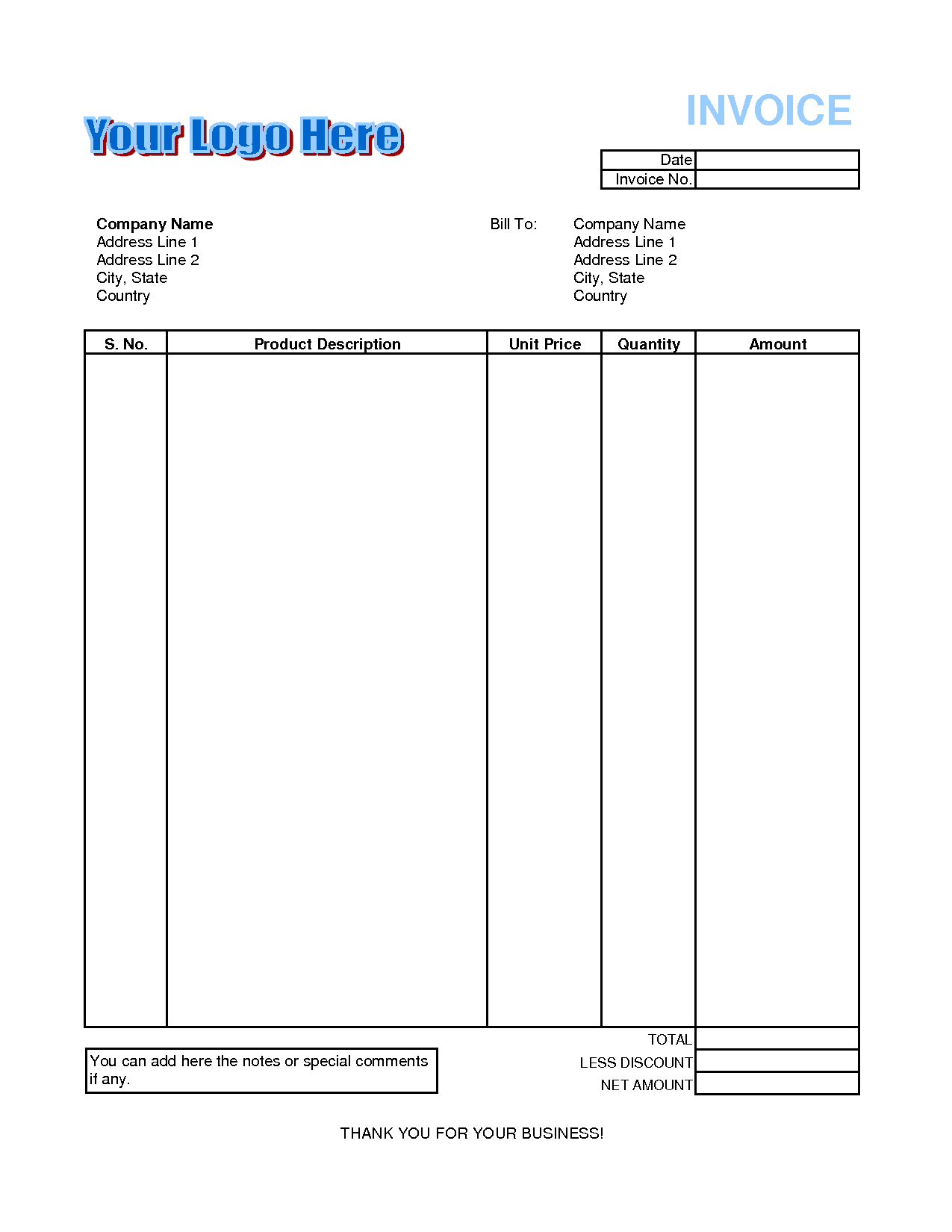

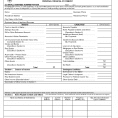

When the invoice was paid, it’s taken out of the file and recorded as an expense. The invoice is put in an accounts payable” file signifying that money is owed and taken out of the file as soon as the amount was paid. Selecting the ideal invoice or billing software for your requirements is no simple feat.

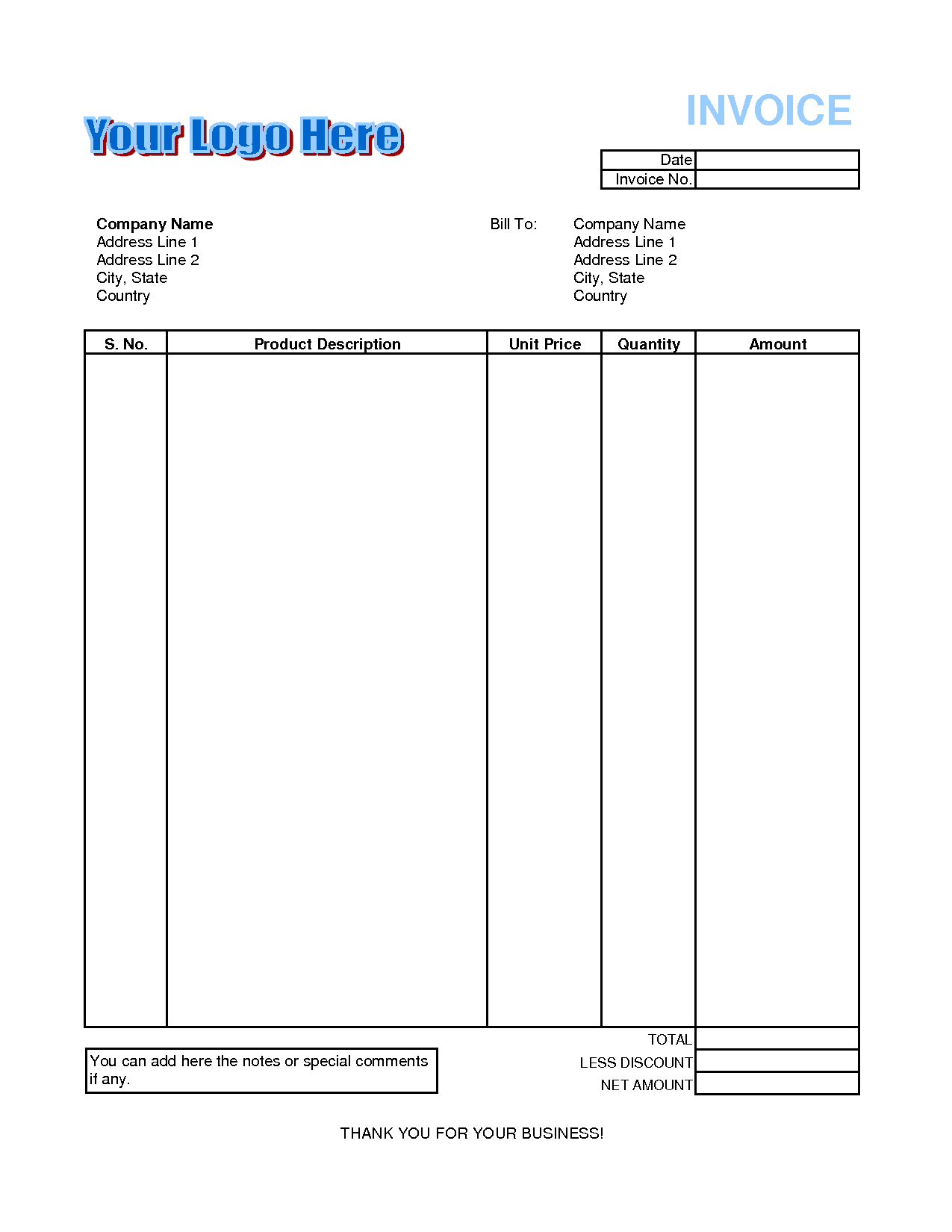

If you consider it, 2 templates may be enough if your company isn’t too large. Templates may also be helpful once you’re attempting to lose or maintain your present weight. Invoice templates don’t need to be boring. It is crucial to try to remember a fantastic billing invoice template won’t only be beneficial for customers, but also help your organization achieve different targets.

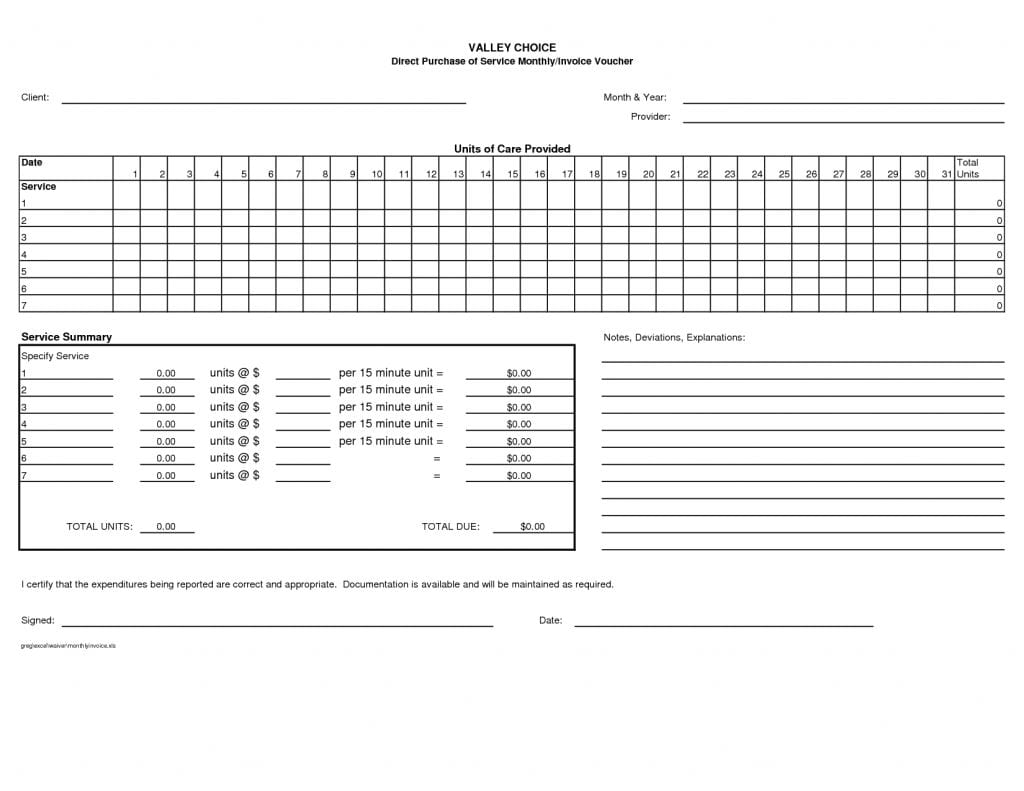

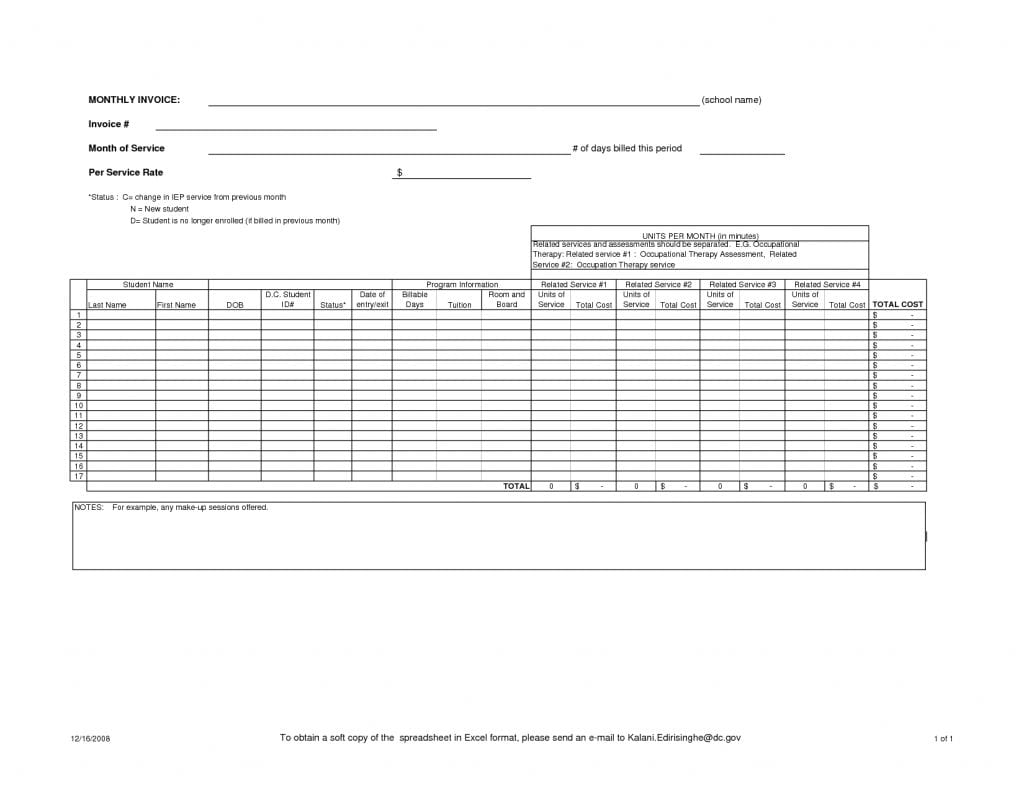

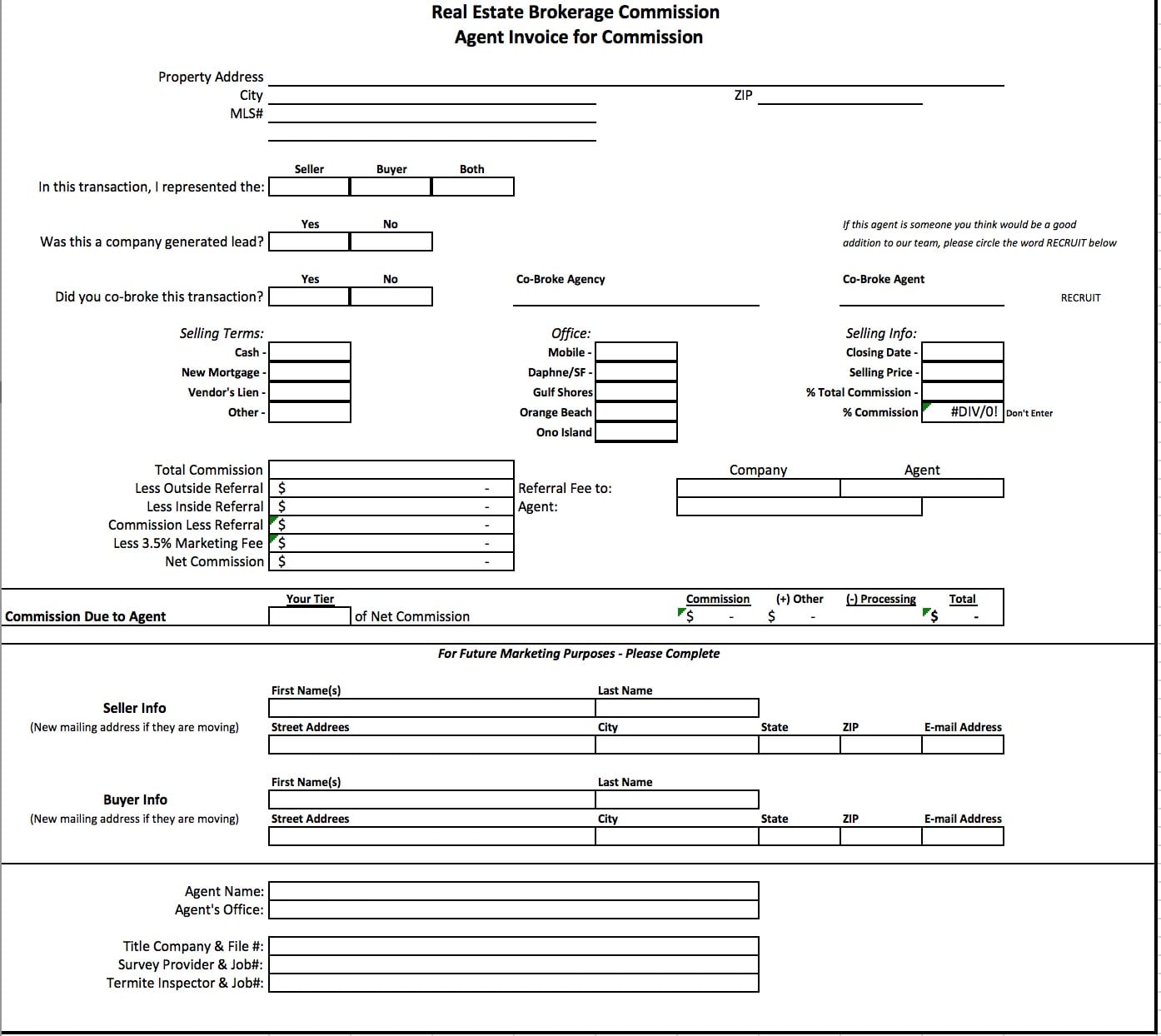

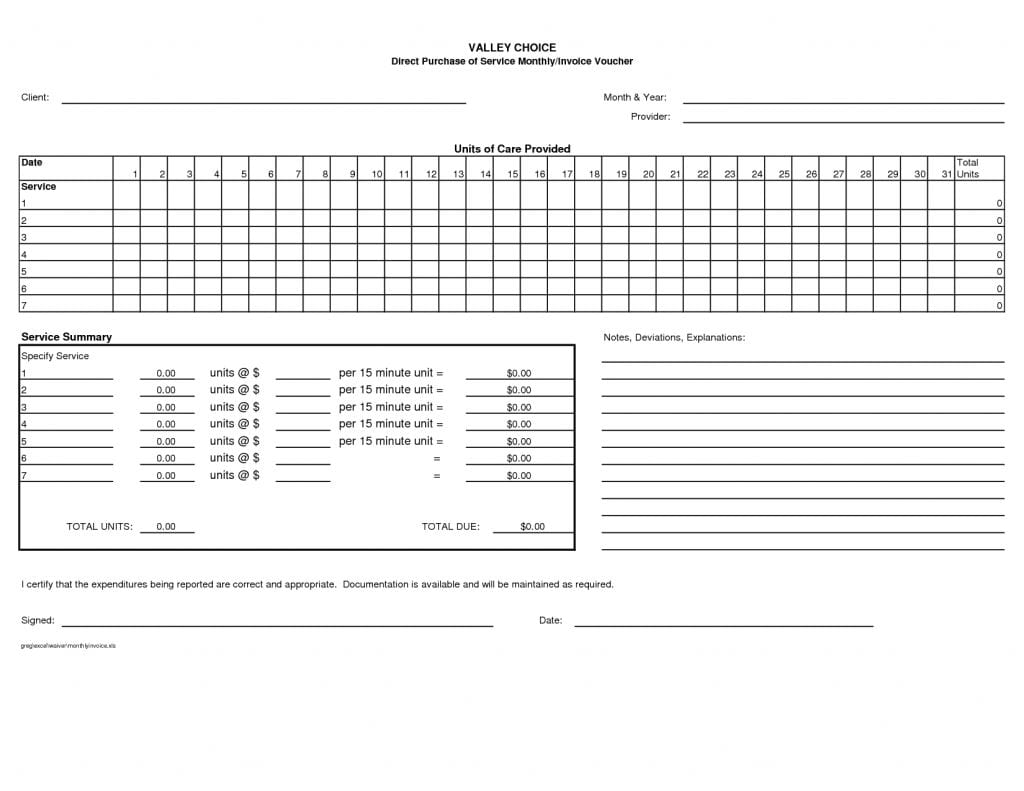

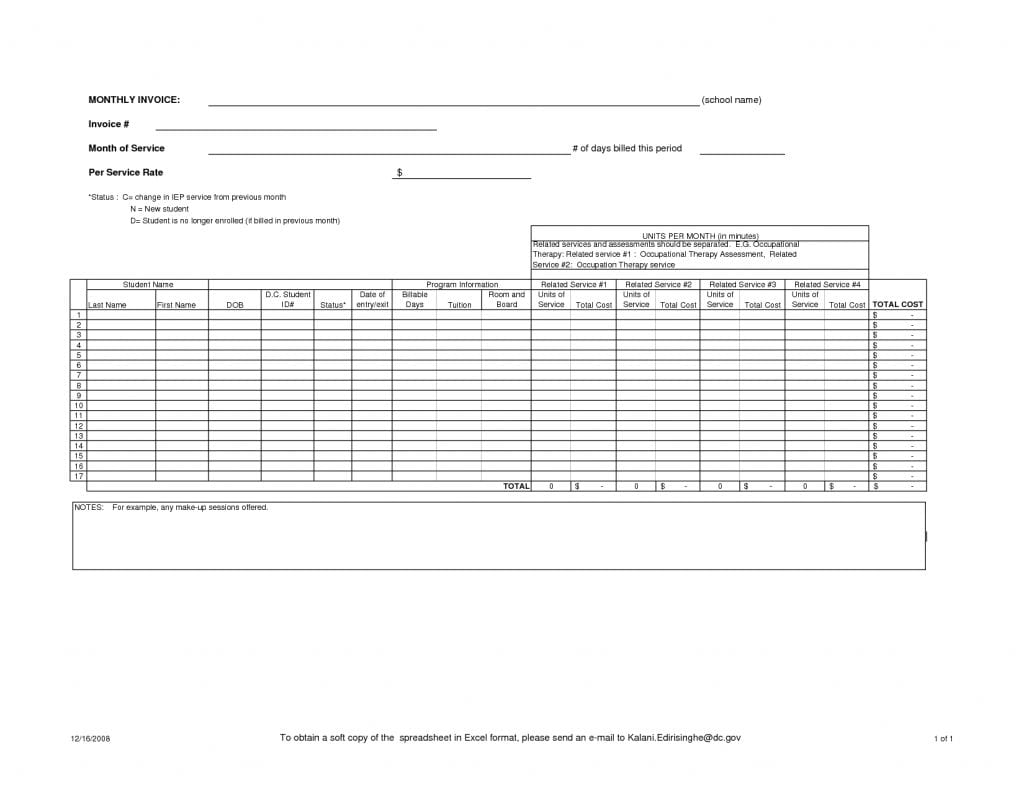

Since the invoice is for four visits, be certain to multiply the price of the weekly visits by the quantity of actual visits. Others may think that it is whenever the invoice is truly received. Invoices, also called a bill, statement, or sales invoice, are an important portion of your company.

Your invoice might just be waiting at the base of a pile, in which case a quick reminder ought to be sufficient to receive your check in the mail. Invoice is also employed by customers to maintain a financial record of the goods or services they’re buying. Accounts payable invoices in the home are bills like electric company debts, telephone accounts, television and internet debts, newspaper subscriptions and other monthly expenses.

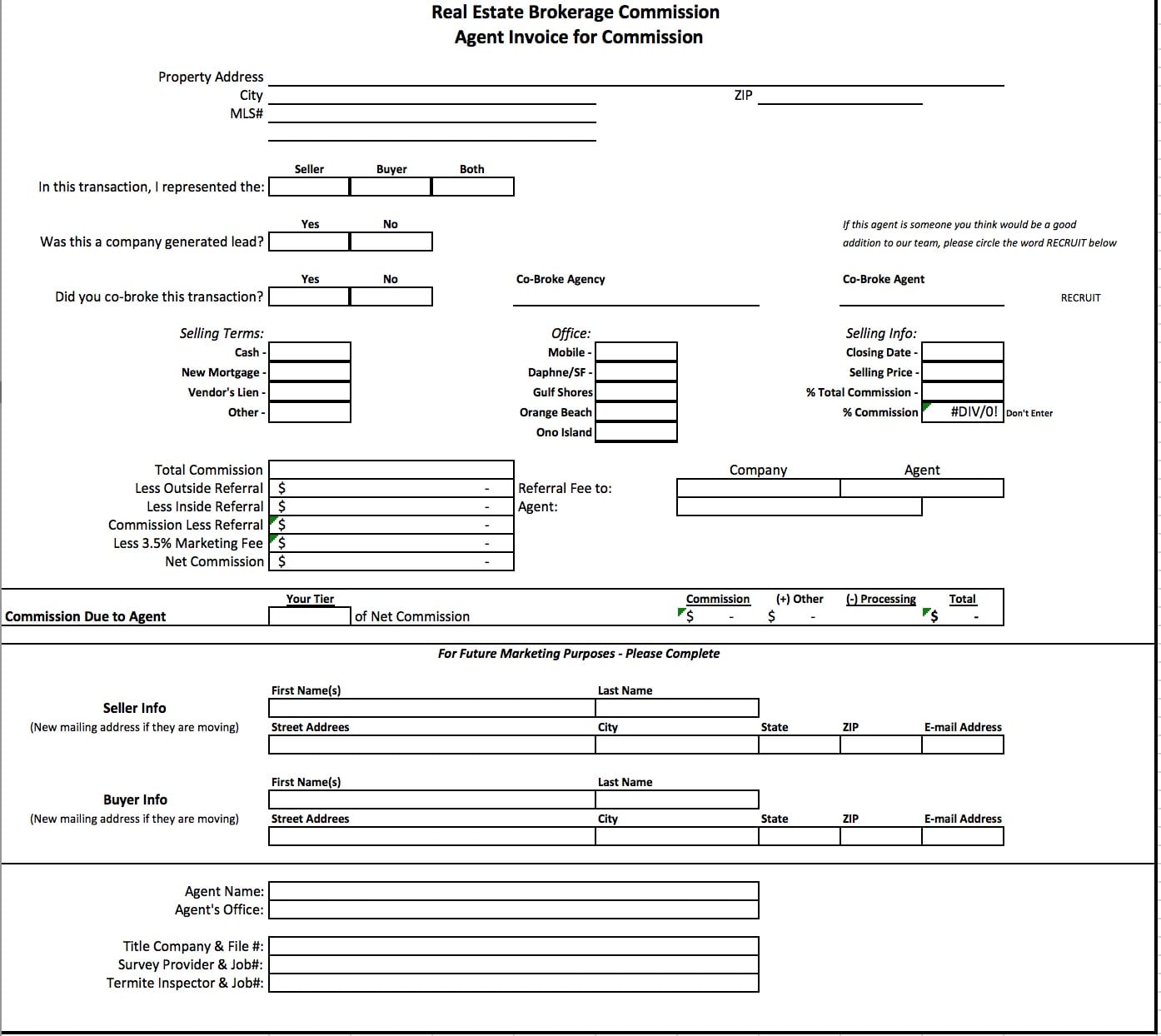

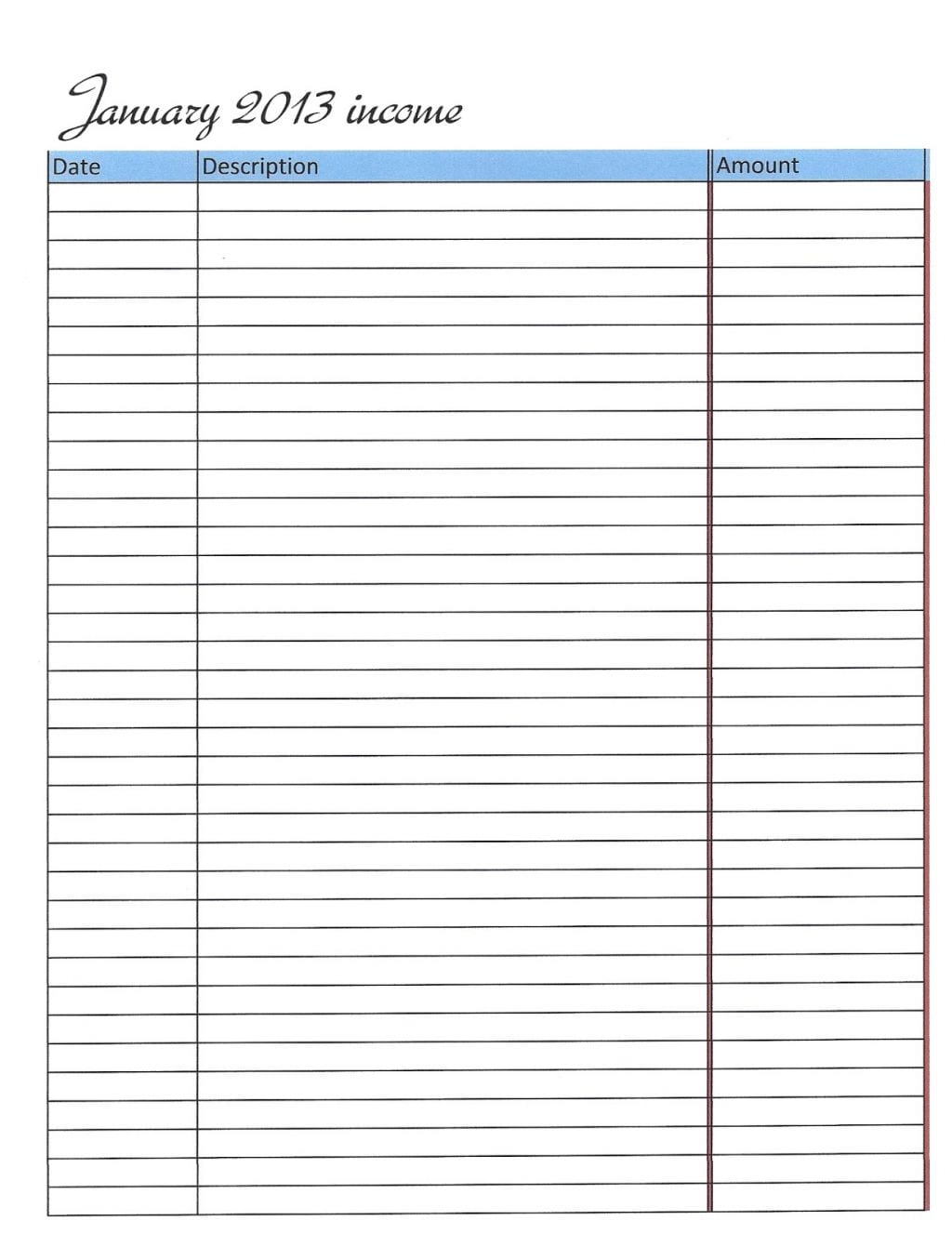

11 photos of the "Monthly Invoice Template"

Related posts of "Monthly Invoice Template"

The statement is truly required if we're very likely to fill out an application for financing or even if planning to carry out a couple investments. It isn't simple to be unique in your personal statement. It's tricky to be unique in your personal statement. You see, there are numerous techniques to conduct business and...

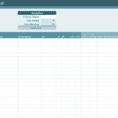

Templates needs to be handled with caution. The template provided by prestashop goes nicely with prestashop open source computer software. Templates are pre-formatted spreadsheets that you may download and use on your PC. You are able to download a cost benefit analysis template at no cost in the event you're short in funds. An absolutely...

If your business is projected to sell a thousand reams of paper in its very first calendar year, make certain you've already sold 900 reams and understand how to easily sell the previous 100 reams. According to Matt, an essential reason companies struggle to manage customer expectations is due to the organisational silos and divisional...

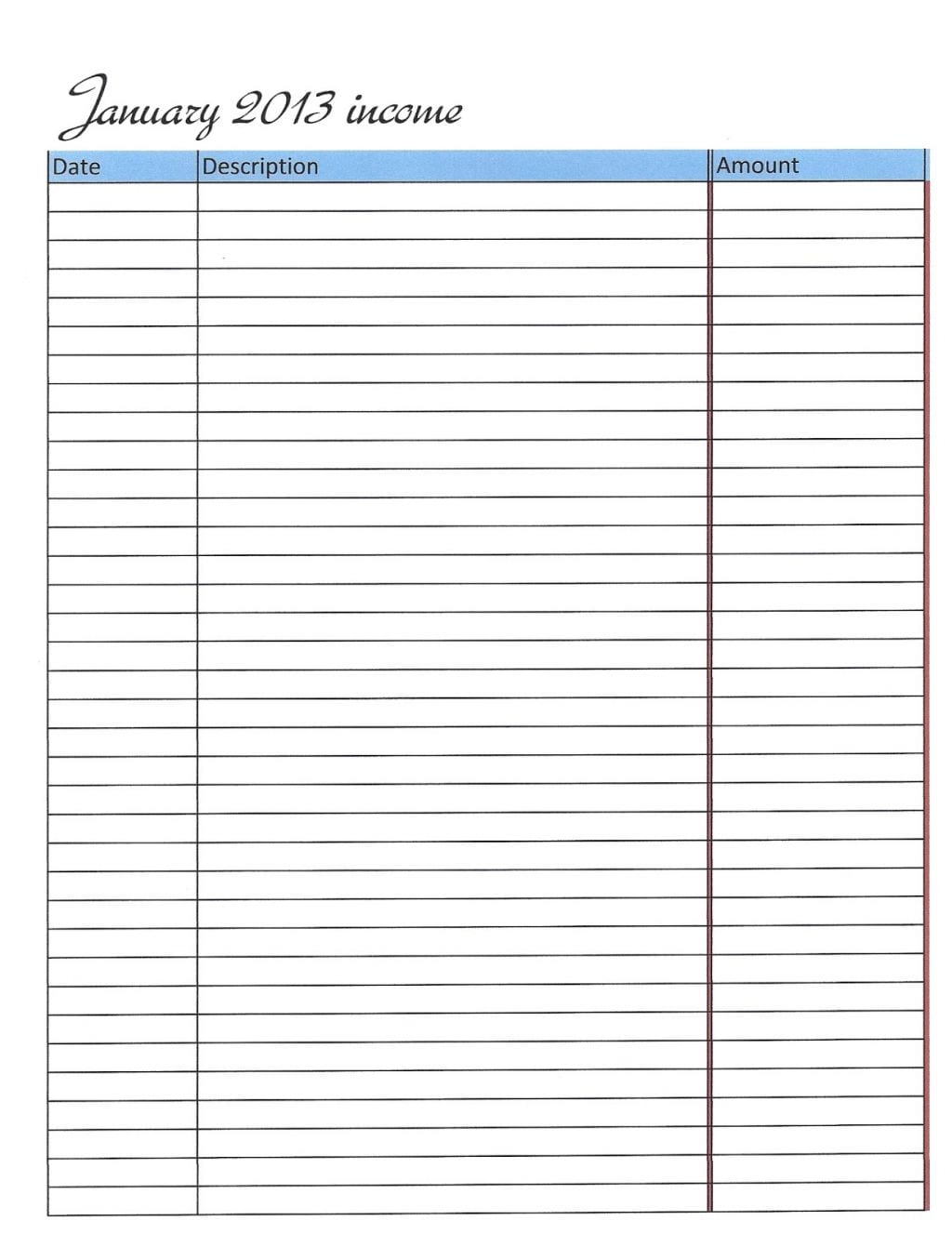

Some expenses arrive in spurts. You're able to cut unnecessary costs, possibly move to a less expensive residence, sell the second vehicle. Rental property expenses are almost always hard to organize and track. If you're not keen on making your own tracking worksheet to deal with your family finances, I strongly advise starting with a...