When you are beginning a home-based business, the most crucial matter to do is to first determine what sort of business at you ultimately trying to get started. Additionally, you’re likely to want to consider whether you shooting for your company or create a limited liability company to control your organization operations.

Therefore, the company would be asked to submit records that would supply a fantastic indication about what the business would have actually lost in net income. A not-for-profit business won’t be in a position to do that, as it’s a level 3 expense. When you determine which kind of home-based business one a start, it’s the right time to begin the preparation of your organization program. Again, in summation, you must always make certain you have started a home-based business for the correct factors.

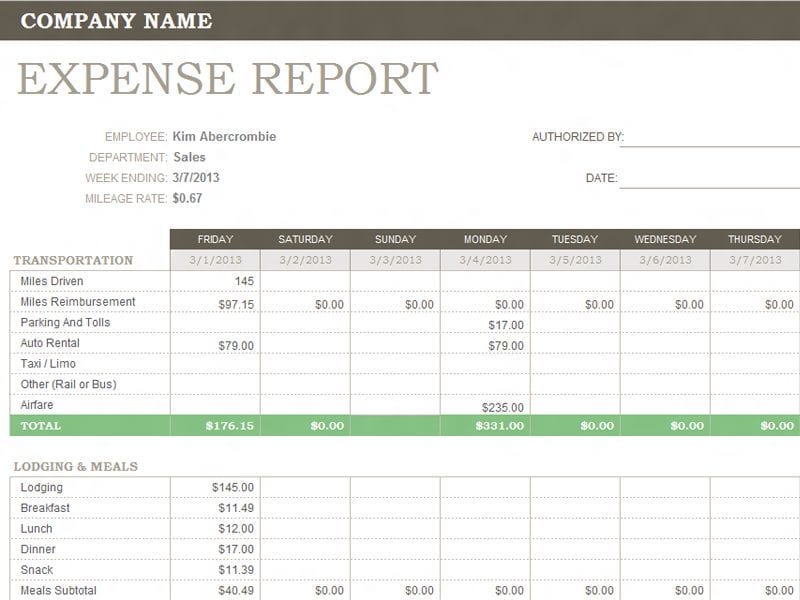

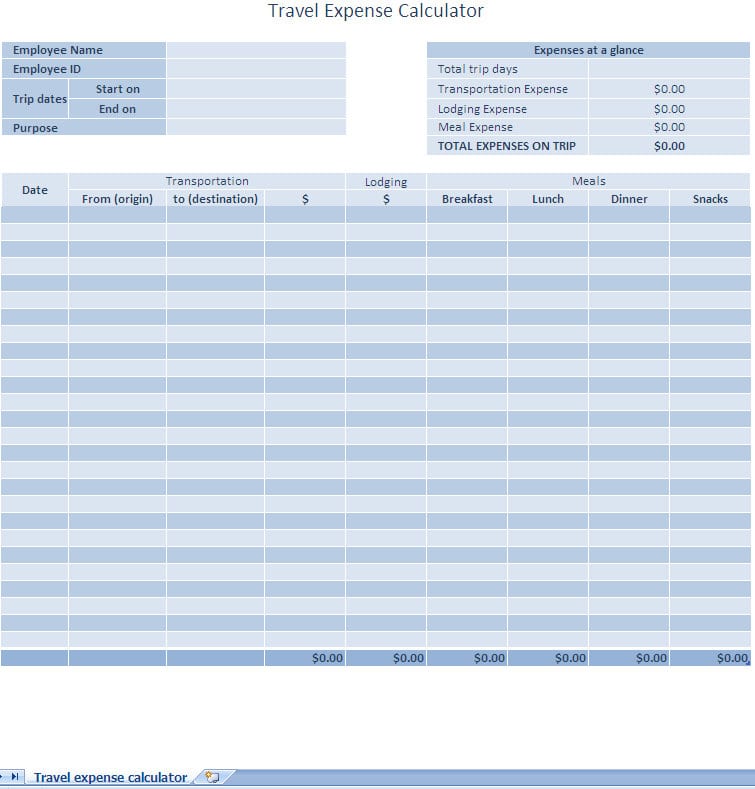

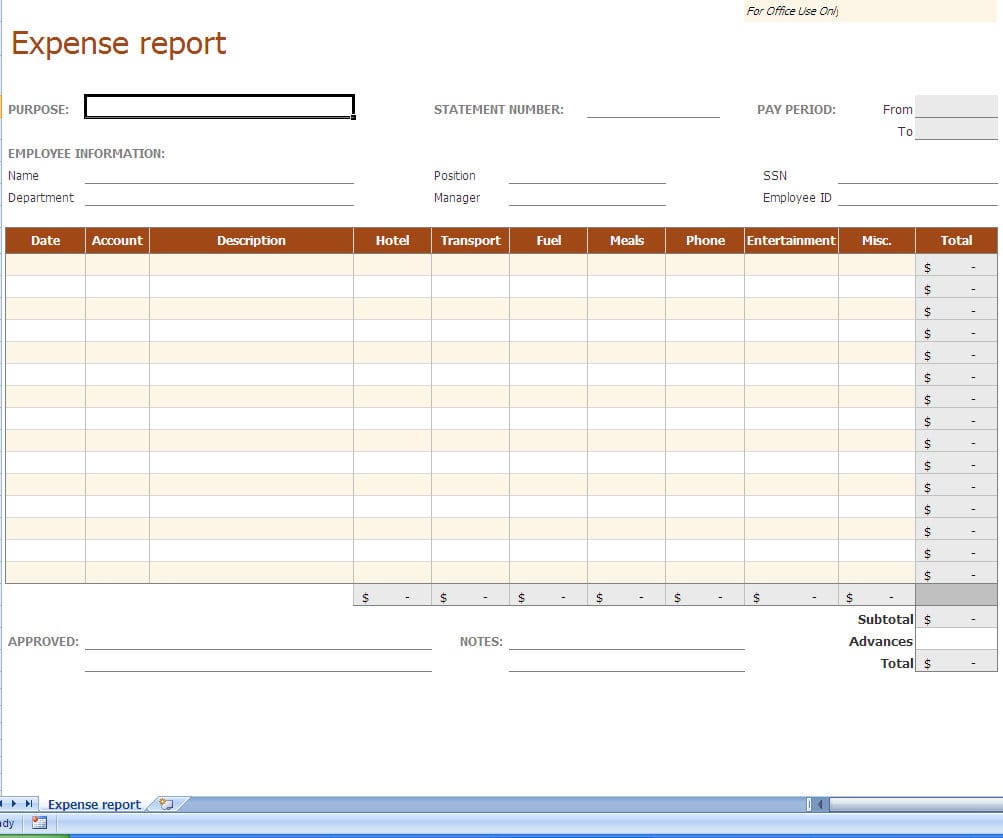

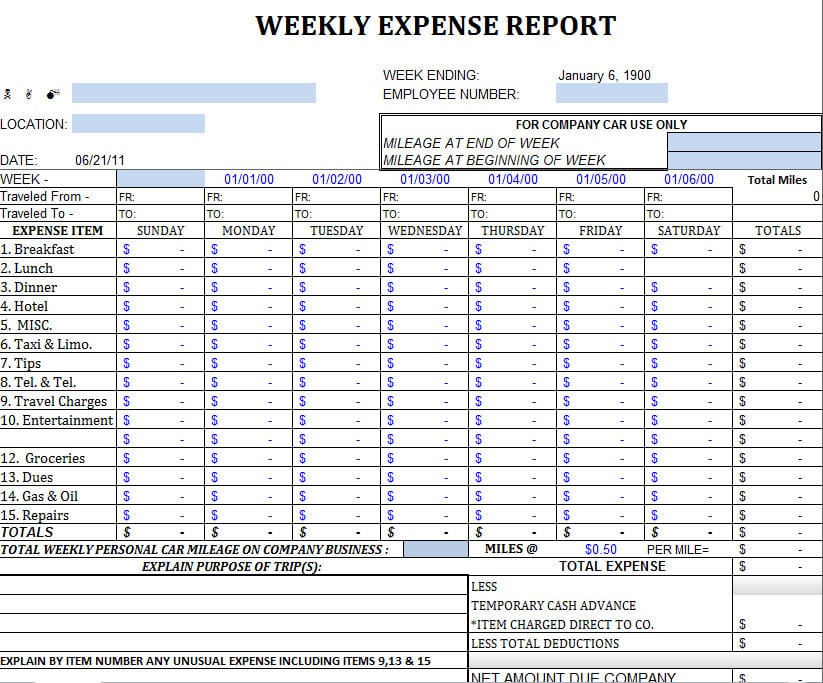

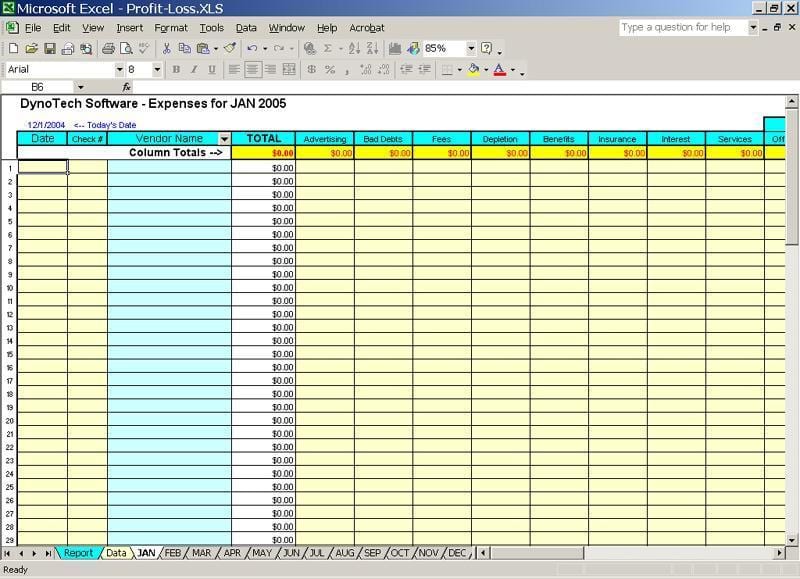

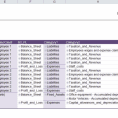

Expenses may include the salary of your workers, office expenditures, advertising, shipping, etc. Otherwise, you wish to accrue the cost in the straddle year. So it’s logical to make sure that you have booked as many legal expenses as possible.

Normally, you ought to avoid hard coded expenses which do not dynamically change as your revenues grow. Also, it’s important to be aware that when entering an expense to be certain to incorporate the negative sign so it’s subtracted from the total rather than added. Other home expenses have to be apportioned between the company and non-business components of the house.