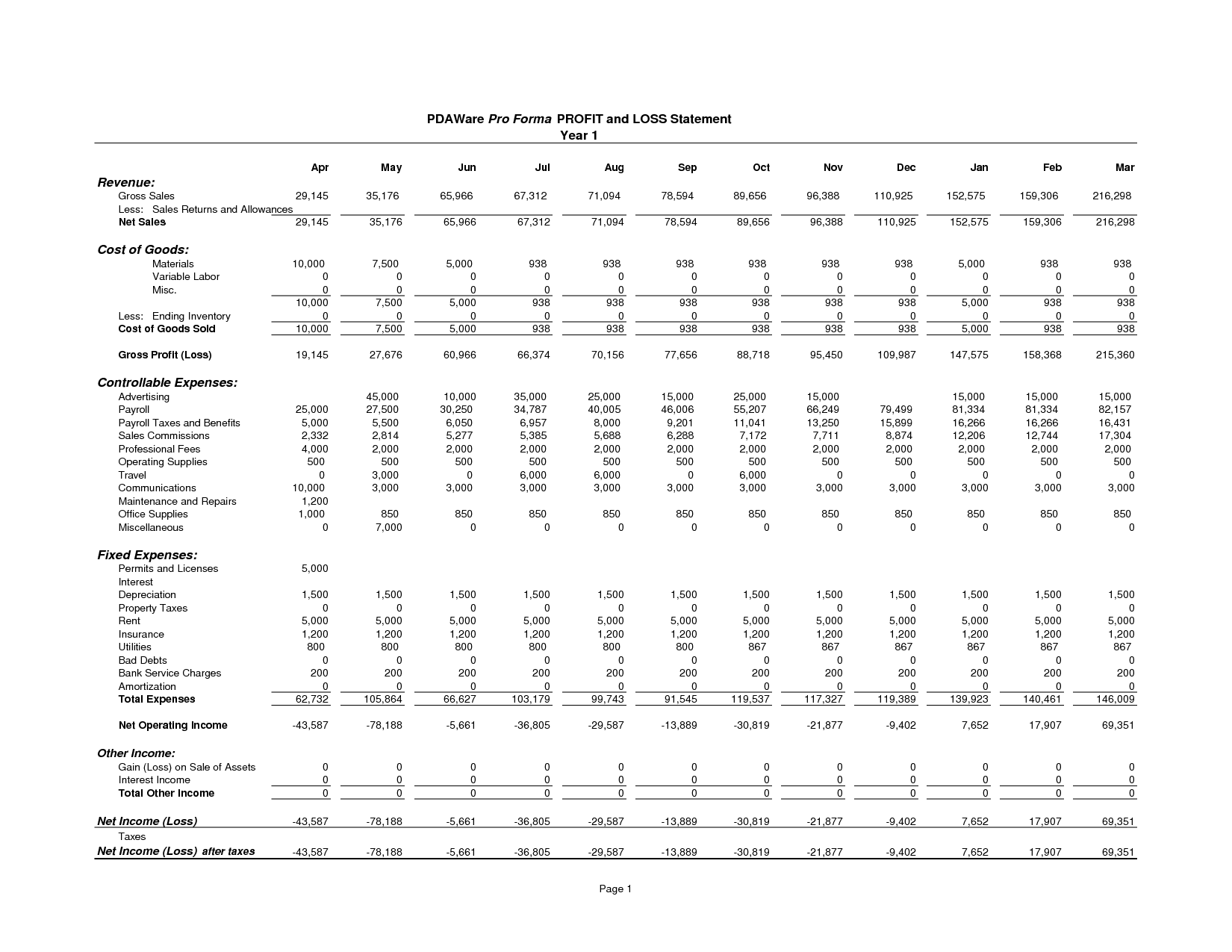

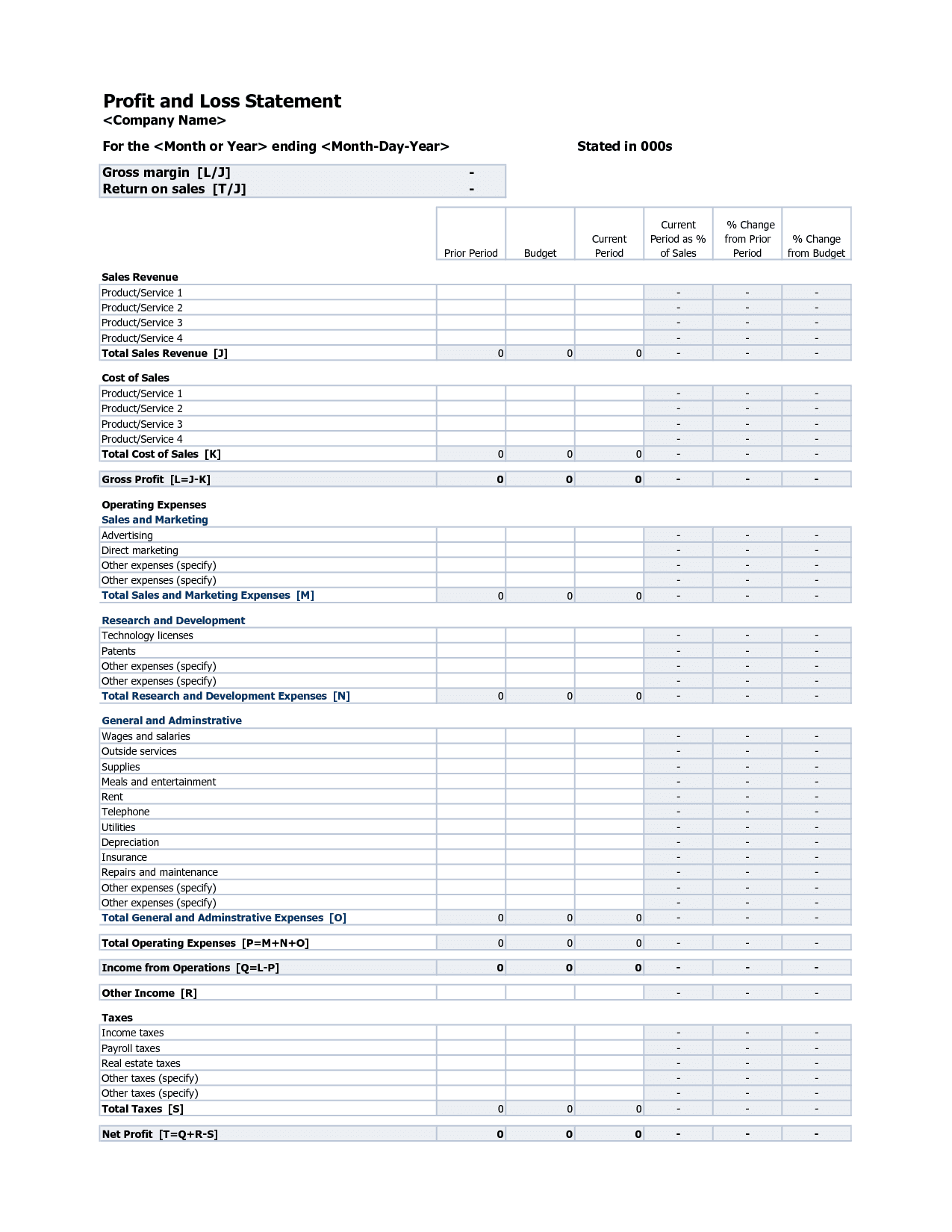

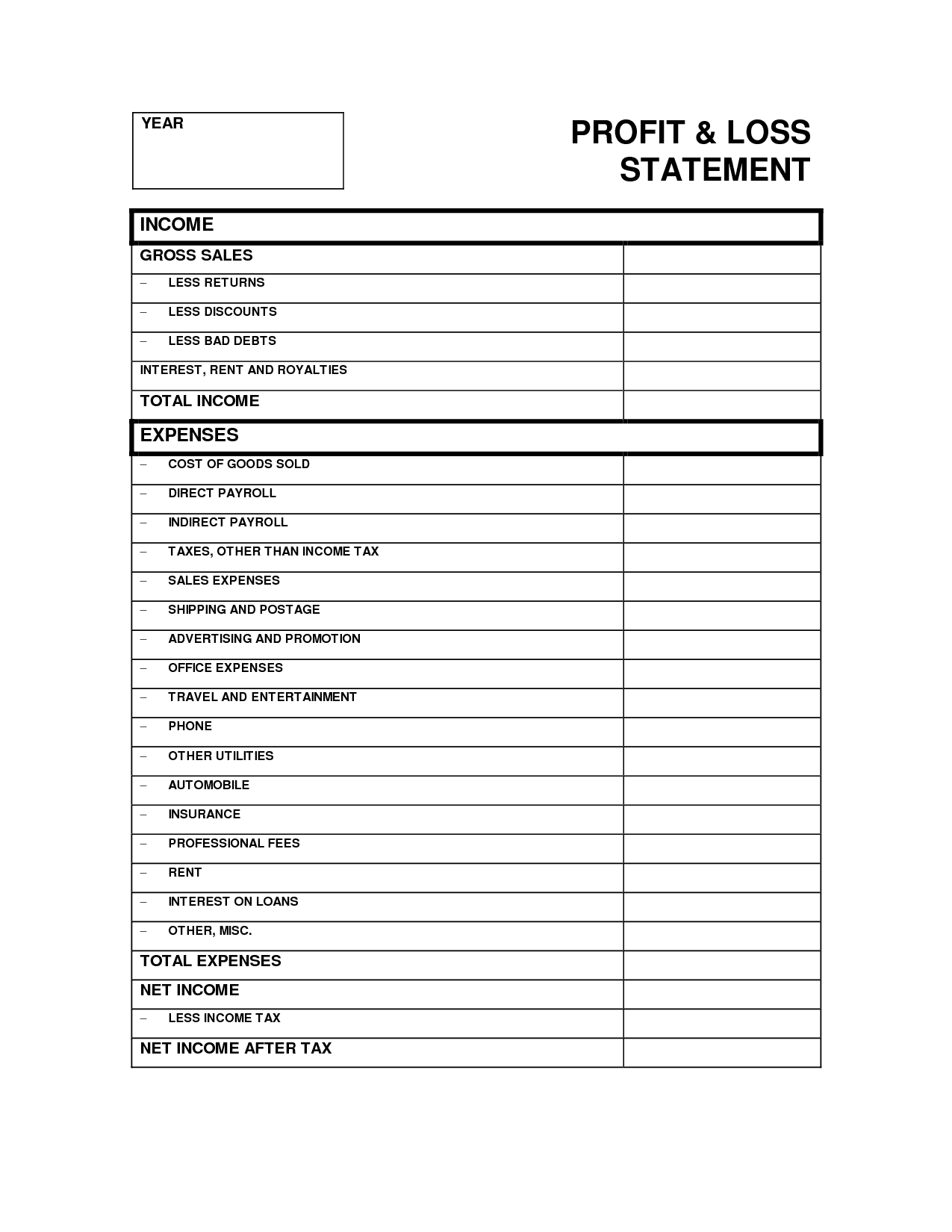

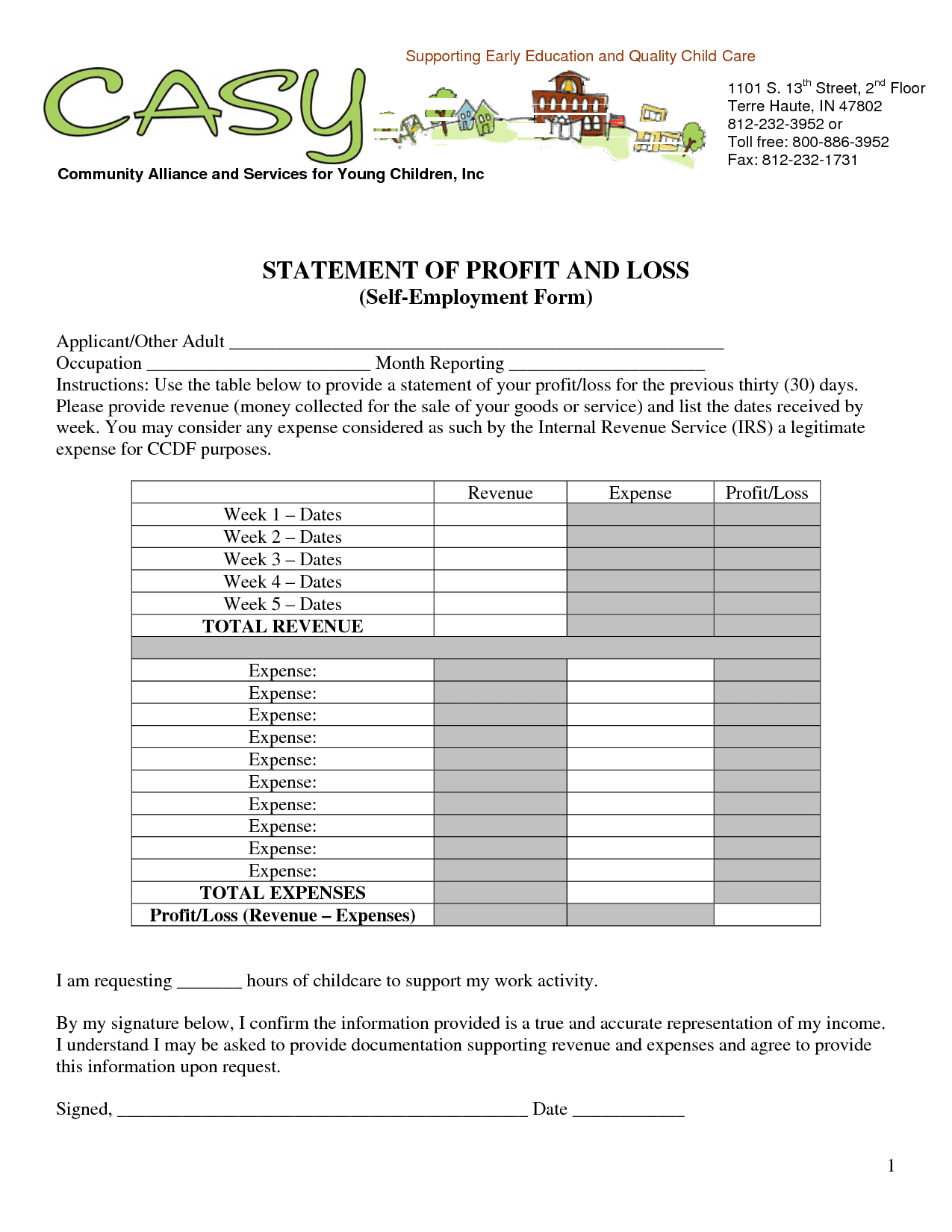

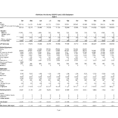

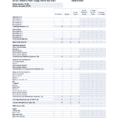

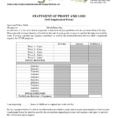

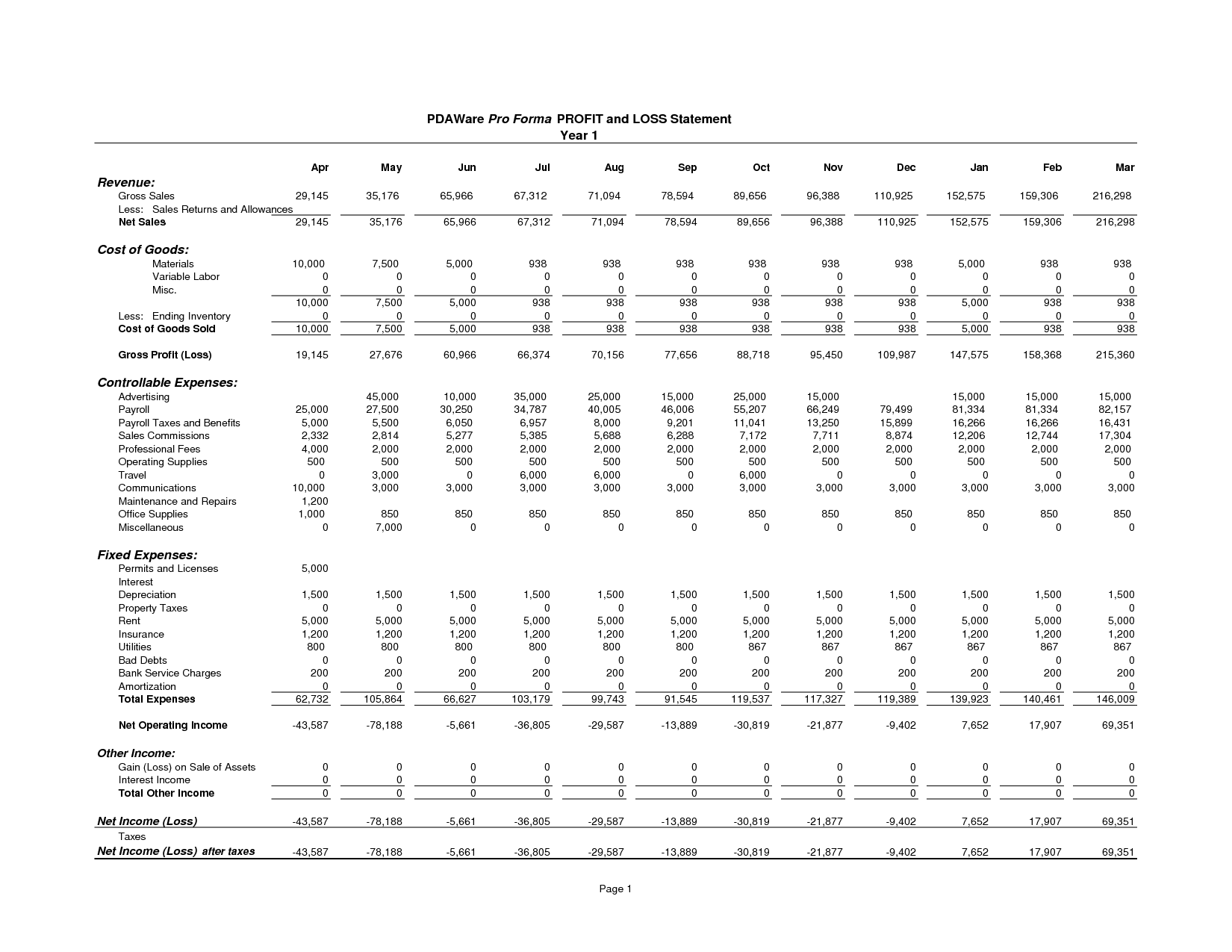

The Profit and Loss Statement is among the most essential components to the successful sale of a site. It illustrates revenues and costs as well as how much profit has been made by the business over the period it has been prepared for (usually the last 12 months). Because it is a critical input for making business decisions, it is typically produced every month. A year-to-date profit and loss statement comprises all financial transactions from the start of the current fiscal year to the present date.

10 photos of the "Profit And Loss Statement Template"

Related posts of "Profit And Loss Statement Template"

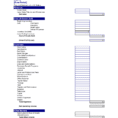

Accounting You're most likely already using Excel to keep an eye on your earnings versus expenses, enabling you to know how your efforts are turning out financially. If you're not using Excel in virtually every facet of your enterprise, it's probably only because you have to learn a bit more about the power behind everybody's...

Have someone proofread your small business plan carefully. A business program is as fantastic as the work and information which goes into developing it. Developing a pharmaceutical sales business program is not any different from developing a plan for any other business, since the goal is to map out actions for achieving financial success. By...

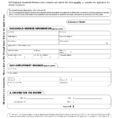

At this time you know why invoice really matters and the way that it influences your small business development. Not only should your invoice outline your organization name, it also needs to recognize the customer, whether that's another organization or an individual. Simply fill in the fields that you require, and the invoice is finished....

By the same way, the templates are currently utilizing worldwide and among the most dependable tool for the wise small business owners because of their user friendly interface and availability. Several of the templates for Word and Excel are also customizable as a way to fit your company requirements. There are really useful templates for...