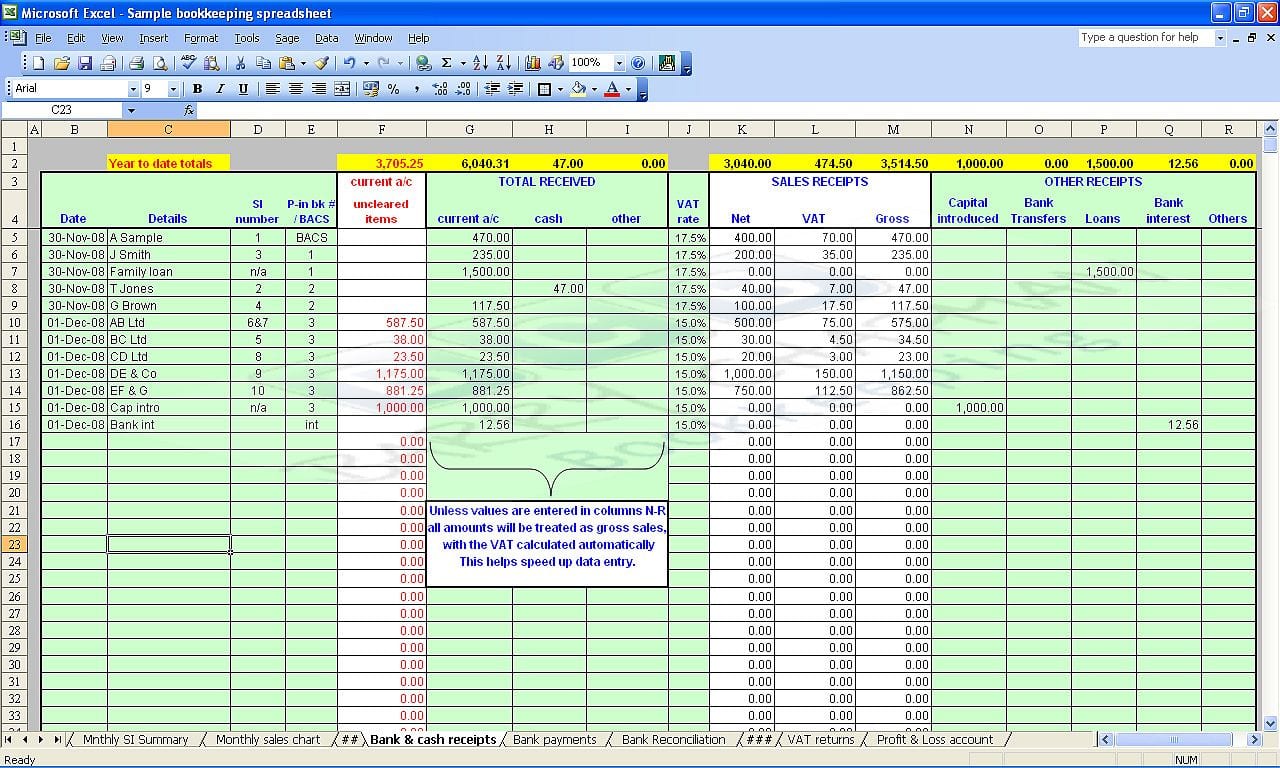

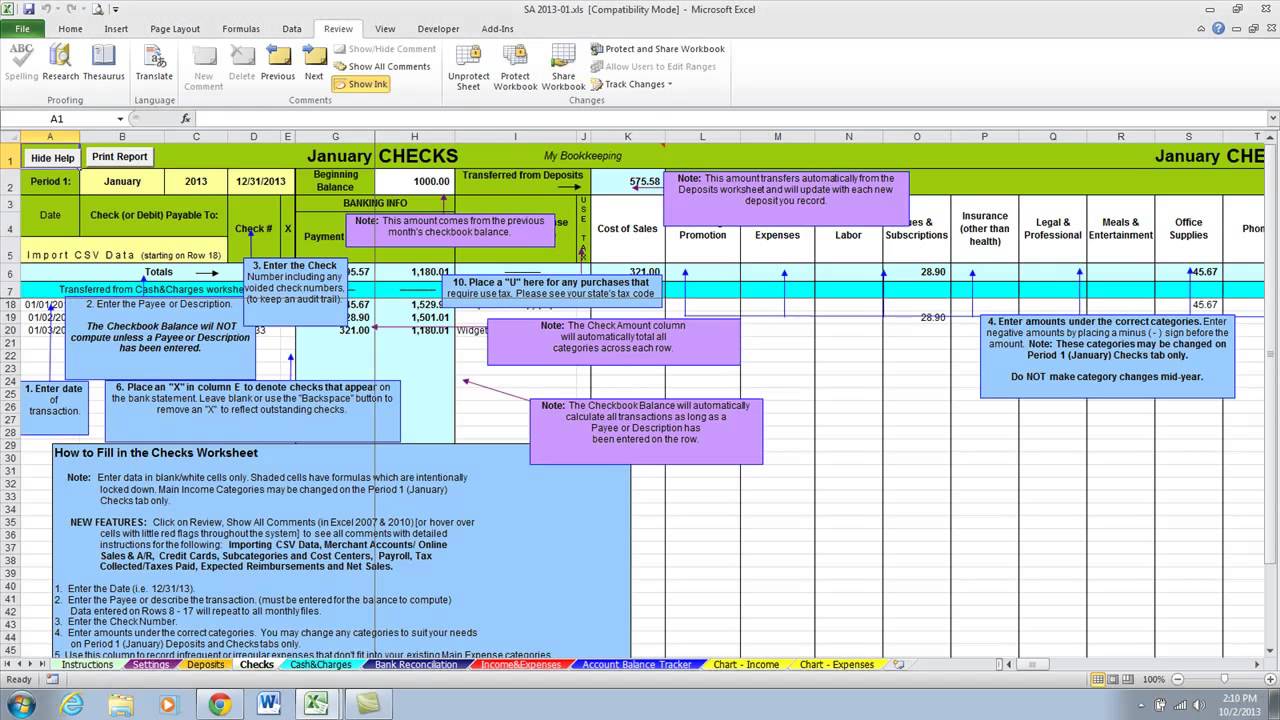

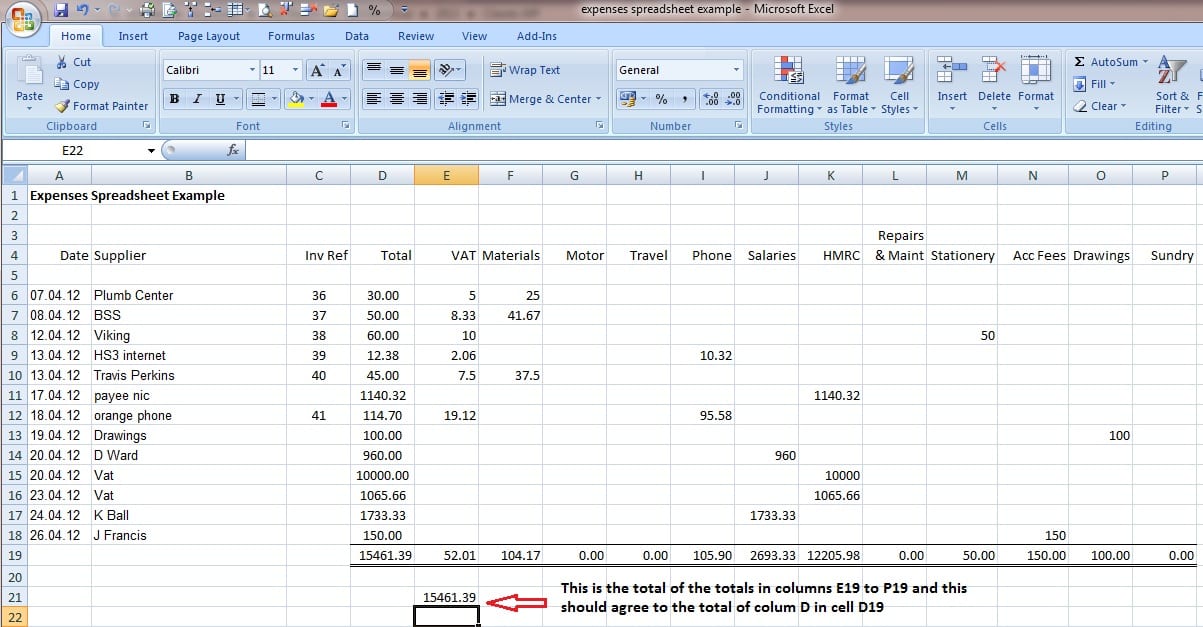

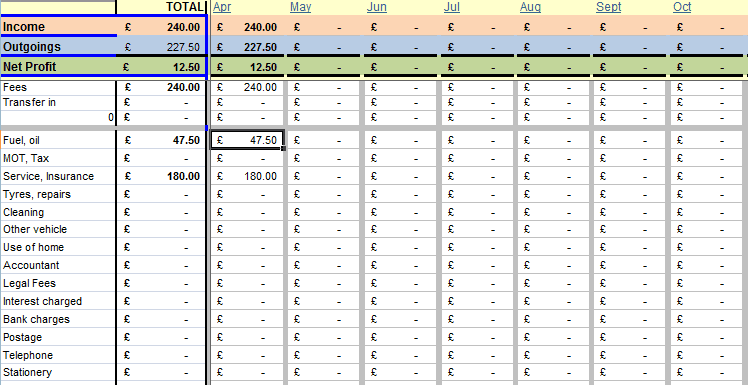

When it comes to training time, user-friendly, flexibility and deep analysis, the spreadsheet is as fantastic as any accounting program. Spreadsheets may also be printed and distributed as a means to give documentation or records. In addition, a new spreadsheet needs to be started each VAT quarter, so the column totals (pink figures at the peak of each column) end up showing the right totals for each VAT return.

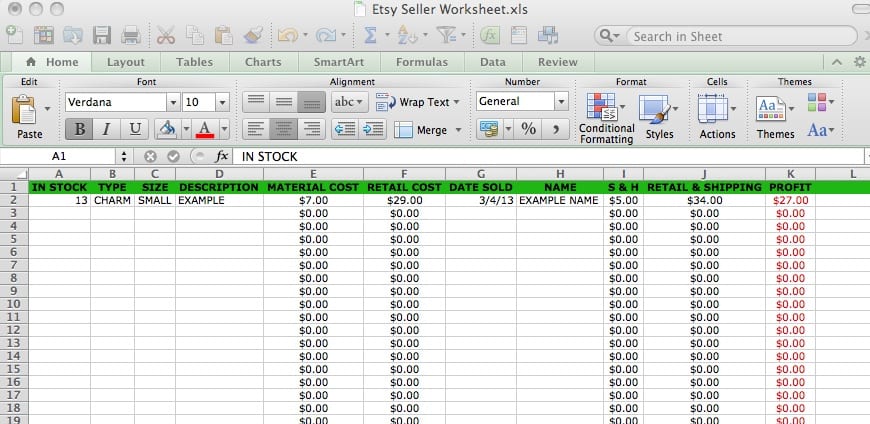

Small businesses starting up can take complete benefit of Excel until they’re in a place to afford bookkeeping program. Small businesses may also gain from professionally produced bookkeeping spreadsheets which have been specifically arranged not merely to create a list of revenue and expenses but also in a manner that analyses that data in how the little business requires it.

They can also benefit from professionally produced bookkeeping spreadsheets that have been specifically arranged not just to produce a list of income and expenses but also in a way that analyze that information in the way the small business requires it. Even today many modest businesses still utilize handwritten records though they can occupy a substantial quantity of your organization time and it is quite simple to make errors.

If you operate a company and will need to deal with your accounts, a spreadsheet can help record the data and carry out any vital calculations on it. After necessary editing like name of the company, logo and other details you may ensure it is appropriate to your company and circumstances so first download the excel bookkeeping template in your computer and after that start editing if required. For a variety of reasons, there are lots of businesses that cannot be converted to cloud accounting software and the spreadsheet is still the only practical solution in their opinion.